Crypto

Handling Data

Introduction

LEAN passes the data you request to the OnDataon_data method so you can make trading decisions. The default OnDataon_data method accepts a Slice object, but you can define additional OnDataon_data methods that accept different data types. For example, if you define an OnDataon_data method that accepts a TradeBar argument, it only receives TradeBar objects. The Slice object that the OnDataon_data method receives groups all the data together at a single moment in time. To access the Slice outside of the OnDataon_data method, use the CurrentSlicecurrent_slice property of your algorithm.

All the data formats use DataDictionary objects to group data by Symbol and provide easy access to information. The plural of the type denotes the collection of objects. For instance, the TradeBars DataDictionary is made up of TradeBar objects. To access individual data points in the dictionary, you can index the dictionary with the security ticker or Symbolsymbol, but we recommend you use the Symbolsymbol.

To view the resolutions that are available for Crypto data, see Resolutions.

Trades

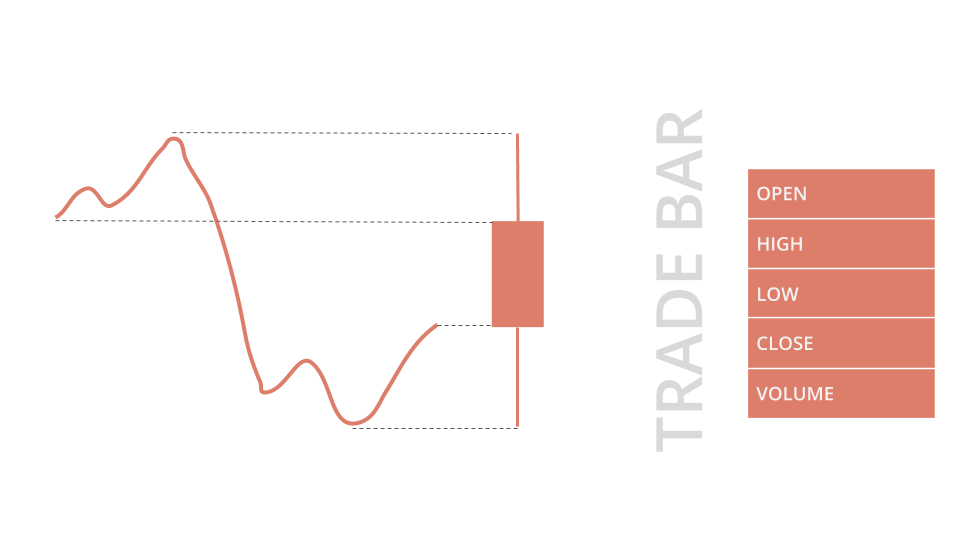

TradeBar objects are price bars that consolidate individual trades from the exchanges. They contain the open, high, low, close, and volume of trading activity over a period of time.

To get the TradeBar objects in the Slice, index the Slice or index the Barsbars property of the Slice with the security Symbolsymbol. If the security doesn't actively trade or you are in the same time step as when you added the security subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your security before you index the Slice with the security Symbolsymbol.

public override void OnData(Slice slice)

{

// Check if the symbol is contained in TradeBars object

if (slice.Bars.ContainsKey(_symbol))

{

// Obtain the mapped TradeBar of the symbol

var tradeBar = slice.Bars[_symbol];

}

}

def on_data(self, slice: Slice) -> None:

# Obtain the mapped TradeBar of the symbol if any

trade_bar = slice.bars.get(self._symbol) # None if not found

You can also iterate through the TradeBars dictionary. The keys of the dictionary are the Symbol objects and the values are the TradeBar objects.

public override void OnData(Slice slice)

{

// Iterate all received Symbol-TradeBar key-value pairs

foreach (var kvp in slice.Bars)

{

var symbol = kvp.Key;

var tradeBar = kvp.Value;

var closePrice = tradeBar.Close;

}

} def on_data(self, slice: Slice) -> None:

# Iterate all received Symbol-TradeBar key-value pairs

for symbol, trade_bar in slice.bars.items():

close_price = trade_bar.close

TradeBar objects have the following properties:

Quotes

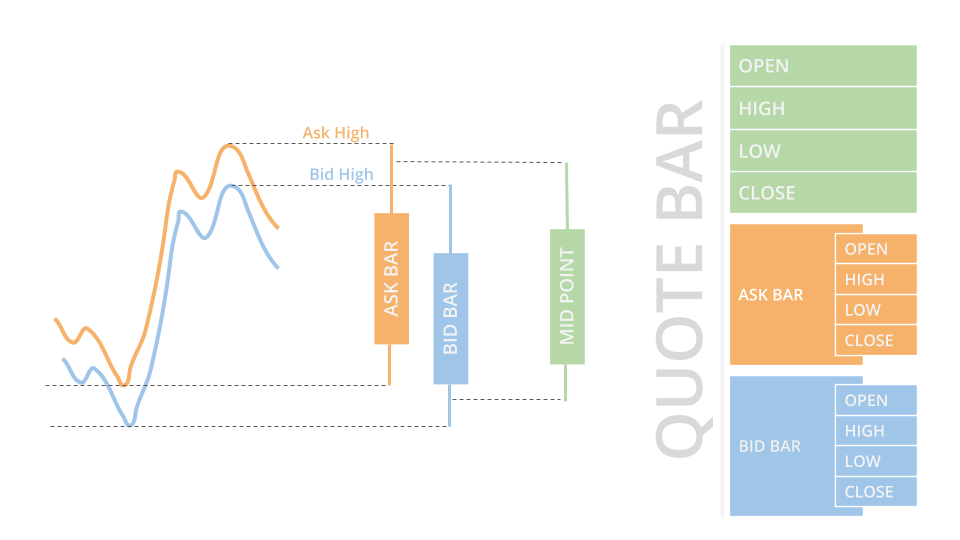

QuoteBar objects are bars that consolidate NBBO quotes from the exchanges. They contain the open, high, low, and close prices of the bid and ask. The Openopen, Highhigh, Lowlow, and Closeclose properties of the QuoteBar object are the mean of the respective bid and ask prices. If the bid or ask portion of the QuoteBar has no data, the Openopen, Highhigh, Lowlow, and Closeclose properties of the QuoteBar copy the values of either the Bidbid or Askask instead of taking their mean.

To get the QuoteBar objects in the Slice, index the QuoteBars property of the Slice with the security Symbolsymbol. If the security doesn't actively get quotes or you are in the same time step as when you added the security subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your security before you index the Slice with the security Symbolsymbol.

public override void OnData(Slice slice)

{

// Check if the symbol is contained in QuoteBars object

if (slice.QuoteBars.ContainsKey(_symbol))

{

// Obtain the mapped QuoteBar of the symbol

var quoteBar = slice.QuoteBars[_symbol];

}

}

def on_data(self, slice: Slice) -> None:

# Obtain the mapped QuoteBar of the symbol if any

quote_bar = slice.quote_bars.get(self._symbol) # None if not found

You can also iterate through the QuoteBars dictionary. The keys of the dictionary are the Symbol objects and the values are the QuoteBar objects.

public override void OnData(Slice slice)

{

// Iterate all received Symbol-QuoteBar key-value pairs

foreach (var kvp in slice.QuoteBars)

{

var symbol = kvp.Key;

var quoteBar = kvp.Value;

var askPrice = quoteBar.Ask.Close;

}

} def on_data(self, slice: Slice) -> None:

# Iterate all received Symbol-QuoteBar key-value pairs

for symbol, quote_bar in slice.quote_bars.items():

ask_price = quote_bar.ask.close

QuoteBar objects let LEAN incorporate spread costs into your simulated trade fills to make backtest results more realistic.

QuoteBar objects have the following properties:

Ticks

Tick objects represent a single trade or quote at a moment in time. A trade tick is a record of a transaction for the security. A quote tick is an offer to buy or sell the security at a specific price.

Trade ticks have a non-zero value for the Quantityquantity and Priceprice properties, but they have a zero value for the BidPricebid_price, BidSizebid_size, AskPriceask_price, and AskSizeask_size properties. Quote ticks have non-zero values for BidPricebid_price and BidSizebid_size properties or have non-zero values for AskPriceask_price and AskSizeask_size properties. To check if a tick is a trade or a quote, use the TickTypeticktype property.

In backtests, LEAN groups ticks into one millisecond buckets. In live trading, LEAN groups ticks into ~70-millisecond buckets. To get the Tick objects in the Slice, index the Ticks property of the Slice with a Symbolsymbol. If the security doesn't actively trade or you are in the same time step as when you added the security subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your security before you index the Slice with the security Symbolsymbol.

public override void OnData(Slice slice)

{

if (slice.Ticks.ContainsKey(_symbol))

{

var ticks = slice.Ticks[_symbol];

foreach (var tick in ticks)

{

var price = tick.Price;

}

}

}

def on_data(self, slice: Slice) -> None:

ticks = slice.ticks.get(self._symbol, []) # Empty if not found

for tick in ticks:

price = tick.price

You can also iterate through the Ticks dictionary. The keys of the dictionary are the Symbol objects and the values are the List<Tick>list[Tick] objects.

public override void OnData(Slice slice)

{

foreach (var kvp in slice.Ticks)

{

var symbol = kvp.Key;

var ticks = kvp.Value;

foreach (var tick in ticks)

{

var price = tick.Price;

}

}

} def on_data(self, slice: Slice) -> None:

for symbol, ticks in slice.ticks.items():

for tick in ticks:

price = tick.price

Tick data is raw and unfiltered, so it can contain bad ticks that skew your trade results. For example, some ticks come from dark pools, which aren't tradable. We recommend you only use tick data if you understand the risks and are able to perform your own online tick filtering.

Tick objects have the following properties:

Examples

The following examples demonstrate some common practices for handling Crypto data.

Example 1: Dollar Cost Average BTC

Dollar cost averaging (DCA) is where you consistently invest a fixed dollar amount into an asset on a regular basis (for example, monthly), regardless of the asset's price. It can reduce the volatility in your PnL due to slowly increasing the position size over time. The following algorithm demonstrates a DCA investment into BTC. It buys $3,000 USD worth of BTC every midnight for 30 consecutive days.

public class CryptoExampleAlgorithm : QCAlgorithm

{

private Symbol _symbol;

// Set a day count variable for counting the days of the DCA trade.

private int _dayCount = 0;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

// Set the brokerage and account type to match your brokerage environment for accurate fee and margin behavior.

SetBrokerageModel(BrokerageName.Bitfinex, AccountType.Cash);

// For daily DCA purchases, subscribe to daily asset data.

_symbol = AddCrypto("BTCUSD", Resolution.Daily).Symbol;

}

public override void OnData(Slice slice)

{

// If you haven't invested for 30 consecutive days yet, continue buying.

if (slice.Bars.ContainsKey(_symbol) && _dayCount++ < 30)

{

// Calculate the order size for $3,000 USD using the current price.

var quantity = 3000m / slice.Bars[_symbol].Close;

// Round down to observe the lot size.

var lotSize = Securities[_symbol].SymbolProperties.LotSize;

quantity = (long)(quantity / lotSize) * lotSize;

if (quantity != 0)

{

MarketOrder(_symbol, quantity);

}

}

}

} class CryptoExampleAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

# Set a day count variable for counting the days of the DCA trade.

self._day_count = 0

# Set the brokerage and account type to match your brokerage environment for accurate fee and margin behavior.

self.set_brokerage_model(BrokerageName.BITFINEX, AccountType.CASH)

# For daily DCA purchases, subscribe to daily asset data.

self._symbol = self.add_crypto("BTCUSD", Resolution.DAILY, Market.BITFINEX).symbol

def on_data(self, slice: Slice) -> None:

# If you haven't invested for 30 consecutive days yet, continue buying.

if self._symbol in slice.bars and self._day_count < 30:

# Increase the day count.

self._day_count += 1

# Calculate the order size for $3,000 USD using the current price.

quantity = 3_000 / slice.bars[self._symbol].close

# Round down to observe the lot size.

lot_size = self.securities[self._symbol].symbol_properties.lot_size

quantity = int(quantity / lot_size) * lot_size

if quantity:

self.market_order(self._symbol, quantity)

Example 2: Inter-Market Spread

There is always a small discrepancy in the price of the same Crypto pair trading on different exchanges. Although you can't currently live trade on algorithm with multiple brokerages, you can study the cointegration pattern and implement 2 live nodes to capture the arbitrage opportunity. The following algorithm demonstrates how to obtain the spread between the BTCUSD pair on Kraken and on Coinbase:

public class CryptoExampleAlgorithm : QCAlgorithm

{

private Symbol _krakenBtc;

private Symbol _coinbaseBtc;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

// Subscribe to BTC/USD on 2 different exchanges.

_krakenBtc = AddCrypto("BTCUSD", market: Market.Kraken).Symbol;

_coinbaseBtc = AddCrypto("BTCUSD", market: Market.Coinbase).Symbol;

}

public override void OnData(Slice slice)

{

// Only calculate the spread if the prices on both exchanges are in the current Slice.

if (slice.Bars.ContainsKey(_krakenBtc) && slice.Bars.ContainsKey(_coinbaseBtc))

{

// Calculate the spread between the 2 exchanges, making sure the comparison is always in the same direction.

var spread = slice.Bars[_krakenBtc].Close - slice.Bars[_coinbaseBtc].Close;

}

}

} class CryptoExampleAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

# Subscribe to BTC/USD on 2 different exchanges.

self.kraken_btc = self.add_crypto("BTCUSD", market=Market.KRAKEN).symbol

self.coinbase_btc = self.add_crypto("BTCUSD", market=Market.COINBASE).symbol

def on_data(self, slice: Slice) -> None:

# Only calculate the spread if the prices on both exchanges are in the current Slice.

if self.kraken_btc in slice.bars and self.coinbase_btc in slice.bars:

# Calculate the spread between the 2 exchanges, making sure the comparison is always in the same direction.

spread = slice.bars[self.kraken_btc].close - slice.bars[self.coinbase_btc].close