Indicators

Trade Bar Indicators

Create Subscriptions

You need to subscribe to some market data in order to calculate indicator values.

qb = QuantBook() symbol = qb.add_equity("SPY").symbol

Create Indicator Timeseries

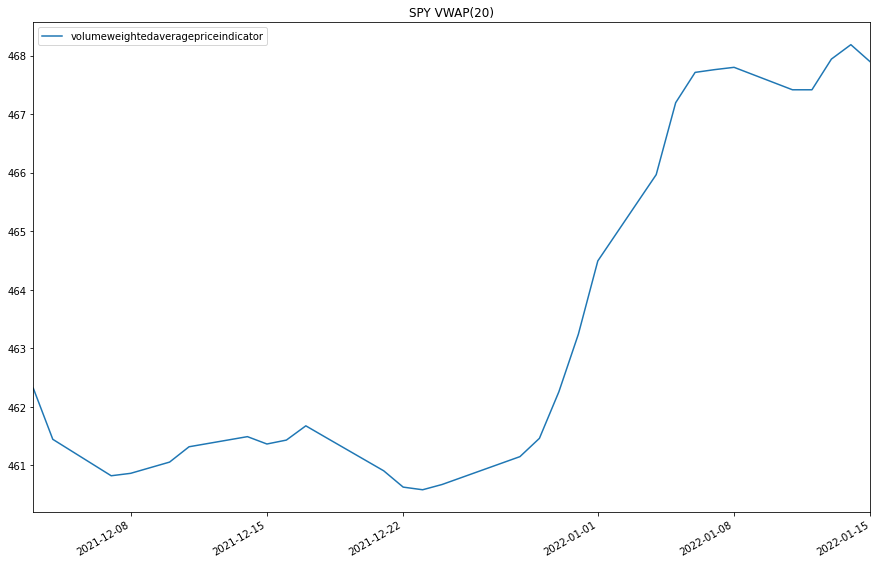

You need to subscribe to some market data and create an indicator in order to calculate a timeseries of indicator values. In this example, use a 20-period VolumeWeightedAveragePriceIndicator indicator.

vwap = VolumeWeightedAveragePriceIndicator(20)

You can create the indicator timeseries with the Indicator helper method or you can manually create the timeseries.

Indicator Helper Method

To create an indicator timeseries with the helper method, call the Indicator method.

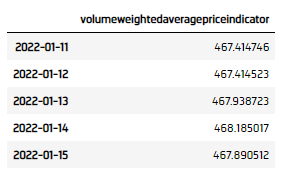

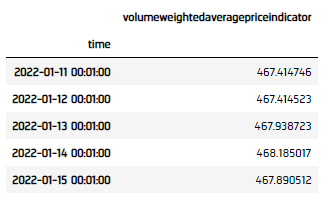

# Create a dataframe with a date index, and columns are indicator values. vwap_dataframe = qb.indicator(vwap, symbol, 50, Resolution.DAILY)

Manually Create the Indicator Timeseries

Follow these steps to manually create the indicator timeseries:

- Get some historical data.

- Set the indicator

window.sizefor each attribute of the indicator to hold their values. - Iterate through the historical market data and update the indicator.

- Populate a

DataFramewith the data in theIndicatorobject.

# Request historical trading data with the daily resolution. history = qb.history[TradeBar](symbol, 70, Resolution.DAILY)

# Set the window.size to the desired timeseries length vwap.window.size = 50

for bar in history: vwap.update(bar)

vwap_dataframe = pd.DataFrame({ "current": pd.Series({x.end_time: x.value for x in vwap})) }).sort_index()

Examples

The following examples demonstrate some common practices for researching with trade bar indicators.

Example 1: Quick Backtest On MoneyFlowIndex

The following example demonstrates a quick backtest to testify the effectiveness of a Money Flow Index mean-reversal under the research enviornment.

# Instantiate the QuantBook instance for researching. qb = QuantBook() # Request SPY data to work with the indicator. symbol = qb.add_equity("SPY").symbol # Get the historical data for trading. history = qb.history(symbol, 252, Resolution.DAILY).close.unstack(0).iloc[:, 0] history = history.groupby(history.index.date).sum() # Create the Money Flow Index with parameters to be studied. indicator = MoneyFlowIndex(10) # Get the indicator history of the indicator. indicator_dataframe = qb.indicator(indicator, symbol, 252, Resolution.DAILY) indicator_dataframe = indicator_dataframe.groupby(indicator_dataframe.index.date).sum() # Match index. common_ix = sorted(set(indicator_dataframe.index).intersection(set(history.index))) history = history.loc[common_ix] indicator_dataframe = indicator_dataframe.loc[common_ix] # Create a order record and return column. # Buy if the asset is underprice (below 20), sell if overpriced (above 80) indicator_dataframe["position"] = indicator_dataframe.apply(lambda x: 1 if x.current < 20 else -1 if x.current > 80 else 0, axis=1) # Get the 1-day forward return. indicator_dataframe["return"] = history.pct_change().shift(-1).fillna(0) indicator_dataframe["return"] = indicator_dataframe["position"] * indicator_dataframe["return"] # Obtain the cumulative return curve as a mini-backtest. equity_curve = (indicator_dataframe["return"] + 1).cumprod() equity_curve.plot(title="Equity Curve", ylabel="Equity", xlabel="time")