US Equity

Handling Data

Introduction

LEAN passes the data you request to the OnDataon_data method so you can make trading decisions. The default OnDataon_data method accepts a Slice object, but you can define additional OnDataon_data methods that accept different data types. For example, if you define an OnDataon_data method that accepts a TradeBar argument, it only receives TradeBar objects. The Slice object that the OnDataon_data method receives groups all the data together at a single moment in time. To access the Slice outside of the OnDataon_data method, use the CurrentSlicecurrent_slice property of your algorithm.

All the data formats use DataDictionary objects to group data by Symbol and provide easy access to information. The plural of the type denotes the collection of objects. For instance, the TradeBars DataDictionary is made up of TradeBar objects. To access individual data points in the dictionary, you can index the dictionary with the security ticker or Symbolsymbol, but we recommend you use the Symbolsymbol.

To view the resolutions that are available for US Equity data, see Resolutions.

Trades

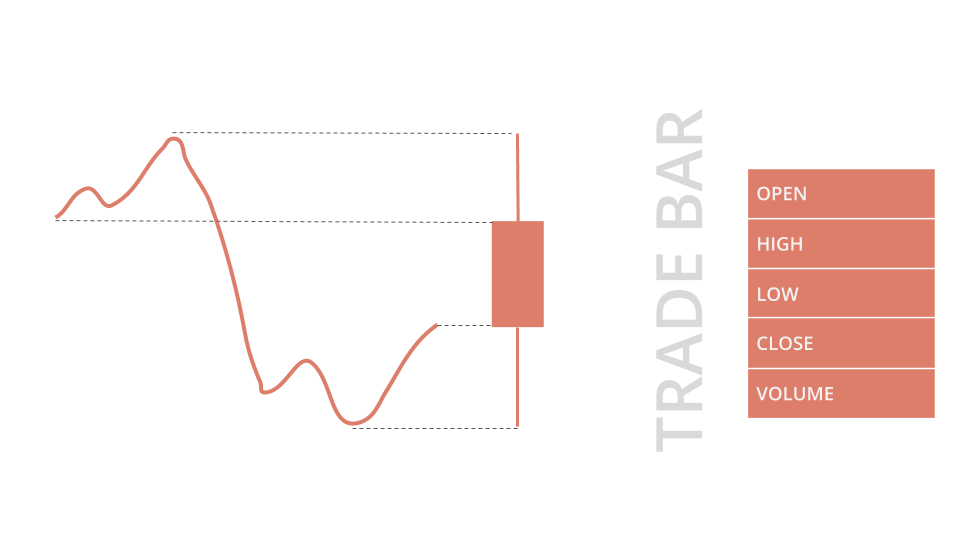

TradeBar objects are price bars that consolidate individual trades from the exchanges. They contain the open, high, low, close, and volume of trading activity over a period of time.

To get the TradeBar objects in the Slice, index the Slice or index the Barsbars property of the Slice with the security Symbolsymbol. If the security doesn't actively trade or you are in the same time step as when you added the security subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your security before you index the Slice with the security Symbolsymbol.

public override void OnData(Slice slice)

{

// Check if the symbol is contained in TradeBars object

if (slice.Bars.ContainsKey(_symbol))

{

// Obtain the mapped TradeBar of the symbol

var tradeBar = slice.Bars[_symbol];

}

}

def on_data(self, slice: Slice) -> None:

# Obtain the mapped TradeBar of the symbol if any

trade_bar = slice.bars.get(self._symbol) # None if not found

You can also iterate through the TradeBars dictionary. The keys of the dictionary are the Symbol objects and the values are the TradeBar objects.

public override void OnData(Slice slice)

{

// Iterate all received Symbol-TradeBar key-value pairs

foreach (var kvp in slice.Bars)

{

var symbol = kvp.Key;

var tradeBar = kvp.Value;

var closePrice = tradeBar.Close;

}

} def on_data(self, slice: Slice) -> None:

# Iterate all received Symbol-TradeBar key-value pairs

for symbol, trade_bar in slice.bars.items():

close_price = trade_bar.close

TradeBar objects have the following properties:

We adjust the daily open and close price of bars to reflect the official auction prices.

Quotes

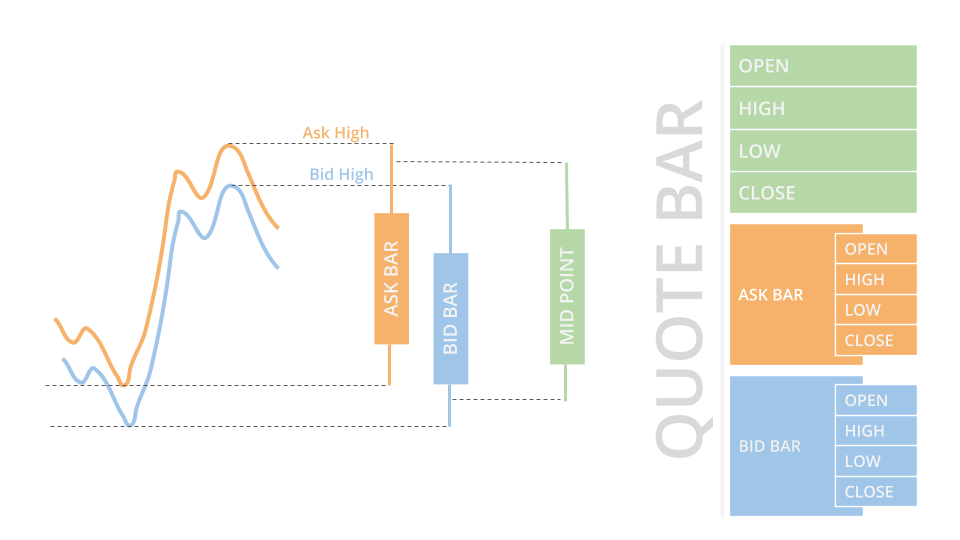

QuoteBar objects are bars that consolidate NBBO quotes from the exchanges. They contain the open, high, low, and close prices of the bid and ask. The Openopen, Highhigh, Lowlow, and Closeclose properties of the QuoteBar object are the mean of the respective bid and ask prices. If the bid or ask portion of the QuoteBar has no data, the Openopen, Highhigh, Lowlow, and Closeclose properties of the QuoteBar copy the values of either the Bidbid or Askask instead of taking their mean.

To get the QuoteBar objects in the Slice, index the QuoteBars property of the Slice with the security Symbolsymbol. If the security doesn't actively get quotes or you are in the same time step as when you added the security subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your security before you index the Slice with the security Symbolsymbol.

public override void OnData(Slice slice)

{

// Check if the symbol is contained in QuoteBars object

if (slice.QuoteBars.ContainsKey(_symbol))

{

// Obtain the mapped QuoteBar of the symbol

var quoteBar = slice.QuoteBars[_symbol];

}

}

def on_data(self, slice: Slice) -> None:

# Obtain the mapped QuoteBar of the symbol if any

quote_bar = slice.quote_bars.get(self._symbol) # None if not found

You can also iterate through the QuoteBars dictionary. The keys of the dictionary are the Symbol objects and the values are the QuoteBar objects.

public override void OnData(Slice slice)

{

// Iterate all received Symbol-QuoteBar key-value pairs

foreach (var kvp in slice.QuoteBars)

{

var symbol = kvp.Key;

var quoteBar = kvp.Value;

var askPrice = quoteBar.Ask.Close;

}

} def on_data(self, slice: Slice) -> None:

# Iterate all received Symbol-QuoteBar key-value pairs

for symbol, quote_bar in slice.quote_bars.items():

ask_price = quote_bar.ask.close

QuoteBar objects let LEAN incorporate spread costs into your simulated trade fills to make backtest results more realistic.

QuoteBar objects have the following properties:

Ticks

Tick objects represent a single trade or quote at a moment in time. A trade tick is a record of a transaction for the security. A quote tick is an offer to buy or sell the security at a specific price.

Trade ticks have a non-zero value for the Quantityquantity and Priceprice properties, but they have a zero value for the BidPricebid_price, BidSizebid_size, AskPriceask_price, and AskSizeask_size properties. Quote ticks have non-zero values for BidPricebid_price and BidSizebid_size properties or have non-zero values for AskPriceask_price and AskSizeask_size properties. To check if a tick is a trade or a quote, use the TickTypeticktype property.

In backtests, LEAN groups ticks into one millisecond buckets. In live trading, LEAN groups ticks into ~70-millisecond buckets. To get the Tick objects in the Slice, index the Ticks property of the Slice with a Symbolsymbol. If the security doesn't actively trade or you are in the same time step as when you added the security subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your security before you index the Slice with the security Symbolsymbol.

public override void OnData(Slice slice)

{

if (slice.Ticks.ContainsKey(_symbol))

{

var ticks = slice.Ticks[_symbol];

foreach (var tick in ticks)

{

var price = tick.Price;

}

}

}

def on_data(self, slice: Slice) -> None:

ticks = slice.ticks.get(self._symbol, []) # Empty if not found

for tick in ticks:

price = tick.price

You can also iterate through the Ticks dictionary. The keys of the dictionary are the Symbol objects and the values are the List<Tick>list[Tick] objects.

public override void OnData(Slice slice)

{

foreach (var kvp in slice.Ticks)

{

var symbol = kvp.Key;

var ticks = kvp.Value;

foreach (var tick in ticks)

{

var price = tick.Price;

}

}

} def on_data(self, slice: Slice) -> None:

for symbol, ticks in slice.ticks.items():

for tick in ticks:

price = tick.price

Tick data is raw and unfiltered, so it can contain bad ticks that skew your trade results. For example, some ticks come from dark pools, which aren't tradable. We recommend you only use tick data if you understand the risks and are able to perform your own online tick filtering.

Tick objects have the following properties:

If we detect a tick that may be suspicious, we set its Suspicioussuspicious flag to true.

Other Data Formats

For more information about data formats available for US Equities, see Corporate Actions.

Examples

The following examples demonstrate some common practices for handling US Equity data.

Example 1: Various Data Resolutions and Formats

The following algorithm handles three data resolutions (Daily, Minute, and Tick) and three data formats (TradeBar, QuoteBar, and Tick). The Equity subscriptions provide the ticks and daily TradeBar objects. To create the 5-minute QuoteBar objects, it consolidates the AAPL ticks.

The algorithm enters a long position in AAPL when the following conditions are met:

- The 16-day Fractal Adaptive Moving Average (FRAMA) of QQQ is increasing, which indicates the trend is up.

- The Relative Strength Index (RSI) of AAPL is above 70, which indicates AAPL has been rising from large buying pressure.

The algorithm enters a short position in AAPL when the following conditions are met:

- The 16-day FRAMA of QQQ is rising, which indicates the trend is down.

- The RSI of AAPL is above, which indicates AAPL has been declining from large selling pressure.

The algorithm liquidates the portfolio when the FRAMA changes direction.

public class USEquityExampleAlgorithm : QCAlgorithm

{

private dynamic _qqq, _aapl;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

// Add QQQ and AAPL data.

_qqq = AddEquity("QQQ", Resolution.Daily);

_aapl = AddEquity("AAPL", Resolution.Tick);

// Create the indicators.

_qqq.Frama = FRAMA(_qqq.Symbol, 16);

_aapl.Rsi = new RelativeStrengthIndex(10);

// Create a 5-minute consolidator to aggregate AAPL tick data into quote bars.

var consolidator = new TickQuoteBarConsolidator(TimeSpan.FromMinutes(5));

// Subscribe the consolidator for automatic updates.

SubscriptionManager.AddConsolidator(_aapl.Symbol, consolidator);

// Attach an event handler to update the RSI indicator with the consolidated bars.

consolidator.DataConsolidated += (sender, bar) => _aapl.Rsi.Update(bar.EndTime, bar.Close);

// Warm up the indicators.

WarmUpIndicator(_qqq.Symbol, _qqq.Frama);

var history = History<QuoteBar>(_aapl.Symbol, 10, Resolution.Minute);

foreach (var bar in history)

{

_aapl.Rsi.Update(bar.EndTime, bar.Close);

}

}

public override void OnData(Slice slice)

{

// Ensure AAPL ticks are in the current slice.

if (!slice.Ticks.ContainsKey(_aapl.Symbol))

{

return;

}

// Get the indicator values.

var frama = _qqq.Frama.Current.Value;

var prevFrama = _qqq.Frama.Previous.Value;

var rsi = _aapl.Rsi.Current.Value;

// Check if we have an AAPL position.

if (_aapl.Holdings.Invested)

{

// If there is divergence between our position and the Frama direction, exit the position.

if ((_aapl.Holdings.IsLong && frama < prevFrama) || (_aapl.Holdings.IsShort && frama > prevFrama))

{

Liquidate(_aapl.Symbol);

}

}

// Look for a long entry.

else if (frama > prevFrama && rsi >= 70)

{

SetHoldings(_aapl.Symbol, 0.5);

}

// Look for a short entry.

else if (frama < prevFrama && rsi <= 30)

{

SetHoldings(_aapl.Symbol, -0.5);

}

}

} class USEquityExampleAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

# Add QQQ and AAPL data.

self._qqq = self.add_equity("QQQ", Resolution.DAILY)

self._aapl = self.add_equity("AAPL", Resolution.TICK)

# Create the indicators.

self._qqq.frama = self.frama(self._qqq.symbol, 16)

self._aapl.rsi = RelativeStrengthIndex(10)

# Create a 5-minute consolidator to aggregate AAPL tick data into quote bars.

consolidator = TickQuoteBarConsolidator(timedelta(minutes=5))

# Subscribe the consolidator for automatic updates.

self.subscription_manager.add_consolidator(self._aapl.symbol, consolidator)

# Attach an event handler handler to update the RSI indicator with the consolidated bars.

consolidator.data_consolidated += lambda _, bar: self._aapl.rsi.update(bar.end_time, bar.close)

# Warm up the indicators.

self.warm_up_indicator(self._qqq.symbol, self._qqq.frama)

for quote_bar in self.history[QuoteBar](self._aapl.symbol, 10, Resolution.MINUTE):

self._aapl.rsi.update(quote_bar.end_time, quote_bar.close)

def on_data(self, slice: Slice) -> None:

# Ensure AAPL ticks are in the current slice.

if self._aapl.symbol not in slice.ticks:

return

# Get the indicator values.

frama = self._qqq.frama.current.value

prev_frama = self._qqq.frama.previous.value

rsi = self._aapl.rsi.current.value

# Check if we have an AAPL position.

if self._aapl.holdings.invested:

# If there is divergence between our position and the Frama direction, exit the position.

if (self._aapl.holdings.is_long and frama < prev_frama or

self._aapl.holdings.is_short and frama > prev_frama):

self.liquidate(self._aapl.symbol)

# Look for a long entry.

elif frama > prev_frama and rsi >= 70:

self.set_holdings(self._aapl.symbol, 0.5)

# Look for a short entry.

elif frama < prev_frama and rsi <= 30:

self.set_holdings(self._aapl.symbol, -0.5)