Crypto Futures

Handling Data

Introduction

LEAN passes the data you request to the OnDataon_data method so you can make trading decisions. The default OnDataon_data method accepts a Slice object, but you can define additional OnDataon_data methods that accept different data types. For example, if you define an OnDataon_data method that accepts a TradeBar argument, it only receives TradeBar objects. The Slice object that the OnDataon_data method receives groups all the data together at a single moment in time. To access the Slice outside of the OnDataon_data method, use the CurrentSlicecurrent_slice property of your algorithm.

All the data formats use DataDictionary objects to group data by Symbol and provide easy access to information. The plural of the type denotes the collection of objects. For instance, the TradeBars DataDictionary is made up of TradeBar objects. To access individual data points in the dictionary, you can index the dictionary with the security ticker or Symbolsymbol, but we recommend you use the Symbolsymbol.

To view the resolutions that are available for Crypto Futures data, see Resolutions.

Trades

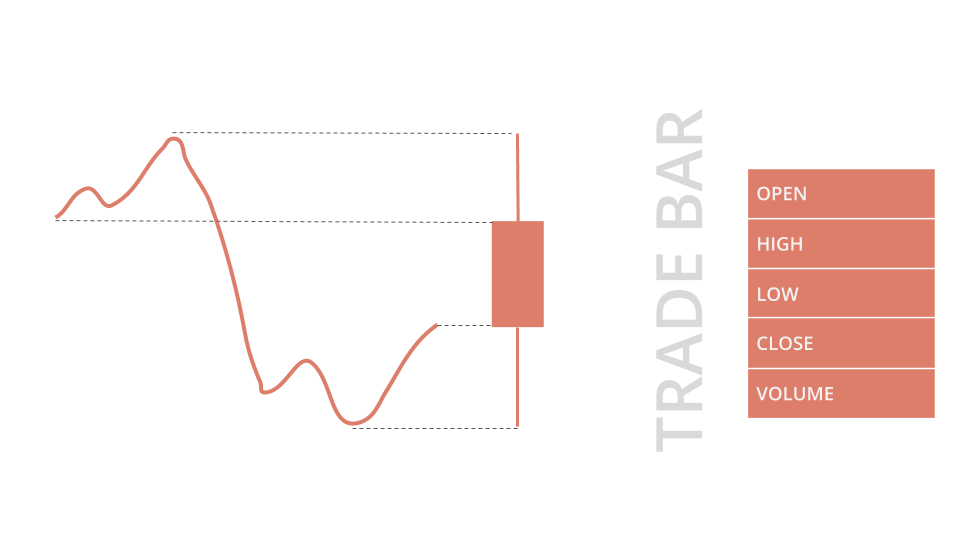

TradeBar objects are price bars that consolidate individual trades from the exchanges. They contain the open, high, low, close, and volume of trading activity over a period of time.

To get the TradeBar objects in the Slice, index the Slice or index the Barsbars property of the Slice with the security Symbolsymbol. If the security doesn't actively trade or you are in the same time step as when you added the security subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your security before you index the Slice with the security Symbolsymbol.

public override void OnData(Slice slice)

{

// Check if the symbol is contained in TradeBars object

if (slice.Bars.ContainsKey(_symbol))

{

// Obtain the mapped TradeBar of the symbol

var tradeBar = slice.Bars[_symbol];

}

}

def on_data(self, slice: Slice) -> None:

# Obtain the mapped TradeBar of the symbol if any

trade_bar = slice.bars.get(self._symbol) # None if not found

You can also iterate through the TradeBars dictionary. The keys of the dictionary are the Symbol objects and the values are the TradeBar objects.

public override void OnData(Slice slice)

{

// Iterate all received Symbol-TradeBar key-value pairs

foreach (var kvp in slice.Bars)

{

var symbol = kvp.Key;

var tradeBar = kvp.Value;

var closePrice = tradeBar.Close;

}

} def on_data(self, slice: Slice) -> None:

# Iterate all received Symbol-TradeBar key-value pairs

for symbol, trade_bar in slice.bars.items():

close_price = trade_bar.close

TradeBar objects have the following properties:

Quotes

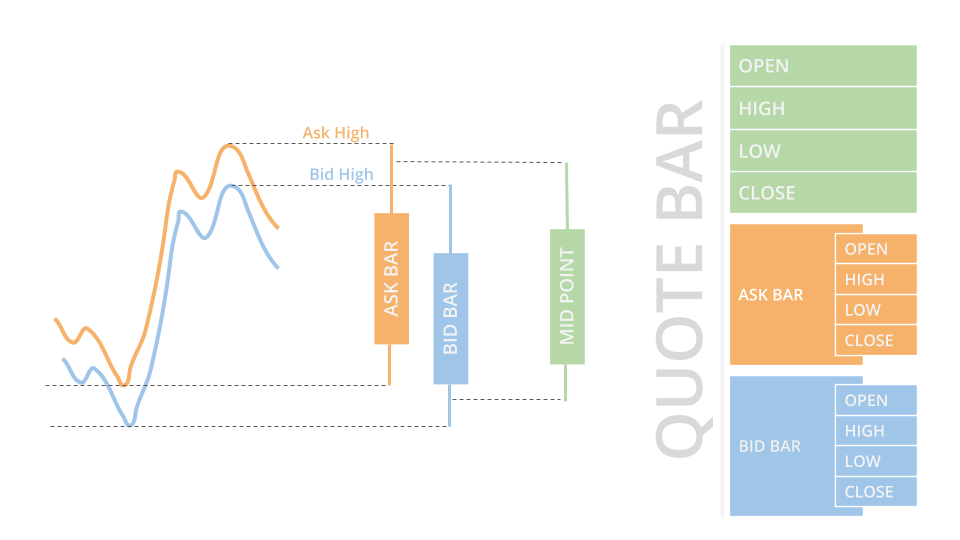

QuoteBar objects are bars that consolidate NBBO quotes from the exchanges. They contain the open, high, low, and close prices of the bid and ask. The Openopen, Highhigh, Lowlow, and Closeclose properties of the QuoteBar object are the mean of the respective bid and ask prices. If the bid or ask portion of the QuoteBar has no data, the Openopen, Highhigh, Lowlow, and Closeclose properties of the QuoteBar copy the values of either the Bidbid or Askask instead of taking their mean.

To get the QuoteBar objects in the Slice, index the QuoteBars property of the Slice with the security Symbolsymbol. If the security doesn't actively get quotes or you are in the same time step as when you added the security subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your security before you index the Slice with the security Symbolsymbol.

public override void OnData(Slice slice)

{

// Check if the symbol is contained in QuoteBars object

if (slice.QuoteBars.ContainsKey(_symbol))

{

// Obtain the mapped QuoteBar of the symbol

var quoteBar = slice.QuoteBars[_symbol];

}

}

def on_data(self, slice: Slice) -> None:

# Obtain the mapped QuoteBar of the symbol if any

quote_bar = slice.quote_bars.get(self._symbol) # None if not found

You can also iterate through the QuoteBars dictionary. The keys of the dictionary are the Symbol objects and the values are the QuoteBar objects.

public override void OnData(Slice slice)

{

// Iterate all received Symbol-QuoteBar key-value pairs

foreach (var kvp in slice.QuoteBars)

{

var symbol = kvp.Key;

var quoteBar = kvp.Value;

var askPrice = quoteBar.Ask.Close;

}

} def on_data(self, slice: Slice) -> None:

# Iterate all received Symbol-QuoteBar key-value pairs

for symbol, quote_bar in slice.quote_bars.items():

ask_price = quote_bar.ask.close

QuoteBar objects let LEAN incorporate spread costs into your simulated trade fills to make backtest results more realistic.

QuoteBar objects have the following properties:

Ticks

Tick objects represent a single trade or quote at a moment in time. A trade tick is a record of a transaction for the security. A quote tick is an offer to buy or sell the security at a specific price.

Trade ticks have a non-zero value for the Quantityquantity and Priceprice properties, but they have a zero value for the BidPricebid_price, BidSizebid_size, AskPriceask_price, and AskSizeask_size properties. Quote ticks have non-zero values for BidPricebid_price and BidSizebid_size properties or have non-zero values for AskPriceask_price and AskSizeask_size properties. To check if a tick is a trade or a quote, use the TickTypeticktype property.

In backtests, LEAN groups ticks into one millisecond buckets. In live trading, LEAN groups ticks into ~70-millisecond buckets. To get the Tick objects in the Slice, index the Ticks property of the Slice with a Symbolsymbol. If the security doesn't actively trade or you are in the same time step as when you added the security subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your security before you index the Slice with the security Symbolsymbol.

public override void OnData(Slice slice)

{

if (slice.Ticks.ContainsKey(_symbol))

{

var ticks = slice.Ticks[_symbol];

foreach (var tick in ticks)

{

var price = tick.Price;

}

}

}

def on_data(self, slice: Slice) -> None:

ticks = slice.ticks.get(self._symbol, []) # Empty if not found

for tick in ticks:

price = tick.price

You can also iterate through the Ticks dictionary. The keys of the dictionary are the Symbol objects and the values are the List<Tick>list[Tick] objects.

public override void OnData(Slice slice)

{

foreach (var kvp in slice.Ticks)

{

var symbol = kvp.Key;

var ticks = kvp.Value;

foreach (var tick in ticks)

{

var price = tick.Price;

}

}

} def on_data(self, slice: Slice) -> None:

for symbol, ticks in slice.ticks.items():

for tick in ticks:

price = tick.price

Tick data is raw and unfiltered, so it can contain bad ticks that skew your trade results. For example, some ticks come from dark pools, which aren't tradable. We recommend you only use tick data if you understand the risks and are able to perform your own online tick filtering.

Tick objects have the following properties:

Margin Interest Rates

MarginInterestRate objects contain the margin interest rate, which is a cost associated with trading on margin.

To get the MarginInterestRate objects in the Slice, index the MarginInterestRatesmargin_interest_rates property of the Slice with the Crypto Future Symbol.

The MarginInterestRatesmargin_interest_rates property of the Slice may not contain data for your Symbol.

To avoid issues, check if the property contains data for your Crypto Future before you index it with the Crypto Future Symbol.

public override void OnData(Slice slice)

{

if (slice.MarginInterestRates.TryGetValue(_symbol, out var marginInterestRate))

{

var interestRate = marginInterestRate.InterestRate;

}

} def on_data(self, slice: Slice) -> None:

margin_interest_rate = slice.margin_interest_rates.get(self._symbol)

if margin_interest_rate:

interest_rate = margin_interest_rate.interest_rate

You can also iterate through the MarginInterestRatesmargin_interest_rates dictionary. The keys of the dictionary are the Symbol objects and the values are the MarginInterestRatemargin_interest_rate objects.

public override void OnData(Slice slice)

{

foreach (var (symbol, marginInterestRate) in slice.MarginInterestRates)

{

var interestRate = marginInterestRate.InterestRate;

}

} def on_data(self, slice: Slice) -> None:

for symbol, margin_interest_rate in slice.margin_interest_rates.items():

interest_rate = margin_interest_rate.interest_rate

MarginInterestRate objects have the following properties:

Examples

The following examples demonstrate some common practices for handling Crypto Futures data.

Example 1: Adjust Holdings on Margin Payments

Perpetual futures have a mechanism called funding , where if you're holding a position at certain times (the funding timestamp), you might have to pay or receive funding based on the difference between the perpetual contract price and the spot price. This example demonstrates how to adjust your position in Crypto Future based on the funding rate. The funding is settled in the quote currency, which is USDT in this case. When you receive USDT, the algorithm increases its position size in BTCUSDT. When you pay USDT, the algorithm decreases its position size.

public class CryptoFutureAlgorithm : QCAlgorithm

{

private Symbol _symbol;

private decimal _lotSize;

private int _day = -1;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

// Set brokerage and account type to match your brokerage environment for accurate fee and margin behavior.

SetBrokerageModel(BrokerageName.Binance, AccountType.Margin);

// In the Binance brokerage, you can't trade with USD.

// Set the account currency as USDT and add the starting cash.

SetAccountCurrency("USDT", 1000000);

// Subscribe to the BTCUSDT perpetual Future contract.

var btcusdt = AddCryptoFuture("BTCUSDT");

_symbol = btcusdt.Symbol;

// Save the lot size to avoid order errors.

_lotSize = btcusdt.SymbolProperties.LotSize;

// Set the starting BTC balance to 10.

btcusdt.BaseCurrency.SetAmount(10);

}

public override void OnData(Slice slice)

{

// Only place orders when the market is open since market on open orders aren't supported.

if (!Portfolio.Invested && IsMarketOpen(_symbol))

{

// Open a long position in the perpetual Crypto Future.

MarketOrder(_symbol, 10);

}

// Only run the following logic once per day.

if (_day == Time.Day)

{

return;

}

// Get the current margin interest rate.

MarginInterestRate interestRate;

if (!slice.MarginInterestRates.TryGetValue(_symbol, out interestRate))

{

return;

}

// Calculate the funding payment.

var holding = Portfolio[_symbol];

var positionValue = holding.GetQuantityValue(holding.Quantity).Amount;

var funding = interestRate.InterestRate * positionValue / holding.Price;

// Increase/decrease the position size based on the funding payment.

var quantity = -(int)(funding / _lotSize) * _lotSize;

if (quantity != 0)

{

MarketOrder(_symbol, quantity);

// Plot the portfolio state.

Plot("CashBook", "USDT", Portfolio.CashBook["USDT"].Amount);

Plot("CashBook", "BTC", Portfolio.CashBook["BTC"].Amount);

Plot("Quantity", "BTCUSDT", Portfolio[_symbol].Quantity);

}

_day = Time.Day;

}

} class CryptoFutureAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

# Set brokerage and account type to match your brokerage environment for accurate fee and margin behavior.

self.set_brokerage_model(BrokerageName.BINANCE, AccountType.MARGIN)

# In the Binance brokerage, you can't trade with USD.

# Set the account currency as USDT and add the starting cash.

self.set_account_currency("USDT", 1000000)

# Subscribe to the BTCUSDT perpetual Future contract.

btcusdt = self.add_crypto_future("BTCUSDT")

self._symbol = btcusdt.symbol

# Save the lot size to avoid order errors.

self._lot_size = btcusdt.symbol_properties.lot_size

# Set the starting BTC balance to 10.

btcusdt.base_currency.set_amount(10)

# Create a member to track the current day.

self._day = -1

def on_data(self, slice: Slice) -> None:

# Only place orders when the market is open since market on open orders aren't supported.

if not self.portfolio.invested and self.is_market_open(self._symbol):

# Open a long position in the perpetual Crypto Future.

self.market_order(self._symbol, 10)

# Only run the following logic once per day.

if self._day == self.time.day:

return

# Get the current margin interest rate.

interest_rate = slice.margin_interest_rates.get(self._symbol)

if not interest_rate:

return

# Calculate the funding payment.

holding = self.portfolio[self._symbol]

position_value = holding.get_quantity_value(holding.quantity).amount

interest_rate = slice.margin_interest_rates[self._symbol].interest_rate

funding = interest_rate * position_value / holding.security.price

# Increase/decrease the position size based on the funding payment.

quantity = -funding // self._lot_size * self._lot_size

if quantity:

self.market_order(self._symbol, quantity)

# Plot the portfolio state.

self.plot("CashBook", "USDT", self.portfolio.cash_book['USDT'].amount)

self.plot("CashBook", "BTC", self.portfolio.cash_book['BTC'].amount)

self.plot("Quantity", "BTCUSDT", self.portfolio[self._symbol].quantity)

self._day = self.time.day

Example 2: Future-Spot Arbitrage

Long-short arbitrage involves simultaneously trading BTCUSDT in the spot market and BTCUSDT Futures with the same size but in the opposite direction. The following algorithm monitors the spread between these markets. If the spot price exceeds the Future price by a threshold, it shorts the spot market and buys the Future contract (and vice vera for the other way around), assuming their discrepancies will be wiped out within a short period due to market efficiency. It closes the positions after the spread inverts.

public class CryptoFutureArbitrageAlgorithm : QCAlgorithm

{

private Crypto _spot;

private CryptoFuture _future;

private decimal _multiplier;

private decimal _threshold = 1.005m; // 0.5%

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

// Set brokerage and account type to match your brokerage

// environment for accurate fee and margin behavior.

SetBrokerageModel(BrokerageName.Binance, AccountType.Margin);

// In the Binance brokerage, you can't trade with USD.

// Set the account currency to USDT and add the starting cash.

SetAccountCurrency("USDT", 50000000);

// Add the BTCUSDT spot and Futures markets.

_spot = AddCrypto("BTCUSDT", fillForward: false, market: Market.Binance);

_future = AddCryptoFuture("BTCUSDT", fillForward: false, market: Market.Binance);

_multiplier = _future.SymbolProperties.ContractMultiplier;

}

public override void OnData(Slice slice)

{

// Wait for there to be a TradeBar for each asset, so we know

// the prices are up-to-date.

foreach (var security in new List<Security>() {_spot, _future})

if (!slice.Bars.ContainsKey(security.Symbol)) return;

var spot = _spot.Price;

var future = _future.Price;

// Buy low sell high: If one's price is above another by the

// set threshold, sell it and buy the other security. The

// threshold ensures there is enough profit potential to overcome

// the fees and slippage. Make sure to equalize the actual order

// size with the contract multiplier.

if (!_spot.Invested)

{

if (spot >= future * _threshold)

{

Enter(-1, 1);

}

else if (future >= spot * _threshold)

{

Enter(1, -1);

}

return;

}

// When the mispricing converges, close both positions to earn

// the spread.

if ((_spot.Holdings.IsShort && spot < future) ||

(_spot.Holdings.IsLong && spot > future))

{

// Liquidate the spot position.

var quantity = Math.Min(_spot.Holdings.Quantity, _spot.BaseCurrency.Amount);

if (quantity < 0m)

{

quantity /= (1 - 0.001m); // To cover the taker fees.

}

var lotSize = _spot.SymbolProperties.LotSize;

quantity = -Math.Round(quantity / lotSize) * lotSize;

MarketOrder(_spot.Symbol, quantity, tag: "Liquidate Spot");

// Liquidate the Future position.

Liquidate(_future.Symbol, tag: "Liquidate Future");

}

}

private void Enter(int spotSign, int futureSign)

{

var quantity = CalculateOrderQuantity(_future.Symbol, 0.5d);

if (quantity == 0) return;

// Enter the spot position.

MarketOrder(_spot.Symbol, spotSign * quantity * _multiplier, tag: "Spot");

// Enter the Future position.

MarketOrder(_future.Symbol, futureSign * quantity, tag: "Future");

}

} class CryptoFutureArbitrageAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

# Set brokerage and account type to match your brokerage

# environment for accurate fee and margin behavior.

self.set_brokerage_model(BrokerageName.BINANCE, AccountType.MARGIN)

# In the Binance brokerage, you can't trade with USD.

# Set the account currency to USDT and add the starting cash.

self.set_account_currency("USDT", 50_000_000)

# Add the BTCUSDT spot and Futures markets.

self._spot = self.add_crypto(

"BTCUSDT", fill_forward=False, market=Market.BINANCE

)

self._future = self.add_crypto_future(

"BTCUSDT", fill_forward=False, market=Market.BINANCE

)

self._multiplier = self._future.symbol_properties.contract_multiplier

self._threshold = 1.005 # 0.5%

def on_data(self, slice: Slice) -> None:

# Wait for there to be a TradeBar for each asset, so we know

# the prices are up-to-date.

for security in [self._spot, self._future]:

if security.symbol not in slice.bars:

return

spot = self._spot.price

future = self._future.price

# Buy low sell high: If one's price is above another by the

# set threshold, sell it and buy the other security. The

# threshold ensures there is enough profit potential to overcome

# the fees and slippage. Make sure to equalize the actual order

# size with the contract multiplier.

if not self._spot.invested:

if spot >= future * self._threshold:

self._enter(-1, 1)

elif future >= spot * self._threshold:

self._enter(1, -1)

return

# When the mispricing converges, close both positions to earn

# the spread.

if ((self._spot.holdings.is_short and spot < future) or

(self._spot.holdings.is_long and spot > future)):

# Liquidate the spot position.

quantity = min(

self._spot.holdings.quantity,

self._spot.base_currency.amount

)

if quantity < 0:

quantity /= (1 - 0.001) # To cover the taker fees.

lot_size = self._spot.symbol_properties.lot_size

quantity = -round(quantity / lot_size) * lot_size

self.market_order(self._spot.symbol, quantity, tag='Liquidate Spot')

# Liquidate the Future position.

self.liquidate(self._future.symbol, tag='Liquidate Future')

def _enter(self, spot_sign, future_sign):

quantity = self.calculate_order_quantity(self._future.symbol, 0.5)

if not quantity:

return

# Enter the spot position.

spot_quantity = spot_sign * quantity * self._multiplier

self.market_order(self._spot.symbol, spot_quantity, tag='Spot')

# Enter the Future position.

self.market_order(self._future, future_sign * quantity, tag='Future')