Indicators

Custom Indicators

Create Subscriptions

You need to subscribe to some market data in order to calculate indicator values.

qb = QuantBook() symbol = qb.add_equity("SPY").symbol

Create Indicator Timeseries

You need to subscribe to some market data in order to calculate a timeseries of indicator values.

Follow these steps to create an indicator timeseries:

- Get some historical data.

- Define a custom indicator class. Note the

PythonIndicatorsuperclass inheritance,Valueattribute, andupdatemethod are mandatory. - Initialize a new instance of the custom indicator.

- Create a

RollingWindowfor each attribute of the indicator to hold their values. - Attach a handler method to the indicator that updates the

RollingWindowobjects. - Iterate through the historical market data and update the indicator.

- Populate a

DataFramewith the data in theRollingWindowobjects.

# Request historical trading data with the daily resolution. history = qb.history[TradeBar](symbol, 70, Resolution.DAILY)

In this tutorial, create an ExpectedShortfallPercent indicator that uses Monte Carlo to calculate the expected shortfall of returns.

class ExpectedShortfallPercent(PythonIndicator): import math, numpy as np def __init__(self, period, alpha): self.value = None # Attribute represents the indicator value self.value_at_risk = None self.alpha = alpha self._window = RollingWindow[float](period) # Override the IsReady attribute to flag all attributes values are ready. @property def is_ready(self) -> bool: return self.value and self.value_at_risk # Method to update the indicator values. Note that it only receives 1 IBaseData object (Tick, TradeBar, QuoteBar) argument. def update(self, input: BaseData) -> bool: count = self._window.Count self._window.Add(input.Close) # Update the Value and other attributes as the indicator current value. if count >= 2: cutoff = math.ceil(self.alpha * count) ret = [ (self._window[i] - self._window[i+1]) / self._window[i+1] for i in range(count-1) ] lowest = sorted(ret)[:cutoff] self.value = np.mean(lowest) self.value_at_risk = lowest[-1] # return a boolean to indicate IsReady. return count >= 2

custom = ExpectedShortfallPercent(50, 0.05)

In this example, save 20 data points.

# Create a window dictionary to store RollingWindow objects. window = {} # Store the RollingWindow objects, index by key is the property of the indicator. window['time'] = RollingWindow[DateTime](20) window['expectedshortfall'] = RollingWindow[float](20) window['valueatrisk'] = RollingWindow[float](20)

When the indicator receives new data, the preceding handler method adds the new IndicatorDataPoint values into the respective RollingWindow.

for bar in history: custom.update(bar) # The Updated event handler is not available for custom indicator in Python, RollingWindows are needed to be updated in here. if custom.is_ready: window['time'].add(bar.end_time) window['expectedshortfall'].add(custom.value) window['valueatrisk'].add(custom.value_at_risk)

custom_dataframe = pd.DataFrame(window).set_index('time')

Examples

The following examples demonstrate some common practices for researching with combining indicators.

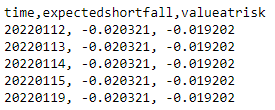

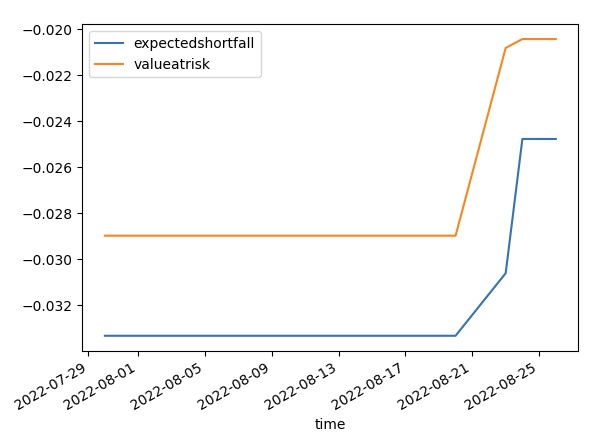

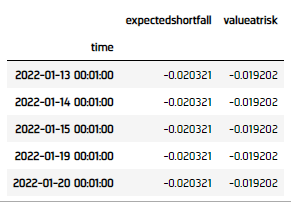

Example 1: Expected Shortfall

The following example demonstrates researching using a custom-constructed Expected Shortfall indicator. Expected Shortfall refers to the average of the N% worst-case return.

# Instantiate the QuantBook instance for researching. qb = QuantBook() # Request SPY data to work with the indicator. symbol = qb.add_equity("SPY").symbol # Request historical trading data with the daily resolution. history = qb.history[TradeBar](symbol, 70, Resolution.DAILY) class ExpectedShortfallPercent(PythonIndicator): import math, numpy as np def __init__(self, period, alpha): self.value = None # Attribute represents the indicator value self.value_at_risk = None self.alpha = alpha self._window = RollingWindow[float](period) # Override the IsReady attribute to flag all attributes values are ready. @property def is_ready(self) -> bool: return self.value and self.value_at_risk # Method to update the indicator values. Note that it only receives 1 IBaseData object (Tick, TradeBar, QuoteBar) argument. def update(self, input: BaseData) -> bool: count = self._window.Count self._window.Add(input.Close) # Update the Value and other attributes as the indicator current value. if count >= 2: cutoff = math.ceil(self.alpha * count) ret = [ (self._window[i] - self._window[i+1]) / self._window[i+1] for i in range(count-1) ] lowest = sorted(ret)[:cutoff] self.value = np.mean(lowest) self.value_at_risk = lowest[-1] # return a boolean to indicate IsReady. return count >= 2 # Initialize a new instance of the custom indicator. custom = ExpectedShortfallPercent(50, 0.05) # Create a window dictionary to store RollingWindow objects. window = {} # Store the RollingWindow objects, index by key is the property of the indicator. window['time'] = RollingWindow[DateTime](20) window['expectedshortfall'] = RollingWindow[float](20) window['valueatrisk'] = RollingWindow[float](20) # Iterate through the historical market data and update the indicator. for bar in history: custom.update(bar) # The Updated event handler is not available for custom indicator in Python, RollingWindows are needed to be updated in here. if custom.is_ready: window['time'].add(bar.end_time) window['expectedshortfall'].add(custom.value) window['valueatrisk'].add(custom.value_at_risk) # Populate a DataFrame with the data in the RollingWindow objects. custom_dataframe = pd.DataFrame(window).set_index('time') # Create line chart of the Expected Shortfall Percent. custom_dataframe.plot(title=f"Expected Shortfall Percent of {symbol}", xlabel="Time", ylabel="%") plt.show()