Popular Libraries

Stable Baselines

Get Historical Data

Get some historical market data to train and test the model. For example, to get data for the different asset class ETFs during 2010 and 2023, run:

qb = QuantBook() symbols = [ qb.add_equity("SPY", Resolution.DAILY).symbol, qb.add_equity("GLD", Resolution.DAILY).symbol, qb.add_equity("TLT", Resolution.DAILY).symbol, qb.add_equity("USO", Resolution.DAILY).symbol, qb.add_equity("UUP", Resolution.DAILY).symbol ] df = qb.history(symbols, datetime(2010, 1, 1), datetime(2024, 1, 1))

Prepare Data

You need some historical data to prepare the data for the model. If you have historical data, manipulate it to train and test the model. In this example, extract the close price series as the outcome and obtain the partial-differenced time-series of OHLCV values as the observation.

history = df.unstack(0) # we arbitrarily select weight 0.5 here, but ideally one should strike a balance between variance retained and stationarity. partial_diff = (history.diff() * 0.5 + history * 0.5).iloc[1:].fillna(0) history = history.close.iloc[1:]

Train Models

You need to prepare the historical data for training before you train the model. If you have prepared the data, build and train the environment and the model. In this example, create a gym environment to initialize the training environment, agent and reward. Then, create a RL model by DQN algorithm. Follow these steps to create the environment and the model:

- Split the data for training and testing to evaluate our model.

- Create a custom

gymenvironment class. - Initialize the environment.

- Train the model.

X_train = partial_diff.iloc[:-100].values X_test = partial_diff.iloc[-100:].values y_train = history.iloc[:-100].values y_test = history.iloc[-100:].values

In this example, create a custom environment with previous 5 OHLCV partial-differenced price data as the observation and the lowest maximum drawdown as the reward.

class PortfolioEnv(gym.Env): def __init__(self, data, prediction, num_stocks): super(PortfolioEnv, self).__init__() self.data = data self.prediction = prediction self.num_stocks = num_stocks self.current_step = 5 self.portfolio_value = [] self.portfolio_weights = np.ones(num_stocks) / num_stocks # Define your action and observation spaces self.action_space = gym.spaces.Box(low=-1.0, high=1.0, shape=(num_stocks, ), dtype=np.float32) self.observation_space = gym.spaces.Box(low=-np.inf, high=np.inf, shape=(5, data.shape[1])) def reset(self): self.current_step = 5 self.portfolio_value = [] self.portfolio_weights = np.ones(self.num_stocks) / self.num_stocks return self._get_observation() def step(self, action): # Normalize the portfolio weights sum_weights = np.sum(np.abs(action)) if sum_weights > 1: action /= sum_weights # deduct transaction fee value = self.prediction[self.current_step] fees = np.abs(self.portfolio_weights - action) @ value # Update portfolio weights based on the chosen action self.portfolio_weights = action # Update portfolio value based on the new weights and the market prices less fee self.portfolio_value.append(np.dot(self.portfolio_weights, value) - fees) # Move to the next time step self.current_step += 1 # Check if the episode is done (end of data) done = self.current_step >= len(self.data) - 1 # Calculate the reward, in here, we use max drawdown reward = self._neg_max_drawdown return self._get_observation(), reward, done, {} def _get_observation(self): # Return the last 5 partial differencing OHLCV as the observation return self.data[self.current_step-5:self.current_step] @property def _neg_max_drawdown(self): # Return max drawdown within 20 days in portfolio value as reward (negate since max reward is preferred) portfolio_value_20d = np.array(self.portfolio_value[-min(len(self.portfolio_value), 20):]) acc_max = np.maximum.accumulate(portfolio_value_20d) return -(portfolio_value_20d - acc_max).min() def render(self, mode='human'): # Implement rendering if needed pass

# Initialize the environment env = PortfolioEnv(X_train, y_train, 5) # Wrap the environment in a vectorized environment env = DummyVecEnv([lambda: env]) # Normalize the observation space env = VecNormalize(env, norm_obs=True, norm_reward=False)

In this example, create a RL model and train with MLP-policy PPO algorithm.

# Define the PPO agent model = PPO("MlpPolicy", env, verbose=0) # Train the agent model.learn(total_timesteps=100000)

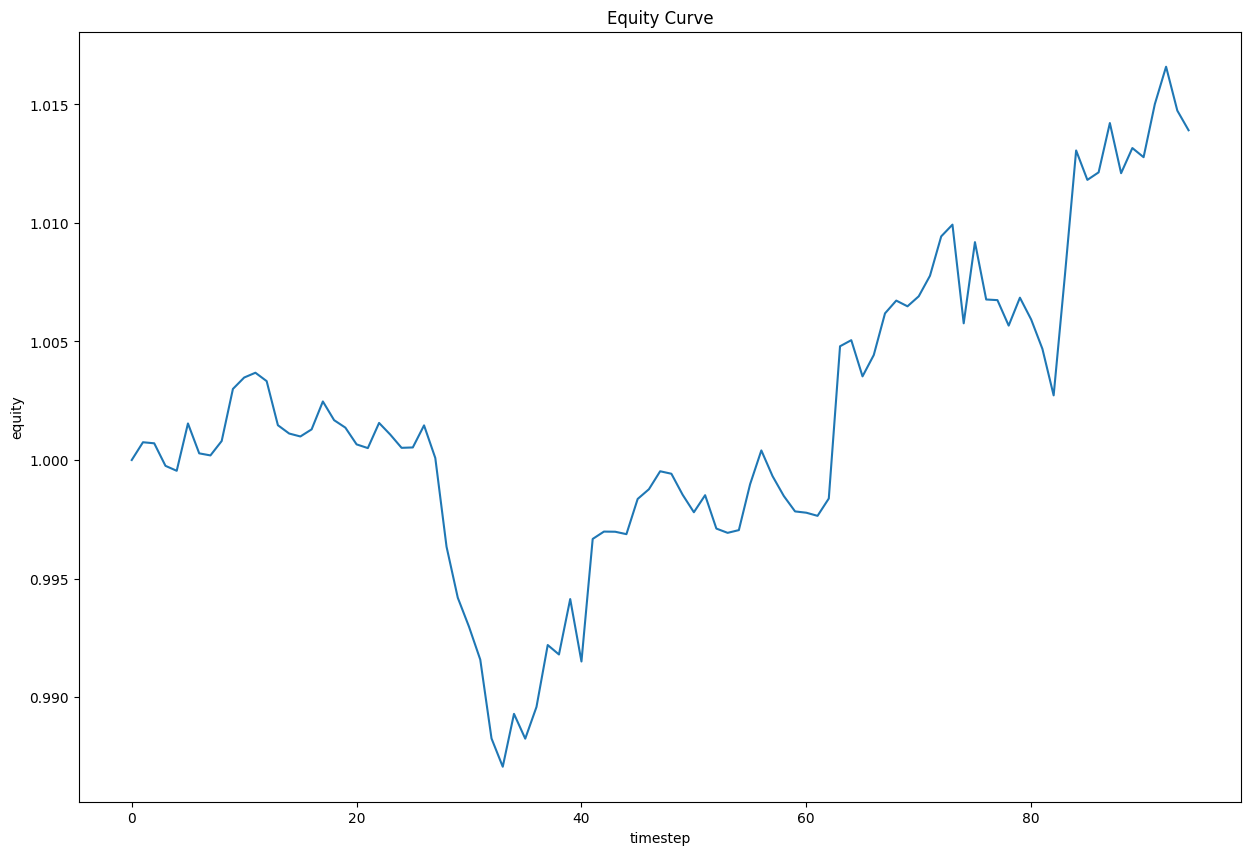

Test Models

You need to build and train the model before you test its performance. If you have trained the model, test it on the out-of-sample data. Follow these steps to test the model:

- Initialize a return series to calculate performance and a list to store the equity value at each timestep.

- Iterate each testing data point for prediction and trading.

- Plot the result.

test = np.log(y_test[1:]/y_test[:-1]) equity = [1]

for i in range(5, X_test.shape[0]-1): action, _ = model.predict(X_test[i-5:i], deterministic=True) sum_weights = np.sum(np.abs(action)) if sum_weights > 1: action /= sum_weights value = test[i] @ action.T equity.append((1+value) * equity[i-5])

plt.figure(figsize=(15, 10)) plt.title("Equity Curve") plt.xlabel("timestep") plt.ylabel("equity") plt.plot(equity) plt.show()

Store Models

You can save and load stable baselines models using the Object Store.

Save Models

- Set the key name of the model to be stored in the Object Store.

- Call the

get_file_pathmethod with the key. - Call the

savemethod with the file path.

model_key = "model"

file_name = qb.object_store.get_file_path(model_key)

This method returns the file path where the model will be stored.

model.save(file_name)

Load Models

You must save a model into the Object Store before you can load it from the Object Store. If you saved a model, follow these steps to load it:

- Call the

contains_keymethod. - Call the

get_file_pathmethod with the key. - Call the

loadmethod with the file path, environment and policy.

qb.object_store.contains_key(model_key)

This method returns a boolean that represents if the model_key is in the Object Store. If the Object Store does not contain the model_key, save the model using the model_key before you proceed.

file_name = qb.object_store.get_file_path(model_key)

This method returns the path where the model is stored.

loaded_model = PPO.load(file_name, env=env, policy="MlpPolicy")

This method returns the saved model.

Examples

The following examples demonstrate some common practices for using the Stable Baselines library.

Example 1: Machine Trading

The following research notebook uses Stable Baselines machine learning model to make trading decision, based on the previous 5 OHLCV partial differencing as observation.

# Import the gym and stable_baselines3 library. import gym from stable_baselines3 import PPO from stable_baselines3.common.vec_env import DummyVecEnv, VecNormalize # Instantiate the QuantBook for researching. qb = QuantBook() # Request the daily history with the date range to be studied. symbols = [ qb.add_equity("SPY", Resolution.DAILY).symbol, qb.add_equity("GLD", Resolution.DAILY).symbol, qb.add_equity("TLT", Resolution.DAILY).symbol, qb.add_equity("USO", Resolution.DAILY).symbol, qb.add_equity("UUP", Resolution.DAILY).symbol ] df = qb.history(symbols, datetime(2010, 1, 1), datetime(2024, 1, 1)) # Obtain the daily partial differencing to be the features and labels. history = df.unstack(0) # we arbitrarily select weight 0.5 here, but ideally one should strike a balance between variance retained and stationarity. partial_diff = (history.diff() * 0.5 + history * 0.5).iloc[1:].fillna(0) history = history.close.iloc[1:] # Split the data for training and testing to evaluate our model. X_train = partial_diff.iloc[:-100].values X_test = partial_diff.iloc[-100:].values y_train = history.iloc[:-100].values y_test = history.iloc[-100:].values # Create a custom gym environment class. In this example, create a custom environment with previous 5 OHLCV partial-differenced price data as the observation and the lowest maximum drawdown as the reward. class PortfolioEnv(gym.Env): def __init__(self, data, prediction, num_stocks): super(PortfolioEnv, self).__init__() self.data = data self.prediction = prediction self.num_stocks = num_stocks self.current_step = 5 self.portfolio_value = [] self.portfolio_weights = np.ones(num_stocks) / num_stocks # Define your action and observation spaces self.action_space = gym.spaces.Box(low=-1.0, high=1.0, shape=(num_stocks, ), dtype=np.float32) self.observation_space = gym.spaces.Box(low=-np.inf, high=np.inf, shape=(5, data.shape[1])) def reset(self): self.current_step = 5 self.portfolio_value = [] self.portfolio_weights = np.ones(self.num_stocks) / self.num_stocks return self._get_observation() def step(self, action): # Normalize the portfolio weights sum_weights = np.sum(np.abs(action)) if sum_weights > 1: action /= sum_weights # deduct transaction fee value = self.prediction[self.current_step] fees = np.abs(self.portfolio_weights - action) @ value # Update portfolio weights based on the chosen action self.portfolio_weights = action # Update portfolio value based on the new weights and the market prices less fee self.portfolio_value.append(np.dot(self.portfolio_weights, value) - fees) # Move to the next time step self.current_step += 1 # Check if the episode is done (end of data) done = self.current_step >= len(self.data) - 1 # Calculate the reward, in here, we use max drawdown reward = self._neg_max_drawdown return self._get_observation(), reward, done, {} def _get_observation(self): # Return the last 5 partial differencing OHLCV as the observation return self.data[self.current_step-5:self.current_step] @property def _neg_max_drawdown(self): # Return max drawdown within 20 days in portfolio value as reward (negate since max reward is preferred) portfolio_value_20d = np.array(self.portfolio_value[-min(len(self.portfolio_value), 20):]) acc_max = np.maximum.accumulate(portfolio_value_20d) return -(portfolio_value_20d - acc_max).min() def render(self, mode='human'): # Implement rendering if needed pass # Initialize the environment. env = PortfolioEnv(X_train, y_train, 5) # Wrap the environment in a vectorized environment env = DummyVecEnv([lambda: env]) # Normalize the observation space env = VecNormalize(env, norm_obs=True, norm_reward=False) # Train the model. In this example, create a RL model and train with MLP-policy PPO algorithm. # Define the PPO agent model = PPO("MlpPolicy", env, verbose=0) # Train the agent model.learn(total_timesteps=100000) # Initialize a return series to calculate performance and a list to store the equity value at each timestep. test = np.log(y_test[1:]/y_test[:-1]) equity = [1] # Iterate each testing data point for prediction and trading. for i in range(5, X_test.shape[0]-1): action, _ = model.predict(X_test[i-5:i], deterministic=True) sum_weights = np.sum(np.abs(action)) if sum_weights > 1: action /= sum_weights value = test[i] @ action.T equity.append((1+value) * equity[i-5]) # Plot the result. plt.figure(figsize=(15, 10)) plt.title("Equity Curve") plt.xlabel("timestep") plt.ylabel("equity") plt.plot(equity) plt.show() # Store the model in the object store to allow accessing the model in the next research session or in the algorithm for trading. model_key = "model" file_name = qb.object_store.get_file_path(model_key) model.save(file_name)