Hey Everybody,

We're excited to give the community the fifth and final demonstration algorithm of how to use one of the 5 ETF universes in the competition: Precious Metals ETFs.

This algorithm provides a rough template of how this universe can be used in a submission and also implements some of the backtest requirements (5-year minimum, $1m starting cash minimum, and using the Alpha Streams brokerage model).

Some factors that tend to affect energy markets that you can consider when writing an algorithm:

- Major news announcements: trade-war news, major geopolitical events, etc.

- Market volatility

- Major Forex movements

- US Treasury information: bond prices, yield curve inversions, etc.

- Analyst sentiment

P.S. -- Keep an eye out for new data sources regarding macro-economic updates, trade-war news, US Treasury data, and analyst sentiment to inform your trading signals!

Jack Simonson

Here is the C# version of the demonstration algorithm using the Precious Metals ETF universe!

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Jack Simonson

For those of you who enjoy using the Classic algorithms and don't want to use the Framework algorithms, we've attached a template here that you can clone and use to start coding!

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Jack Simonson

Here's the C# version!

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Dr. Roland Preiss

The competition and the examples are using the brokerage model BrokerageName.AlphaStreams. Where can I find detailed information (source code / documentation) about the fee model which is used within this brokerage model? I would assume that a good strategy should be aware of the fee model to optimize for a good result after fees are applied.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Jared Broad

Thanks Roland you're 100% correct. I've whipped this up for you this morning.

https://www.quantconnect.com/docs/alpha-streams/alpha-fee-modelsThe material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Dr. Roland Preiss

Thx for the swift reply :)

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Jeff Ward INVESTOR

This is a great starter, but I think it would help out a lot to understand what the metrics mean and how to interpret them. For instance, I can make an alpha with Market Insight +$7,200, but the total return is -67%. Is this good? I assume the return is because the back test traded it in a bad way, but the insights themselves were good. Also what is Fitness and the other indicators like Active Strategy? What do people look for that indicate you have a decent alpha? Things like sharpe ratio make no sense because you are just emitting insights, not actually trading or allocating risk.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Jared Broad

Hi Jeff; I completely agree that Sharpe Ratio makes no sense with a pure alpha signal. It is a hard task to balance something universally understandable with something which perfectly measures what institutions are looking for. Combined with that - each institution is looking for totally different things! We consulted industry-leading quants (former quant head of $10B+ fund) in this process to find a good hybrid - eventually settling on the PSR (coming soon).

We documented our research process and solicited community feedback which you can review in the forums(1, 2, 3). The short answer is -- we'll measure everything and it'll be up to the funds to decide what KPI is important to them.

For the purposes of this competition, this institution is looking for the metrics provided in the competition rules. This is a rare "behind the curtains" view which we're hoping will give the community a focused target. The competition is looking for daily trading signals (to establish statistical significance) with a 5 year backtest (sufficient market types). The universes provided are to focus on assets not correlated to the US markets - so alphas built of them are unlikely to be correlated.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Jeff Ward INVESTOR

Thanks! That's really helpful. Not to sidetrack the discussion too much, but another helpful feature would be to add an IsBearish flag to the symbol (I know this would probably take a lot of backend work). If you are trying to go long an energy product, for instance, on a news report, but your universe of energy ETFs also contains bearish ones, the code can get a bit complicated trying to sort out which thing does what. If the universe is fixed ahead of time, it might be ok, but not if institutions are allowed to add and subtract equites whenever they want. It took a little debugging before I realized what was going on in my code.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Jared Broad

short ETF's in the universe!

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Troy B

Would Jack or someone else be willing to post the full Python code for the above algorithm in Classic format? I'm still learning Python and am not getting this to work in Classic form.

Thanks,

Troy

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Alexandre Catarino

Hi Troy B ,

I have attached a full Classic Algorithm example.

In this case, the logic from OnSecuritiesChanged is moved to Initialize:

tickers = ["GLD", "IAU", "SLV", "GDX", "AGQ", "GDXJ", "PPLT", "NUGT", "DUST", "USLV", "UGLD", "JNUG", "JDST"] for ticker in tickers: self.AddEquity(ticker, Resolution.Hour) self.universe = { } history = self.History(tickers, 30, Resolution.Hour) for symbol in self.Securities.Keys: self.universe[symbol] = AssetData(symbol, history.loc[str(symbol.ID)])We can also remove the optional framework model and place the orders directly using SetHoldings:

def ScheduleDemo(self): insights = [] for symbol, assetData in self.universe.items(): price = self.ActiveSecurities[symbol].Price if assetData.is_ready() and assetData.deviating(price): # Demonstration: Ensure to emit Insights to clearly signal intent to fund. insights.append(Insight.Price(symbol, timedelta(3), InsightDirection.Up)) for insight in insights: self.SetHoldings(insight.Symbol, 1/len(insights)) self.EmitInsights(insights)The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Troy B

Thanks Alexandre! This is very helpful.

Troy

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Nathan Swenson

I'm thinking to set up the live trading, but to use it with paper trading just to get the signals in real time. I guess it would be better if it alerts ahead of time, like at open that there will be a trade at 2 hours after open. Because this strategy has so few trades, it's easy enough to just do the trades manually. I'm thinking I'll use a small amount in futures to trade NQ and ZB pair and my TD Ameritrade self managed 401k with a more conservative setup.

Regarding the Alpha Competition, this version qualifies with 84% PSR (Alpha score). Peter, you should think about entering it. You did all the work. I'm just playing around with for consideration of using for my own accounts.

Regarding the high results above, that was without any Margin. So if you wanted to go crazy, you could add some margin to it, or simply trade non-Leverage funds but lean more on margin.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Nathan Swenson

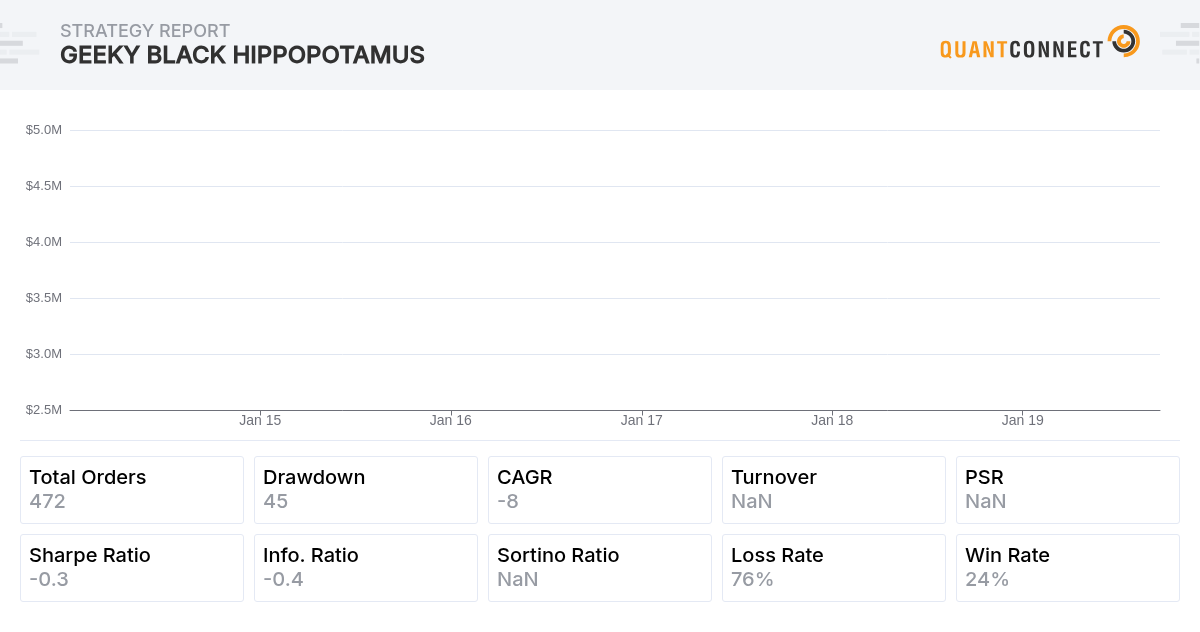

Screen shot of the end result.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Nathan Swenson

Sorry for all the posts. Having trouble posting screen shots when working from an IPAD.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Mateusz Pulka

Tien Duy Vo Peter Guenther

I have spotted this bug also, the problem is here (the loop is run outside the if statement):

if not self.be_in:

# Close 'In' holdings

#for asset, weight in self.HLD_IN.items():

# self.SetHoldings(asset, 0)

#for asset, weight in self.HLD_OUT.items():

# self.SetHoldings(asset, weight)

wt[self.STKS] = 0

wt[self.TLT] = .5

wt[self.IEF] = .5

# Thomas's reducing unnecessary trades

for sec, weight in wt.items():

cond1 = (self.Portfolio[sec].Quantity > 0) and (weight == 0)

cond2 = (self.Portfolio[sec].Quantity == 0) and (weight > 0)

if cond1 or cond2:

self.SetHoldings(sec, weight)

The for loop will be fire every time even if we set self.be_in to false. The correct version is:

if not self.be_in:

# Close 'In' holdings

#for asset, weight in self.HLD_IN.items():

# self.SetHoldings(asset, 0)

#for asset, weight in self.HLD_OUT.items():

# self.SetHoldings(asset, weight)

wt[self.STKS] = 0

wt[self.TLT] = .5

wt[self.IEF] = .5

# Thomas's reducing unnecessary trades

for sec, weight in wt.items():

cond1 = (self.Portfolio[sec].Quantity > 0) and (weight == 0)

cond2 = (self.Portfolio[sec].Quantity == 0) and (weight > 0)

if cond1 or cond2:

self.SetHoldings(sec, weight)

The same should be applied in second if statement.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Mateusz Pulka

Sorry some kind of formatting problem. Generally the for loop should be move inside the if statement as Tien Duy Vo pointed out when algo starts and be_in paramter is true we will buy long and short at the same time.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Nathan Swenson

I'm sorry, I don't know Python. I don't see any difference between your code blocks. Is this mistake resulting in inflated results due to margin usage?

Edit: Didn't see your last response. I will wait for a Python coder to update it. I only know C#.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Mateusz Pulka

Sorry for formating problem. The code should look like this:

https://pastebin.com/cnKm9BVYinstead of this:

https://pastebin.com/pPcGFKR0The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Nathan Swenson

So the issue pointed out by Gpw radar and Tien Duy Vo only occurs if "be_in = true" at the time of start. I don't see any issues with my order when ran from 2008 to 2020. It would seem that the results for mine are correct. I was worried that the results were invalid.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Tien Duy Vo

gpw radar : Thanks for pointing out. Great job. Unfortunately, the backtesting framework on Quantconnect seems to be much slower than on Quantopian. It is quite difficult to debug that way.

There is another issue related to this part of the code:

self.Schedule.On(

self.DateRules.EveryDay(),

self.TimeRules.AfterMarketOpen('SPY', 120),

self.rebalance_when_out_of_the_market

)

self.Schedule.On(

self.DateRules.WeekEnd(),

self.TimeRules.AfterMarketOpen('SPY', 120),

self.rebalance_when_in_the_market

)

Here, the algo is firing the two functions rebalance_when_out_of_the_market and self.rebalance_when_in_the_market, which is responsible to get "in" and "out". However, you can see that one is started every day and the other one at weekend. I wonder, whether this is done on purpose.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Mateusz Pulka

You are right Nathan Swenson it only occures once at the begining when you start algo and when flag in is set to true. For example check out your orders when you set the star date at 1st January 2018. It is not a big deal but worh to fix it.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Mark hatlan

Great work! This market timer does a really nice job.

However TQQQ does do way better than SPXL. SPXL starts on 11/03/2008. UPRO starts on 6/28/2009. TQQQ starts on 2/7/2010. When switching the start date to 2/7/2010 here are the returns:

SPXL +7,552%

UPRO +7,180%

TQQQ +19,859%

I think SPXL only looked better because of the earlier first trade date.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Nathan Swenson

Thanks Mark! Good point!

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Aalap Sharma

Relativily new to all this and I would really like to know are these returns realistic in the real markets? Has anyone deployed such algos to the market and seen healthy returns. Just curious...

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Nathan Swenson

Aalap, I just turned the algo on and entered TMF. We shall see soon enough. I'm going very aggressive with leveraged products. It should be very realistic as it only trades about 10 times a year with trades just 2 hours after RTH market open. Algo is entirely in treasury bonds at the moment.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Aalap Sharma

Cool! I was thinking the same :)

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Mateusz Pulka

Hi Guys,

I have added some improvments to the code and please noticed the result. So first algo has improvment in terms of open the trade at the begning of the cycle when we start the algo. The return for 2010-2020 is: 16 772%

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Mateusz Pulka

The second run contains the following improvement. I just want to generate a signal about in/out just right after the open market. But open position just in the same way as the original algo. What is surprising the result is 21 011%. I am a little bit surprised about this, to be honest. Any idea where this difference comes from?

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Nathan Swenson

Gpw Radar, I see it takes more trades when you check signal at open. Perhaps it's due to increased volatility at open which is more likely to trigger needed deviation. The 2 hours after close is actually European market close for which there is often a ramp up in index price. I had thought about messing around with that as even 5 minutes makes a difference in that period. I know 2hrs and 5 min is significant. The timing of entry vs exit and asset type all matter. Bonds seem affected more at open, mid day, and close, while 2hr after open seems more significant for equities. Lots of opportunity for improvement I believe with timing alone.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Mateusz Pulka

please notice that I only generate a signal in/out 1min after the market is open and then after 120min I open the position base on the signal. I have noticed that as I used IB with the cash parameter some of the orders were not filled (lack of money) and the order was later sometimes even 5 days later.

Peter Guenther Have you tried to use futures instead of etf to generate the in/out signal?

https://finance.yahoo.com/commodities?.tsrc=fin-srch

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Nathan Swenson

Gpw, perhaps the delayed order in due to transaction order. I often see that the buy order is executed before the sell order for prior holdings. This probably needs to be fixed.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!