Equity Options

Handling Data

Introduction

LEAN passes the data you request to the OnDataon_data method so you can make trading decisions. The default OnDataon_data method accepts a Slice object, but you can define additional OnDataon_data methods that accept different data types. For example, if you define an OnDataon_data method that accepts a TradeBar argument, it only receives TradeBar objects. The Slice object that the OnDataon_data method receives groups all the data together at a single moment in time. To access the Slice outside of the OnDataon_data method, use the CurrentSlicecurrent_slice property of your algorithm.

All the data formats use DataDictionary objects to group data by Symbol and provide easy access to information. The plural of the type denotes the collection of objects. For instance, the TradeBars DataDictionary is made up of TradeBar objects. To access individual data points in the dictionary, you can index the dictionary with the contract ticker or Symbolsymbol, but we recommend you use the Symbolsymbol.

To view the resolutions that are available for Equity Options data, see Resolutions.

Trades

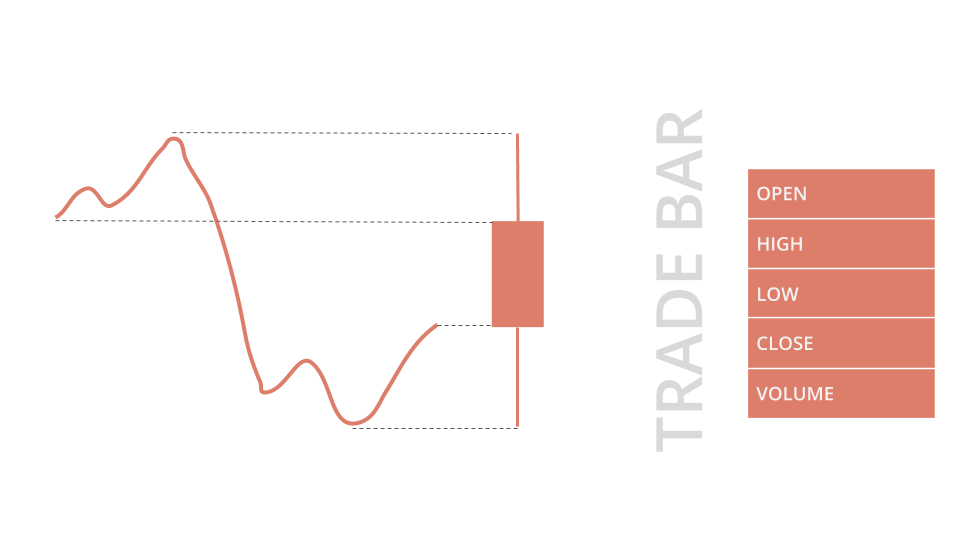

TradeBar objects are price bars that consolidate individual trades from the exchanges. They contain the open, high, low, close, and volume of trading activity over a period of time.

To get the TradeBar objects in the Slice, index the Slice or index the Barsbars property of the Slice with the contract Symbolsymbol. If the contract doesn't actively trade or you are in the same time step as when you added the contract subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your contract before you index the Slice with the contract Symbolsymbol.

public override void OnData(Slice slice)

{

// Check if the symbol is contained in TradeBars object

if (slice.Bars.ContainsKey(_contractSymbol))

{

// Obtain the mapped TradeBar of the symbol

var tradeBar = slice.Bars[_contractSymbol];

}

}

def on_data(self, slice: Slice) -> None:

# Obtain the mapped TradeBar of the symbol if any

trade_bar = slice.bars.get(self._contract_symbol) # None if not found

You can also iterate through the TradeBars dictionary. The keys of the dictionary are the Symbol objects and the values are the TradeBar objects.

public override void OnData(Slice slice)

{

// Iterate all received Symbol-TradeBar key-value pairs

foreach (var kvp in slice.Bars)

{

var symbol = kvp.Key;

var tradeBar = kvp.Value;

var closePrice = tradeBar.Close;

}

} def on_data(self, slice: Slice) -> None:

# Iterate all received Symbol-TradeBar key-value pairs

for symbol, trade_bar in slice.bars.items():

close_price = trade_bar.close

TradeBar objects have the following properties:

Quotes

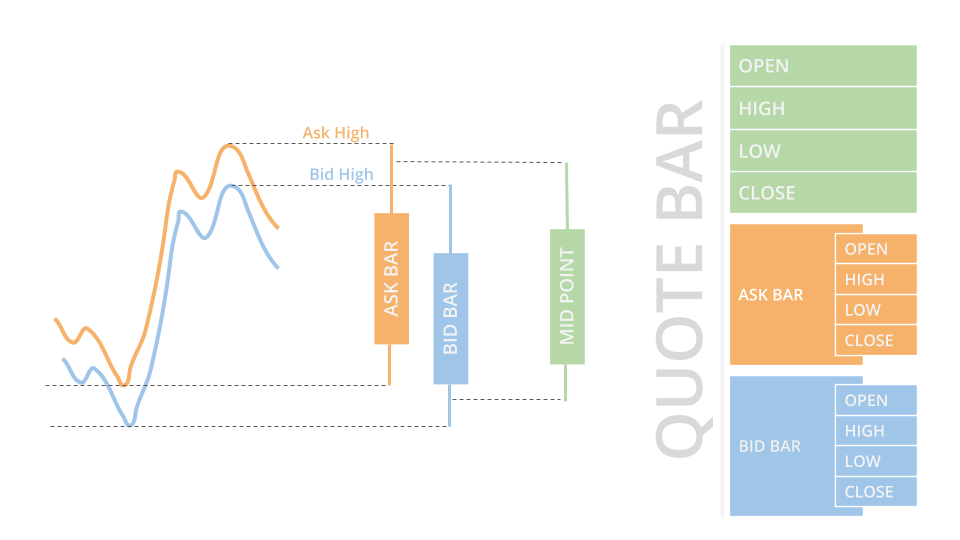

QuoteBar objects are bars that consolidate NBBO quotes from the exchanges. They contain the open, high, low, and close prices of the bid and ask. The Openopen, Highhigh, Lowlow, and Closeclose properties of the QuoteBar object are the mean of the respective bid and ask prices. If the bid or ask portion of the QuoteBar has no data, the Openopen, Highhigh, Lowlow, and Closeclose properties of the QuoteBar copy the values of either the Bidbid or Askask instead of taking their mean.

To get the QuoteBar objects in the Slice, index the QuoteBars property of the Slice with the contract Symbolsymbol. If the contract doesn't actively get quotes or you are in the same time step as when you added the contract subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your contract before you index the Slice with the contract Symbolsymbol.

public override void OnData(Slice slice)

{

// Check if the symbol is contained in QuoteBars object

if (slice.QuoteBars.ContainsKey(_contractSymbol))

{

// Obtain the mapped QuoteBar of the symbol

var quoteBar = slice.QuoteBars[_contractSymbol];

}

}

def on_data(self, slice: Slice) -> None:

# Obtain the mapped QuoteBar of the symbol if any

quote_bar = slice.quote_bars.get(self._contract_symbol) # None if not found

You can also iterate through the QuoteBars dictionary. The keys of the dictionary are the Symbol objects and the values are the QuoteBar objects.

public override void OnData(Slice slice)

{

// Iterate all received Symbol-QuoteBar key-value pairs

foreach (var kvp in slice.QuoteBars)

{

var symbol = kvp.Key;

var quoteBar = kvp.Value;

var askPrice = quoteBar.Ask.Close;

}

} def on_data(self, slice: Slice) -> None:

# Iterate all received Symbol-QuoteBar key-value pairs

for symbol, quote_bar in slice.quote_bars.items():

ask_price = quote_bar.ask.close

QuoteBar objects let LEAN incorporate spread costs into your simulated trade fills to make backtest results more realistic.

QuoteBar objects have the following properties:

Option Chains

OptionChain objects represent an entire chain of Option contracts for a single underlying security.

To get the OptionChain, index the OptionChainsoption_chains property of the Slice with the canonical Symbol.

public override void OnData(Slice slice)

{

// Try to get the OptionChain using the canonical symbol

if (slice.OptionChains.TryGetValue(_contractSymbol.Canonical, out var chain))

{

// Get all contracts if the OptionChain contains any member

var contracts = chain.Contracts;

}

} def on_data(self, slice: Slice) -> None:

# Try to get the OptionChain using the canonical symbol (None if no OptionChain return)

chain = slice.option_chains.get(self._contract_symbol.Canonical)

if chain:

# Get all contracts if the OptionChain contains any member

contracts = chain.contracts

You can also loop through the OptionChainsoption_chains property to get each OptionChain.

public override void OnData(Slice slice)

{

// Iterate all received Canonical Symbol-OptionChain key-value pairs

foreach (var kvp in slice.OptionChains)

{

var canonicalSymbol = kvp.Key;

var chain = kvp.Value;

var contracts = chain.Contracts;

}

} def on_data(self, slice: Slice) -> None:

# Iterate all received Canonical Symbol-OptionChain key-value pairs

for canonical_symbol, chain in slice.option_chains.items():

contracts = chain.contracts

OptionChain objects have the following properties:

Option Contracts

OptionContract objects represent the data of a single Option contract in the market.

To get the Option contracts in the Slice, use the Contractscontracts property of the OptionChain.

public override void OnData(Slice slice)

{

// Try to get the OptionChain using the canonical symbol

if (slice.OptionChains.TryGetValue(_contractSymbol.Canonical, out var chain))

{

// Get individual contract data

if (chain.Contracts.TryGetValue(_contractSymbol, out var contract))

{

var price = contract.Price;

}

}

} def on_data(self, slice: Slice) -> None:

# Try to get the OptionChain using the canonical symbol

chain = slice.option_chains.get(self._contract_symbol.canonical)

if chain:

# Get individual contract data

contract = chain.contracts.get(self._contract_symbol)

if contract:

price = contract.price

Greeks and Implied Volatility

To get the Greeks and implied volatility of an Option contract, use the Greeksgreeks and implied_volatility members.

public override void OnData(Slice slice)

{

// Try to get the OptionChain using the canonical symbol

if (slice.OptionChains.TryGetValue(_contractSymbol.Canonical, out var chain))

{

// Get individual contract data

if (chain.Contracts.TryGetValue(_contractSymbol, out var contract))

{

// Get greeks data of the selected contract

var delta = contract.Greeks.Delta;

var iv = contract.ImpliedVolatility;

}

}

} def on_data(self, slice: Slice) -> None:

# Try to get the OptionChain using the canonical symbol

chain = slice.option_chains.get(self._contract_symbol.canonical)

if chain:

# Get individual contract data

contract = chain.contracts.get(self._contract_symbol)

if contract:

# Get greeks data of the selected contract

delta = contract.greeks.delta

iv = contract.implied_volatility

LEAN only calculates Greeks and implied volatility when you request them because they are expensive operations. If you invoke the Greeksgreeks property, the Greeks aren't calculated. However, if you invoke the Greeks.Deltagreeks.delta, LEAN calculates the delta. To avoid unecessary computation in your algorithm, only request the Greeks and implied volatility when you need them. For more information about the Greeks and implied volatility, see Options Pricing.

Open Interest

Open interest is the number of outstanding contracts that haven't been settled. It provides a measure of investor interest and the market liquidity, so it's a popular metric to use for contract selection. Open interest is calculated once per day. To get the latest open interest value, use the OpenInterestopen_interest property of the Option or OptionContractoption_contract.

public override void OnData(Slice slice)

{

// Try to get the OptionChains using the canonical symbol

if (slice.OptionChains.TryGetValue(_contractSymbol.Canonical, out var chain))

{

// Get individual contract data

if (chain.Contracts.TryGetValue(_contractSymbol, out var contract))

{

// Get the open interest of the selected contracts

var openInterest = contract.OpenInterest;

}

}

}

public void OnData(OptionChains optionChains)

{

// Try to get the OptionChains using the canonical symbol

if (optionChains.TryGetValue(_contractSymbol.Canonical, out var chain))

{

// Get individual contract data

if (chain.Contracts.TryGetValue(_contractSymbol, out var contract))

{

// Get the open interest of the selected contracts

var openInterest = contract.OpenInterest;

}

}

}

def on_data(self, slice: Slice) -> None:

# Try to get the option_chains using the canonical symbol

chain = slice.option_chains.get(self._contract_symbol.canonical)

if chain:

# Get individual contract data

contract = chain.contracts.get(self._contract_symbol)

if contract:

# Get the open interest of the selected contracts

open_interest = contract.open_interest

Properties

OptionContract objects have the following properties:

Examples

Example 1: Get Mid Price For Individual Contracts

This example shows how to handle

QuoteBar

data for shortlisted Equity Option contracts to calculate mid price using bid close and ask close data, while

filter individual option contracts and request data

using

OptionChain

self.option_chain

method for the contracts that expires within the current week. Using mid price, we can examine the market fair value of the Option and compare with model theoretical price.

public class EquityOptionHandlingDataAlgorithm : QCAlgorithm

{

private Symbol _spy;

private List<Symbol> _contracts = new();

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

// Seed the price with last known price to ensure the underlying price data is available on initial option contract filtering.

Settings.SeedInitialPrices = true;

// Subscribe to underlying data for ATM calculation using the update underlying price.

// Set data normalization mode to raw is required to ensure strike price and underlying price is comparable.

_spy = AddEquity("SPY", dataNormalizationMode: DataNormalizationMode.Raw).Symbol;

// Update the tradable contracts daily before market open since the option contract list provider populate them daily.

Schedule.On(

DateRules.EveryDay(_spy),

TimeRules.At(9, 0),

UpdateContracts

);

}

private void UpdateContracts()

{

// Get all contracts that expiring this week to trade with, subscribe to data for trading need.

_contracts = OptionChain(_spy)

.Where(x => x.ID.Date <= Expiry.EndOfWeek(Time))

.Select(x => AddOptionContract(x).Symbol)

.ToList();

}

public override void OnData(Slice slice)

{

// Only focus on filtered list of option contracts to trade.

foreach (var contract in _contracts)

{

// Mid price can only be calculated when quote bar data is available.

if (slice.QuoteBars.TryGetValue(contract, out var quote))

{

if (quote.Bid != null && quote.Ask != null)

{

// Mid price = average of bid close price and ask close price.

var midPrice = (quote.Bid.Close + quote.Ask.Close) * 0.5m;

}

}

}

}

} class EquityOptionHandlingDataAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

self.contracts = []

# Seed the price with last known price to ensure the underlying price data is available on initial option contract filtering.

self.settings.seed_initial_prices = True

# Subscribe to underlying data for ATM calculation using the update underlying price.

# Set data normalization mode to raw is required to ensure strike price and underlying price is comparable.

self.spy = self.add_equity("SPY", data_normalization_mode=DataNormalizationMode.RAW).symbol

# Update the tradable contracts daily before market open since the option contract list provider populate them daily.

self.schedule.on(

self.date_rules.every_day(self.spy),

self.time_rules.at(9, 0),

self.update_contracts

)

def update_contracts(self) -> None:

# Get all contracts that expiring this week to trade with, subscribe to data for trading need.

contracts = self.option_chain(self.spy)

self.contracts = [self.add_option_contract(x).symbol for x in contracts

if x.id.date < Expiry.end_of_week(self.time)]

def on_data(self, slice: Slice) -> None:

# Only focus on filtered list of option contracts to trade.

for contract in self.contracts:

# Mid price can only be calculated when quote bar data is available.

quote = slice.quote_bars.get(contract)

if quote and quote.bid is not None and quote.ask is not None:

# Mid price = average of bid close price and ask close price.

mid_price = (quote.bid.close + quote.ask.close) * 0.5

Example 2: Get Mid Price For Universe

This example shows how to handle

QuoteBar

data for shortlisted Equity Option contracts to calculate mid price using bid close and ask close data, while

request data through universe selection function

using

SetFilter

set_filter

method for the contracts that expires within the current week. Using mid price, we can examine the market fair value of the Option and compare with model theoretical price.

public class EquityOptionHandlingDataAlgorithm : QCAlgorithm

{

private Symbol _symbol;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

// Seed the price with last known price to ensure the underlying price data is available on initial option contract filtering.

Settings.SeedInitialPrices = true;

// Subscribe to underlying data for ATM calculation using the update underlying price.

// Set data normalization mode to raw is required to ensure strike price and underlying price is comparable.

var spy = AddEquity("SPY", dataNormalizationMode: DataNormalizationMode.Raw).Symbol;

// Subscribe to SPY option data.

var option = AddOption(spy);

_symbol = option.Symbol;

// We wish to only trade the contracts expiring within the same week since they have the highest volume.

option.SetFilter((u) => u.IncludeWeeklys().Contracts((x) => x.Where(s => s.ID.Date <= Expiry.EndOfWeek(Time))));

}

public override void OnData(Slice slice)

{

// Only want to obtain the option chain of the selected symbol.

if (slice.OptionChains.TryGetValue(_symbol, out var chain))

{

foreach (var contract in chain)

{

// Mid price = average of bid close price and ask close price.

var midPrice = (contract.BidPrice + contract.AskPrice) * 0.5m;

}

}

}

} class EquityOptionHandlingDataAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

# Seed the price with last known price to ensure the underlying price data is available on initial option contract filtering.

self.settings.seed_initial_prices = True

# Subscribe to underlying data for ATM calculation using the update underlying price.

# Set data normalization mode to raw is required to ensure strike price and underlying price is comparable.

spy = self.add_equity("SPY", data_normalization_mode=DataNormalizationMode.RAW).symbol

# Subscribe to SPY option data.

option = self.add_option(spy)

self._symbol = option.symbol

# We wish to only trade the contracts expiring within the same week since they have the highest volume.

option.set_filter(lambda u: u.include_weeklys().contracts(lambda x: [s for s in x if s.id.date <= Expiry.end_of_week(self.time)]))

def on_data(self, slice: Slice) -> None:

# Only want to obtain the option chain of the selected symbol.

chain = slice.option_chains.get(self._symbol)

if not chain:

return

for contract in chain:

# Mid price = average of bid close price and ask close price

mid_price = (contract.bid_price + contract.ask_price) * 0.5

Example 3: Get Instant Delta

The option greeks change rapidly, so we need to obtain the instant greeks to accurately calculate the hedge size for arbitration or replication portfolio. You can call the

Greeks

property from the

OptionChain

data to access various greeks. In this example, we will demonstrate how to obtain the contract with delta closest to 0.4 among all call contracts expiring the same week.

public class EquityOptionHandlingDataAlgorithm : QCAlgorithm

{

private Symbol _symbol;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

// Seed the price with last known price to ensure the underlying price data is available on initial option contract filtering.

Settings.SeedInitialPrices = true;

// Subscribe to underlying data for ATM calculation using the update underlying price.

// Set data normalization mode to raw is required to ensure strike price and underlying price is comparable.

var spy = AddEquity("SPY", dataNormalizationMode: DataNormalizationMode.Raw).Symbol;

// Subscribe to SPY option data.

var option = AddOption(spy);

_symbol = option.Symbol;

// We wish to only trade the contracts expiring within the same week since they have the highest volume.

// 0.4 Delta will only appear in call contracts.

option.SetFilter((u) => u.IncludeWeeklys().Delta(0.2m, 0.6m).Contracts((x) => x.Where(s => s.ID.Date <= Expiry.EndOfWeek(Time))));

}

public override void OnData(Slice slice)

{

// Only want to obtain the option chain of the selected symbol.

if (slice.OptionChains.TryGetValue(_symbol, out var chain))

{

// Get the contract with Delta closest to 0.4 to trade.

// The arbitary delta criterion might be set due to hedging need or risk adjustment.

var selected = chain.OrderBy(x => Math.Abs(x.Greeks.Delta - 0.4m)).First();

}

}

} class EquityOptionHandlingDataAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

# Seed the price with last known price to ensure the underlying price data is available on initial option contract filtering.

self.settings.seed_initial_prices = True

# Subscribe to underlying data for ATM calculation using the update underlying price.

# Set data normalization mode to raw is required to ensure strike price and underlying price is comparable.

spy = self.add_equity("SPY", data_normalization_mode=DataNormalizationMode.RAW).symbol

# Subscribe to SPY option data.

option = self.add_option(spy)

self._symbol = option.symbol

# We wish to only trade the contracts expiring within the same week since they have the highest volume.

# 0.4 Delta will only appear in call contracts.

option.set_filter(lambda u: u.include_weeklys().delta(0.2, 0.6).contracts(lambda x: [s for s in x if s.id.date <= Expiry.end_of_week(self.time)]))

def on_data(self, slice: Slice) -> None:

# Only want to obtain the option chain of the selected symbol.

chain = slice.option_chains.get(self._symbol)

if not chain:

return

# Get the contract with Delta closest to 0.4 to trade.

# The arbitary delta criterion might be set due to hedging need or risk adjustment.

selected = sorted(chain, key=lambda x: abs(x.greeks.delta - 0.4))[0]