Indicators

Data Point Indicators

Create Subscriptions

You need to subscribe to some market data in order to calculate indicator values.

qb = QuantBook() symbol = qb.add_equity("SPY").symbol

Create Indicator Timeseries

You need to subscribe to some market data and create an indicator in order to calculate a timeseries of indicator values. In this example, use a 20-period 2-standard-deviation BollingerBands indicator.

bb = BollingerBands(20, 2)

You can create the indicator timeseries with the Indicator helper method or you can manually create the timeseries.

Indicator Helper Method

To create an indicator timeseries with the helper method, call the Indicator method.

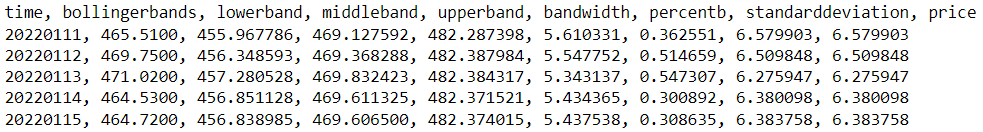

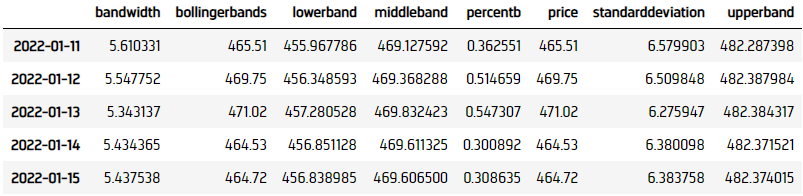

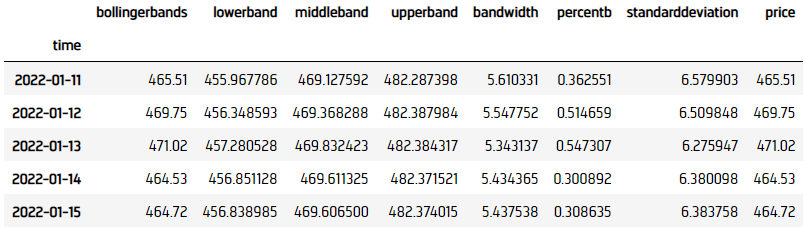

# Create a dataframe with a date index, and columns are indicator values. bb_dataframe = qb.indicator(bb, symbol, 50, Resolution.DAILY)

Manually Create the Indicator Timeseries

Follow these steps to manually create the indicator timeseries:

- Get some historical data.

- Set the indicator

window.sizefor each attribute of the indicator to hold their values. - Iterate through the historical market data and update the indicator.

- Populate a

DataFramewith the data in theIndicatorobject.

# Request historical trading data with the daily resolution. history = qb.history[TradeBar](symbol, 70, Resolution.DAILY)

# Set the window.size to the desired timeseries length bb.window.size=50 bb.lower_band.window.size=50 bb.middle_band.window.size=50 bb.upper_band.window.size=50 bb.band_width.window.size=50 bb.percent_b.window.size=50 bb.standard_deviation.window.size=50 bb.price.window.size=50

for bar in history: bb.update(bar.end_time, bar.close)

bb_dataframe = pd.DataFrame({ "current": pd.Series({x.end_time: x.value for x in bb}), "lowerband": pd.Series({x.end_time: x.value for x in bb.lower_band}), "middleband": pd.Series({x.end_time: x.value for x in bb.middle_band}), "upperband": pd.Series({x.end_time: x.value for x in bb.upper_band}), "bandwidth": pd.Series({x.end_time: x.value for x in bb.band_width}), "percentb": pd.Series({x.end_time: x.value for x in bb.percent_b}), "standarddeviation": pd.Series({x.end_time: x.value for x in bb.standard_deviation}), "price": pd.Series({x.end_time: x.value for x in bb.price}) }).sort_index()

Plot Indicators

You need to create an indicator timeseries to plot the indicator values.

Follow these steps to plot the indicator values:

- Select the columns/features to plot.

- Call the

plotmethod. - Show the plots.

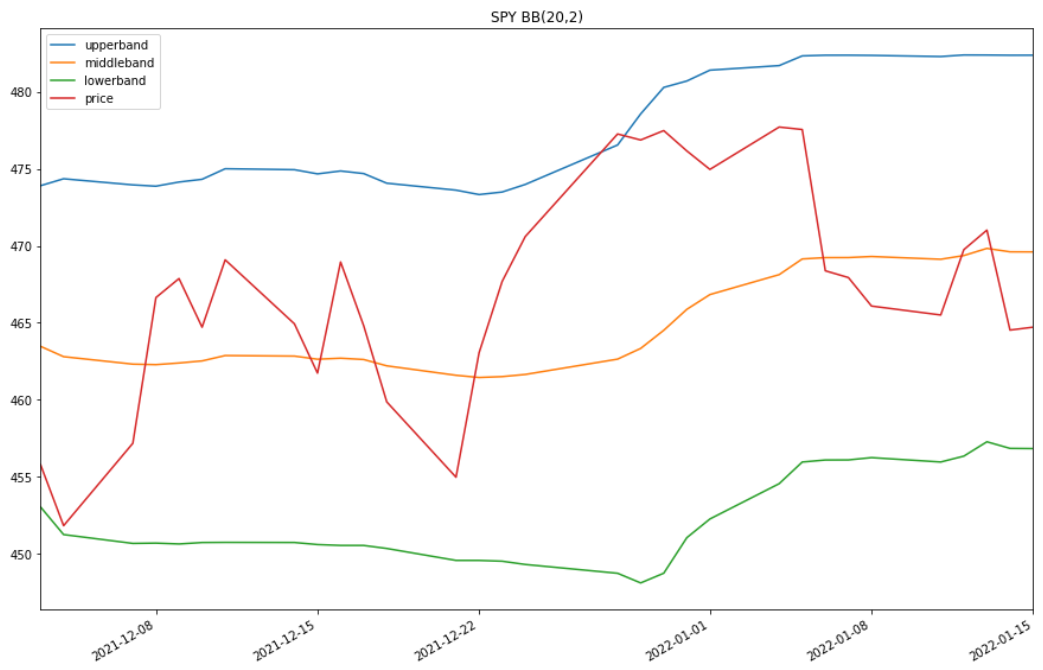

bb_plot = bb_indicator[["upperband", "middleband", "lowerband", "price"]]

bb_plot.plot(figsize=(15, 10), title="SPY BB(20,2)"))

plt.show()

Examples

The following examples demonstrate some common practices for researching with data point indicators.

Example 1: Quick Backtest On Bollinger Band

The following example demonstrates a quick backtest to testify the effectiveness of a Bollinger Band mean-reversal under the research enviornment.

# Instantiate the QuantBook instance for researching. qb = QuantBook() # Request SPY data to work with the indicator. symbol = qb.add_equity("SPY").symbol # Create the Bollinger Band indicator with parameters to be studied. bb = BollingerBands(20, 2) # Get the indicator history of the indicator. bb_dataframe = qb.indicator(bb, symbol, 252, Resolution.DAILY) # Create a order record and return column. # Buy if the asset is underprice (below the lower band), sell if overpriced (above the upper band) bb_dataframe["position"] = bb_dataframe.apply(lambda x: 1 if x.price < x.lowerband else -1 if x.price > x.upperband else 0, axis=1) # Get the 1-day forward return. bb_dataframe["return"] = bb_dataframe["price"].pct_change().shift(-1).fillna(0) bb_dataframe["return"] = bb_dataframe["position"] * bb_dataframe["return"] # Obtain the cumulative return curve as a mini-backtest. equity_curve = (bb_dataframe["return"] + 1).cumprod() equity_curve.plot(title="Equity Curve on BBand Mean Reversal", ylabel="Equity", xlabel="time")