Option Strategies

Long Straddle

Introduction

Long Straddle is an Options trading strategy that consists of buying an ATM call and an ATM put, where both contracts have the same underlying asset, strike price, and expiration date. This strategy aims to profit from volatile movements in the underlying stock, either positive or negative.

Implementation

Follow these steps to implement the long straddle strategy:

- In the

Initializeinitializemethod, set the start date, end date, cash, and Option universe. - In the

OnDataon_datamethod, select the expiration date and strike price of the contracts in the strategy legs. - In the

OnDataon_datamethod, select the contracts and place the orders.

private Symbol _symbol;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

SetCash(100000);

UniverseSettings.Asynchronous = true;

var option = AddOption("GOOG");

_symbol = option.Symbol;

option.SetFilter(universe => universe.IncludeWeeklys().Straddle(30));

} def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

self.set_cash(100000)

self.universe_settings.asynchronous = True

option = self.add_option("GOOG")

self._symbol = option.symbol

option.set_filter(lambda universe: universe.include_weeklys().straddle(30))

The Straddlestraddle filter narrows the universe down to just the two contracts you need to form a long straddle.

public override void OnData(Slice slice)

{

if (Portfolio.Invested ||

!slice.OptionChains.TryGetValue(_symbol, out var chain))

{

return;

}

// Find ATM options with the nearest expiry

var expiry = chain.Min(contract => contract.Expiry);

var strike = chain.OrderBy(contract => Math.Abs(contract.Strike - chain.Underlying.Price)).First().Strike; def on_data(self, slice: Slice) -> None:

if self.portfolio.invested:

return

chain = slice.option_chains.get(self._symbol, None)

if not chain:

return

# Find ATM options with the nearest expiry

expiry = min([x.expiry for x in chain])

strike = sorted(chain, key=lambda x: abs(x.strike - chain.underlying.price))[0].strike

Approach A: Call the OptionStrategies.StraddleOptionStrategies.straddle method with the details of each leg and then pass the result to the Buybuy method.

var longStraddle = OptionStrategies.Straddle(_symbol, strike, expiry); Buy(longStraddle, 1);

long_straddle = OptionStrategies.straddle(self._symbol, strike, expiry) self.buy(long_straddle, 1)

Approach B: Create a list of Leg objects and then call the Combo Market Ordercombo_market_order, Combo Limit Ordercombo_limit_order, or Combo Leg Limit Ordercombo_leg_limit_order method.

var contracts = chain.Where(contract => contract.Expiry == expiry && contract.Strike == strike);

if (contracts.Length < 2) return;

var atmCall = contracts.Single(x => x.Right == OptionRight.Call);

var atmPut = contracts.Single(x => x.Right == OptionRight.Put);

var legs = new List<Leg>()

{

Leg.Create(atmCall.Symbol, 1),

Leg.Create(atmPut.Symbol, 1)

};

ComboMarketOrder(legs, 1); contracts = [x for x in chain if x.expiry == expiry and x.strike == strike]

if len(contracts) < 2:

return

atm_call = [x for x in contracts if x.right == OptionRight.CALL][0]

atm_put = [x for x in contracts if x.right == OptionRight.PUT][0]

legs = [

Leg.create(atm_call.symbol, 1),

Leg.create(atm_put.symbol, 1)

]

self.combo_market_order(legs, 1)

Strategy Payoff

The payoff of the strategy is

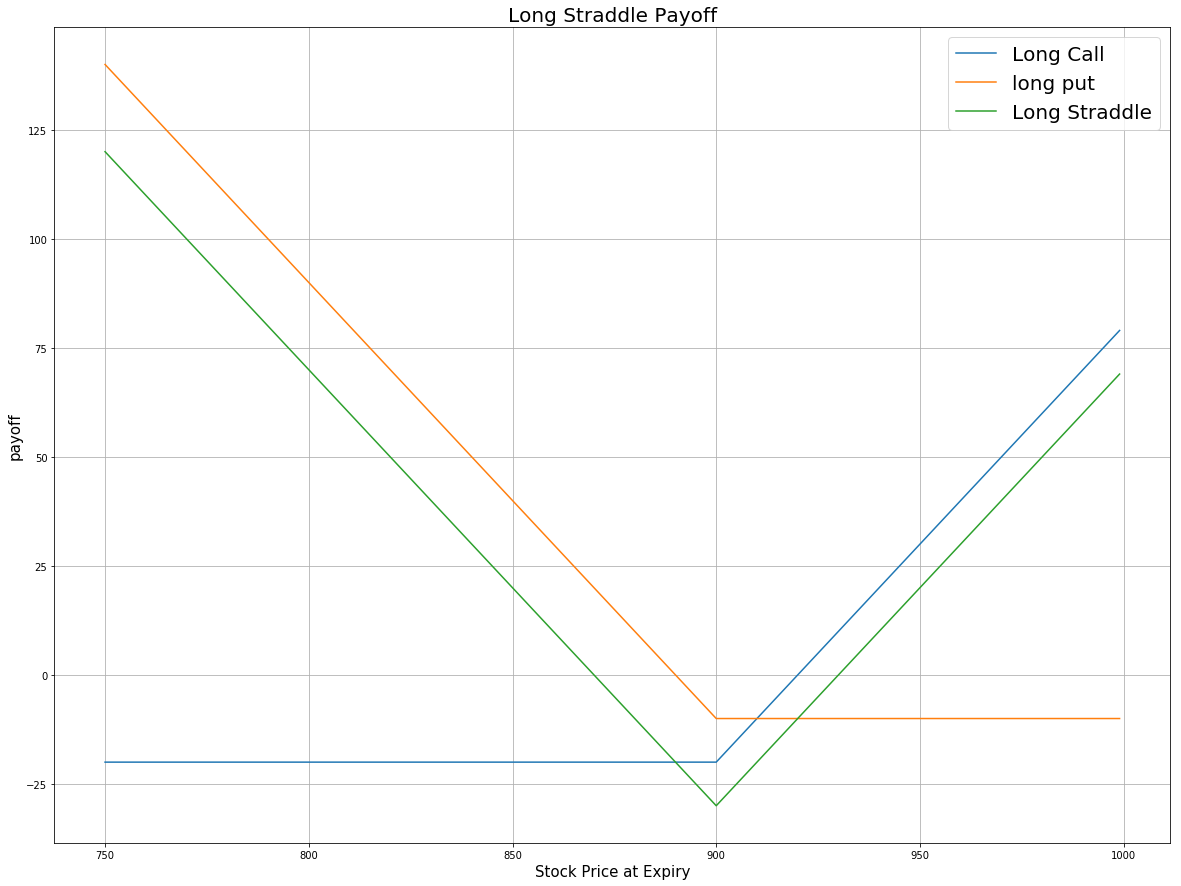

$$ \begin{array}{rcll} C^{ATM}_T & = & (S_T - K^{C})^{+}\\ P^{ATM}_T & = & (K^{P} - S_T)^{+}\\ P_T & = & (C^{ATM}_T + P^{ATM}_T - C^{ATM}_0 - P^{ATM}_0)\times m - fee \end{array} $$ $$ \begin{array}{rcll} \textrm{where} & C^{ATM}_T & = & \textrm{ATM call value at time T}\\ & P^{ATM}_T & = & \textrm{ATM put value at time T}\\ & S_T & = & \textrm{Underlying asset price at time T}\\ & K^{C} & = & \textrm{ATM call strike price}\\ & K^{P} & = & \textrm{ATM put strike price}\\ & P_T & = & \textrm{Payout total at time T}\\ & C^{ATM}_0 & = & \textrm{ATM call value at position opening (debit paid)}\\ & P^{ATM}_0 & = & \textrm{ATM put value at position opening (debit paid)}\\ & m & = & \textrm{Contract multiplier}\\ & T & = & \textrm{Time of expiration} \end{array} $$The following chart shows the payoff at expiration:

The maximum profit is unlimited if the underlying price rises to infinity or substantial, $K^{P} - C^{OTM}_0 - P^{OTM}_0$, if it drops to zero at expiration.

The maximum loss is the net debit paid, $C^{ATM}_0 + P^{ATM}_0$. It occurs when the underlying price is the same at expiration as it was when you opened the trade. In this case, both Options expire worthless.

Example

The following table shows the price details of the assets in the algorithm at Option expiration (2017-05-20):

| Asset | Price ($) | Strike ($) |

|---|---|---|

| Call | 22.30 | 835.00 |

| Put | 23.90 | 835.00 |

| Underlying Equity at expiration | 934.01 | - |

Therefore, the payoff is

$$ \begin{array}{rcll} C^{ATM}_T & = & (S_T - K^{C})^{+}\\ & = & (934.01-835.00)^{+}\\ & = & 98.99\\ P^{ATM}_T & = & (K^{P} - S_T)^{+}\\ & = & (835.00-934.01)^{+}\\ & = & 0\\ P_T & = & (C^{ATM}_T + P^{ATM}_T - C^{ATM}_0 - P^{ATM}_0)\times m - fee\\ & = & (98.99+0-22.3-23.9)\times100-1.00\times2\\ & = & 5277 \end{array} $$So, the strategy gains $5,277.

The following algorithm implements a long straddle Option strategy:

public class LongStraddleAlgorithm : QCAlgorithm

{

private Symbol _symbol;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

SetCash(100000);

var option = AddOption("GOOG");

_symbol = option.Symbol;

option.SetFilter(universe => universe.IncludeWeeklys().Straddle(30));

}

public override void OnData(Slice slice)

{

if (Portfolio.Invested ||

!slice.OptionChains.TryGetValue(_symbol, out var chain))

{

return;

}

// Find ATM options with the nearest expiry

var expiry = chain.Min(contract => contract.Expiry);

var contracts = chain.Where(contract => contract.Expiry == expiry)

.OrderBy(contract => Math.Abs(contract.Strike - chain.Underlying.Price))

.ToArray();

if (contracts.Length < 2) return;

var longStraddle = OptionStrategies.Straddle(_symbol, contracts[0].Strike, expiry);

Buy(longStraddle, 1);

}

} class LongStraddleAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

self.set_cash(100000)

option = self.add_option("GOOG")

self.symbol = option.symbol

option.set_filter(lambda universe: universe.include_weeklys().straddle(30))

def on_data(self, slice: Slice) -> None:

if self.portfolio.invested:

return

chain = slice.option_chains.get(self.symbol, None)

if not chain:

return

# Find ATM options with the nearest expiry

expiry = min([x.expiry for x in chain])

contracts = sorted([x for x in chain if x.expiry == expiry],

key=lambda x: abs(chain.underlying.price - x.strike))

if len(contracts) < 2:

return

# The first two contracts are the ATM Call and the ATM Put

contracts = contracts[0:2]

long_straddle = OptionStrategies.straddle(self.symbol, contracts[0].strike, expiry)

self.buy(long_straddle, 1)