Indicators

Custom Resolutions

Create Subscriptions

You need to subscribe to some market data in order to calculate indicator values.

qb = QuantBook() symbol = qb.add_equity("SPY").symbol

Create Indicator Timeseries

You need to subscribe to some market data and create an indicator in order to calculate a timeseries of indicator values.

Follow these steps to create an indicator timeseries:

- Get some historical data.

- Create a data-point indicator.

- Create a

RollingWindowfor each attribute of the indicator to hold their values. - Attach a handler method to the indicator that updates the

RollingWindowobjects. - Create a

TradeBarConsolidatorto consolidate data into the custom resolution. - Attach a handler method to feed data into the consolidator and updates the indicator with the consolidated bars.

- Iterate through the historical market data and update the indicator.

- Populate a

DataFramewith the data in theRollingWindowobjects.

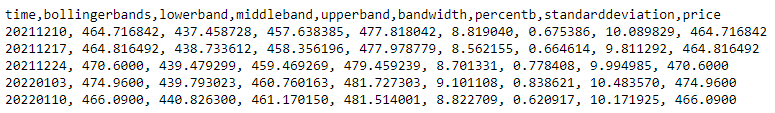

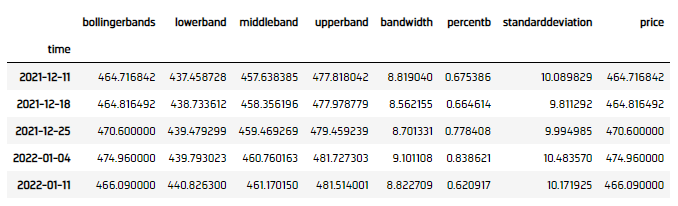

# Request historical trading data with the daily resolution. history = qb.history[TradeBar](symbol, 70, Resolution.DAILY)

In this example, use a 20-period 2-standard-deviation BollingerBands indicator.

bb = BollingerBands(20, 2)

# Create a window dictionary to store RollingWindow objects. window = {} # Store the RollingWindow objects, index by key is the property of the indicator. window['time'] = RollingWindow[DateTime](50) window["bollingerbands"] = RollingWindow[float](50) window["lowerband"] = RollingWindow[float](50) window["middleband"] = RollingWindow[float](50) window["upperband"] = RollingWindow[float](50) window["bandwidth"] = RollingWindow[float](50) window["percentb"] = RollingWindow[float](50) window["standarddeviation"] = RollingWindow[float](50) window["price"] = RollingWindow[float](50)

# Define an update function to add the indicator values to the RollingWindow object. def update_bollinger_band_window(sender: object, updated: IndicatorDataPoint) -> None: indicator = sender window['time'].add(updated.end_time) window["bollingerbands"].add(updated.value) window["lowerband"].add(indicator.lower_band.current.value) window["middleband"].add(indicator.middle_band.current.value) window["upperband"].add(indicator.upper_band.current.value) window["bandwidth"].add(indicator.band_width.current.value) window["percentb"].add(indicator.percent_b.current.value) window["standarddeviation"].add(indicator.standard_deviation.current.value) window["price"].add(indicator.price.current.value) bb.updated += update_bollinger_band_window

When the indicator receives new data, the preceding handler method adds the new IndicatorDataPoint values into the respective RollingWindow.

consolidator = TradeBarConsolidator(timedelta(days=7))

def on_data_consolidated(sender, consolidated): bb.update(consolidated.end_time, consolidated.close) consolidator.data_consolidated += on_data_consolidated

When the consolidator receives 7 days of data, the handler generates a 7-day TradeBar and update the indicator.

for bar in history: consolidator.update(bar)

bb_dataframe = pd.DataFrame(window).set_index('time')

Examples

The following examples demonstrate some common practices for researching with data point indicators.

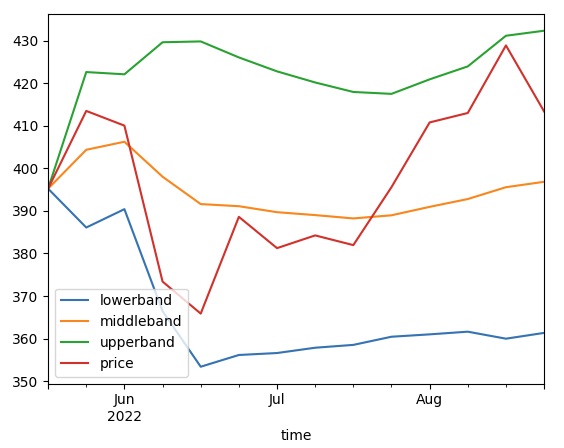

Example 1: Quick Backtest On Bollinger Band

The following example demonstrates a quick backtest to testify the effectiveness of a Bollinger Band mean-reversal, using 5-miunte bar under the research enviornment.

# Instantiate the QuantBook instance for researching. qb = QuantBook() # Request SPY data to work with the indicator. symbol = qb.add_equity("SPY").symbol # Request historical trading data with the minute resolution. history = qb.history[TradeBar](symbol, 1000, Resolution.MINUTE) # Create a window dictionary to store RollingWindow objects. window = {} # Store the RollingWindow objects, index by key is the property of the indicator. window['time'] = RollingWindow[DateTime](50) window["bollingerbands"] = RollingWindow[float](50) window["lowerband"] = RollingWindow[float](50) window["middleband"] = RollingWindow[float](50) window["upperband"] = RollingWindow[float](50) window["price"] = RollingWindow[float](50) # Define an update function to add the indicator values to the RollingWindow object. def update_bollinger_band_window(sender: object, updated: IndicatorDataPoint) -> None: indicator = sender window['time'].add(updated.end_time) window["bollingerbands"].add(updated.value) window["lowerband"].add(indicator.lower_band.current.value) window["middleband"].add(indicator.middle_band.current.value) window["upperband"].add(indicator.upper_band.current.value) window["price"].add(indicator.price.current.value) # Create the Bollinger Band indicator with parameters to be studied. bb = BollingerBands(20, 2) bb.updated += update_bollinger_band_window # Create a TradeBarConsolidator to consolidate data into the custom resolution. consolidator = TradeBarConsolidator(timedelta(minutes=5)) # Attach a handler method to feed data into the consolidator and updates the indicator with the consolidated bars. def on_data_consolidated(sender, consolidated): bb.update(consolidated.end_time, consolidated.close) consolidator.data_consolidated += on_data_consolidated # Iterate through the historical market data and update the indicator. for bar in history: consolidator.update(bar) # Populate a DataFrame with the data in the RollingWindow objects. bb_dataframe = pd.DataFrame(window).set_index('time') # Create a order record and return column. # Buy if the asset is underprice (below the lower band), sell if overpriced (above the upper band) bb_dataframe["position"] = bb_dataframe.apply(lambda x: 1 if x.price < x.lowerband else -1 if x.price > x.upperband else 0, axis=1) # Get the 1-day forward return. bb_dataframe["return"] = bb_dataframe["price"].pct_change().shift(-1).fillna(0) bb_dataframe["return"] = bb_dataframe["position"] * bb_dataframe["return"] # Obtain the cumulative return curve as a mini-backtest. equity_curve = (bb_dataframe["return"] + 1).cumprod() equity_curve.plot(title="Equity Curve on BBand Mean Reversal", ylabel="Equity", xlabel="time")