Equity Options

Individual Contracts

Introduction

This page explains how to request historical data for individual Equity Option contracts. The history requests on this page only return the prices and open interest of the Option contracts, not their implied volatility or Greeks. For information about history requests that return the daily implied volatility and Greeks, see Universes.

Create Subscriptions

Follow these steps to subscribe to individual Equity Option contracts:

- Create a

QuantBook. - Add the underlying Equity with raw data normalization.

- Set the start date to a date in the past that you want to use as the analysis date.

- Call the

option_chainmethod with the underlyingEquitySymbol. - Sort and filter the data to select the specific contract(s) you want to analyze.

- Call the

add_option_contractmethod with anOptionContractSymboland disable fill-forward.

qb = QuantBook()

underlying_symbol = qb.add_equity("SPY", data_normalization_mode=DataNormalizationMode.RAW).symbol

To view the supported underlying assets in the US Equity Options dataset, see the Data Explorer.

qb.set_start_date(2024, 1, 1)

The method that you call in the next step returns data on all the contracts that were tradable on this date.

# Get the Option contracts that were tradable on January 1st, 2024. chain = qb.option_chain(underlying_symbol, flatten=True)

This method returns an OptionChain object, which represent an entire chain of Option contracts for a single underlying security.

You can even format the chain data into a DataFrame where each row in the DataFrame represents a single contract.

# Get the contracts available to trade (in DataFrame format). chain = chain.data_frame # Select a contract. expiry = chain.expiry.min() contract_symbol = chain[ # Select call contracts with the closest expiry. (chain.expiry == expiry) & (chain.right == OptionRight.CALL) & # Select contracts with a 0.3-0.7 delta. (chain.delta > 0.3) & (chain.delta < 0.7) # Select the contract with the largest open interest. ].sort_values('openinterest').index[-1]

# Subscribe to the target contract. option_contract = qb.add_option_contract(contract_symbol, fill_forward=False)

Disable fill-forward because there are only a few OpenInterest data points per day.

Trade History

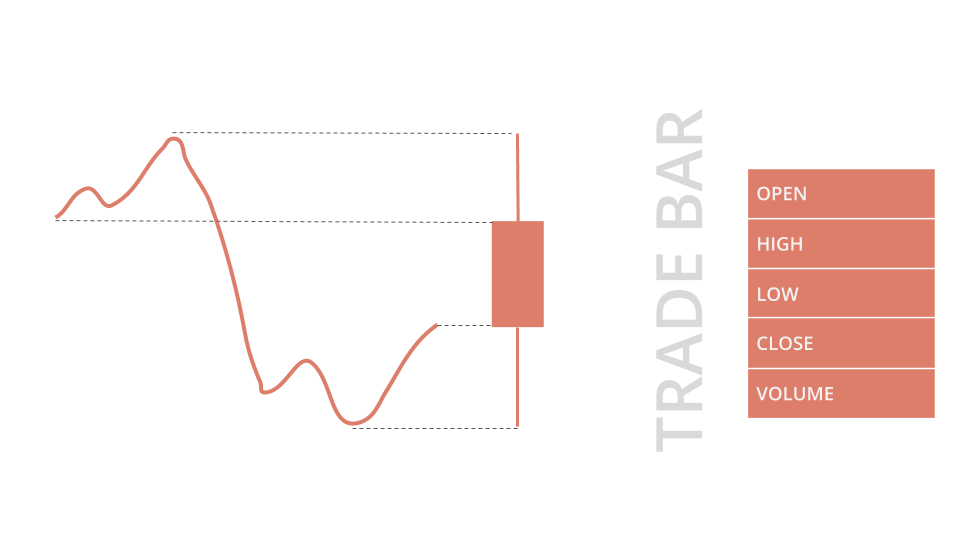

TradeBar objects are price bars that consolidate individual trades from the exchanges. They contain the open, high, low, close, and volume of trading activity over a period of time.

To get trade data, call the history or history[TradeBar] method with the contract Symbol object(s).

# DataFrame format history_df = qb.history(TradeBar, contract_symbol, timedelta(3)) display(history_df) # TradeBar objects history = qb.history[TradeBar](contract_symbol, timedelta(3)) for trade_bar in history: print(trade_bar)

TradeBar objects have the following properties:

Quote History

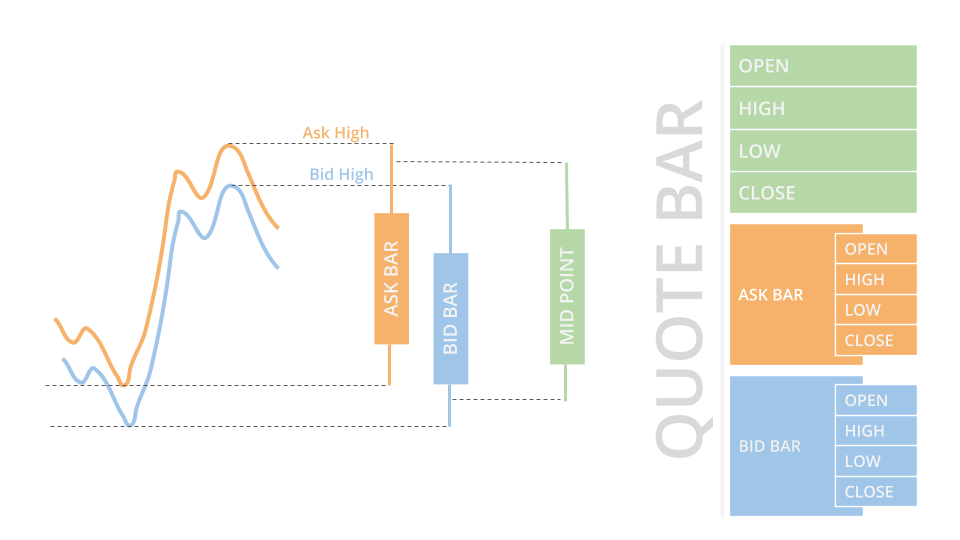

QuoteBar objects are bars that consolidate NBBO quotes from the exchanges. They contain the open, high, low, and close prices of the bid and ask. The open, high, low, and close properties of the QuoteBar object are the mean of the respective bid and ask prices. If the bid or ask portion of the QuoteBar has no data, the open, high, low, and close properties of the QuoteBar copy the values of either the bid or ask instead of taking their mean.

To get quote data, call the history or history[QuoteBar] method with the contract Symbol object(s).

# DataFrame format history_df = qb.history(QuoteBar, contract_symbol, timedelta(3)) display(history_df) # QuoteBar objects history = qb.history[QuoteBar](contract_symbol, timedelta(3)) for quote_bar in history: print(quote_bar)

QuoteBar objects have the following properties:

Open Interest History

Open interest is the number of outstanding contracts that haven't been settled. It provides a measure of investor interest and the market liquidity, so it's a popular metric to use for contract selection. Open interest is calculated once per day.

To get open interest data, call the history or history[OpenInterest] method with the contract Symbol object(s).

# DataFrame format history_df = qb.history(OpenInterest, contract_symbol, timedelta(3)) display(history_df) # OpenInterest objects history = qb.history[OpenInterest](contract_symbol, timedelta(3)) for open_interest in history: print(open_interest)

OpenInterest objects have the following properties:

Greeks and IV History

The Greeks are measures that describe the sensitivity of an Option's price to various factors like underlying price changes (Delta), time decay (Theta), volatility (Vega), and interest rates (Rho), while Implied Volatility (IV) represents the market's expectation of the underlying asset's volatility over the life of the Option.

Follow these steps to get the Greeks and IV data:

- Create the mirror contract

Symbol. - Set up the risk free interest rate, dividend yield, and Option pricing models.

- Define a method to return the IV & Greeks indicator values for each contract.

- Call the preceding method and display the results.

mirror_contract_symbol = Symbol.create_option( option_contract.underlying.symbol, contract_symbol.id.market, option_contract.style, OptionRight.Call if option_contract.right == OptionRight.PUT else OptionRight.PUT, option_contract.strike_price, option_contract.expiry )

In our research, we found the Forward Tree model to be the best pricing model for indicators.

risk_free_rate_model = qb.risk_free_interest_rate_model dividend_yield_model = DividendYieldProvider(underlying_symbol) option_model = OptionPricingModelType.FORWARD_TREE

def greeks_and_iv(contracts, period, risk_free_rate_model, dividend_yield_model, option_model): # Get the call and put contract. call, put = sorted(contracts, key=lambda s: s.id.option_right) def get_values(indicator_class, contract, mirror_contract): return qb.indicator_history( indicator_class(contract, risk_free_rate_model, dividend_yield_model, mirror_contract, option_model), [contract, mirror_contract, contract.underlying], period ).data_frame.current return pd.DataFrame({ 'iv_call': get_values(ImpliedVolatility, call, put), 'iv_put': get_values(ImpliedVolatility, put, call), 'delta_call': get_values(Delta, call, put), 'delta_put': get_values(Delta, put, call), 'gamma_call': get_values(Gamma, call, put), 'gamma_put': get_values(Gamma, put, call), 'rho_call': get_values(Rho, call, put), 'rho_put': get_values(Rho, put, call), 'vega_call': get_values(Vega, call, put), 'vega_put': get_values(Vega, put, call), 'theta_call': get_values(Theta, call, put), 'theta_put': get_values(Theta, put, call), })

greeks_and_iv([contract_symbol, mirror_contract_symbol], 15, risk_free_rate_model, dividend_yield_model, option_model)

The DataFrame can have NaN entries if there is no data for the contracts or the underlying asset at a moment in time.

Examples

The following examples demonstrate some common practices for analyzing individual Equity Option contracts in the Research Environment.

Example 1: Contract Trade History

The following notebook plots the historical prices of an SPY Equity Option contract using Plotly:

import plotly.graph_objects as go # Get the SPY Option chain for January 1, 2024. qb = QuantBook() underlying_symbol = qb.add_equity("SPY", data_normalization_mode=DataNormalizationMode.RAW).symbol qb.set_start_date(2024, 1, 1) chain = qb.option_chain(underlying_symbol, flatten=True).data_frame # Select a contract from the chain. expiry = chain.expiry.min() contract_symbol = chain[ (chain.expiry == expiry) & (chain.right == OptionRight.CALL) & (chain.delta > 0.3) & (chain.delta < 0.7) ].sort_values('openinterest').index[-1] # Add the target contract. qb.add_option_contract(contract_symbol) # Get the contract history. history = qb.history(contract_symbol, timedelta(3)) # Plot the price history. go.Figure( data=go.Candlestick( x=history.index.levels[4], open=history['open'], high=history['high'], low=history['low'], close=history['close'] ), layout=go.Layout( title=go.layout.Title(text=f'{contract_symbol.value} OHLC'), xaxis_title='Date', yaxis_title='Price', xaxis_rangeslider_visible=False ) ).show()

Example 2: Contract Open Interest History

The following notebook plots the historical open interest of a TSLA Equity Option contract using Matplotlib:

# Get the TSLA Option chain for January 1, 2024. qb = QuantBook() underlying_symbol = qb.add_equity("TSLA", data_normalization_mode=DataNormalizationMode.RAW).symbol qb.set_start_date(2024, 1, 1) chain = qb.option_chain(underlying_symbol, flatten=True).data_frame # Select a contract from the chain. strike_distance = (chain.strike - chain.underlyinglastprice).abs() target_strike_distance = strike_distance.min() chain = chain.loc[strike_distance[strike_distance == target_strike_distance].index] contract_symbol = chain.sort_values('impliedvolatility').index[-1] # Add the target contract. qb.add_option_contract(contract_symbol, fill_forward=False) # Get the contract's open interest history. history = qb.history(OpenInterest, contract_symbol, timedelta(90)) history.index = history.index.droplevel([0, 1, 2]) history = history['openinterest'].unstack(0)[contract_symbol] # Plot the open interest history. history.plot(title=f'{contract_symbol.value} Open Interest') plt.show()