Hey All!

We've created a new algorithm creation wizard for laying the groundwork for your algorithm. This wizard lets us pull in assorted modules and quickly assemble them into auto-coded scaffolding.

We've added a dozen or so Alphas over the last 2 days and we'll keep adding more and more so you'll have an enormous pool of template code to work from to seed your ideas. You'll still need to code though as these modules will just lay a foundation by importing the data needed and creating alpha models.

Just click "Create New Algorithm" to test it out!

Marcus Ducklow

That's really cool! I keep getting this error through.

Runtime Error: AttributeError : 'Pandas' object has no attribute 'volume' AttributeError : 'Pandas' object has no attribute 'volume' (Open Stacktrace)

So far every combination I've tried has errored out.

Jared Broad

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Filib Uster

The wizzard is awesome! I'd suggest to add module templates, which creates files containing the basic code for each of the module types: alpha template module, universe template module, etc.

Apollos Hill

This. Is. LEGIT! Thank you so much!

Armin Ranjbar

Thank you guys!

Jackson Dude

I like to hand code, but this is cool and will teach me to code the correct way in QuantConnect.

Thanks mate, you are a legend.

Jared Broad

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Frank Giardina

I know i should know this but how do you chose Python code vs C#, Does the system only look at your profile

Thanks

Jack Simonson

Hi Frank,

You can quickly switch between Python and C# by clicking the C#/Py icon on the bottom-right of the IDE window. When you switch between the two, there is no need to reload the page and you can immediately build new algorithms!

Frank Giardina

Sent from my Verizon Wireless 4G LTE DROID

QuantConnect Community

Jeffrey Margolis

Very interesting!

Would be extremly useful to add a framework reference library to the Editor,

Rather than having to specify the specific components at the onset of algorithm creation, it would enable viewing the available Pallete of Alpha/Universe/Portfolio/Risk/Execution models to choose from.

All you really need(want) is enough to see what is available, the reference instantiation snippet (copy paste) and possibly and configuration documentation...

Further would be nice if this included privately defined and licensed alphas...

Link Liang

Hi Jeffrey,

Thanks for your suggestions! We will definitely consider those cool ideas and add them to our roadmap.

Mykola Dobrochynskyy

Great Work! Thx U guys!

Sachin S

Hello,

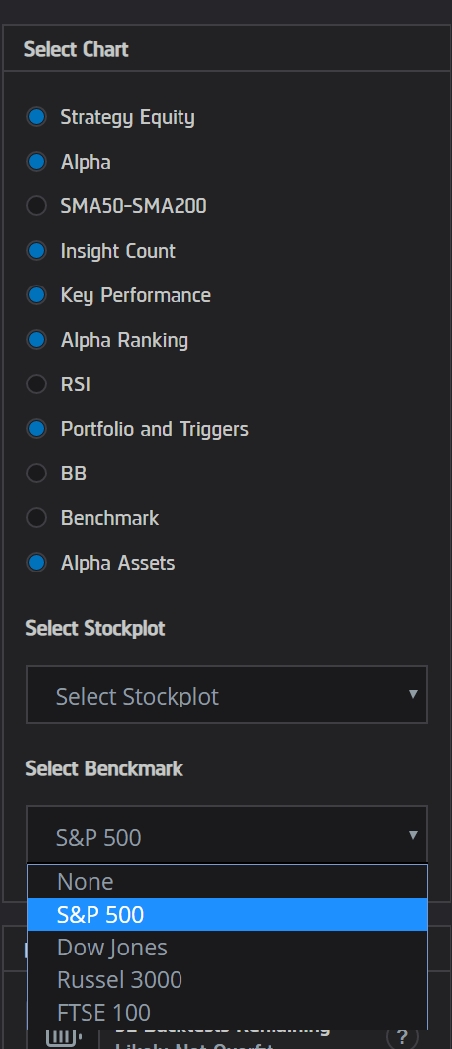

I am new to using LEAN. I built my first test usind "Algorithm Creator" to do the following: Implement and understand how RSI strategy works for "SPY". I used default plug and play components from "Algorithm Creator" and added a few graphs to undertsand how it works. (see attached backtest for code and graphs)

I am trying to figure out how to modify the code to undretsand the following things:

1. Why I see "SPY" baught and sold on the same day, in most of the trades.

2.Why I do not see any Insignts generated (I use Daily resolution to reduce backtest time).

3. Why S&P500 Benchmark shown as a straight line ?

4. How to show indiators and buy/sell signals on "Strategy equity graph"?

Any suggestions?

Thanks

Sachin

Link Liang

Hi Sachin,

1) The short answer is: the resolution is too low.

Here is the real answer: Since we are using daily resolution, the time of daily bar arrives is out of market hour. Therefore, every order is placed when the market is closed, and filled on the next day.

An example would be: On 2018-06-26, the closing price triggers risk management model and submitted an order to liquidate. However, that order is filled on 2018-06-27 with the new closing price on that day. And as it is filled, self.Portfolio.Invested becomes false again and another buy order is placed (and filled immediately). Moreover, although those two orders are filled, the portfolio values (unrealized profit, absolute holding cost) which are involved in the risk management calculation are not updated immediately. In fact, the new values will be effective when the next bar arrives (tomorrow). However, the closing price of 2018-06-27 still triggers risk management and another Liquidate() takes place. This is why you saw both buy and sell on 2018-06-27.

To avoid this: use minute resolution or higher. You would see what you expected: sell when risk management is triggered, and buy back when next bar arrives.

2) The reason is there was no insight triggered. I would recommand to user higher resolution or reduce the period (currently 60). To reduce backtest running time, besides using low resolution, we could also set end date to use less data. For example:

self.SetEndDate(2018, 12, 1)3) It is a legacy issue and we will fix it soon. Meanwhile, you could use

self.SetBenchmark("SPY")or select S&P500 benchmark by this:

4) In order to plot the values, I attached the RsiAlphaModel below the original code, and added the plot statement in Update() method. "Strategy equity graph" is our default chart and it's better not to modify it. We could always create a new chart for our own use. Please check for the last session in initialize() for my implementation, and here is our documentation page regarding charting.

Hope it helps.

Sachin S

Thanks Liang for the reply and suggestions. I will check it out.

Link Liang

Hi Filip,

To manage your subscription, you could go to subscription page. Thanks for your support!

Roman Gobov

Hi. I'm new here. I can't find algorithm creator. where do I need to click?

Here is my display

https://prnt.sc/11zhyzq

Derek Melchin

Hi Roman,

The Algorithm Wizard has been replaced with the new Strategy Builder that's displayed in the screenshot above. To add a framework module, click Add Module. To start from scratch with the IDE, click the Exit Builder Mode button.

We are in the process of updating our documentation and will be sure to include the Strategy Builder in the new docs. We appreciate the patience.

Best,

Derek Melchin

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Def returns

I'm trying to use an alpha I've been testing with the prebuilt universe selection, risk management, etc… available from the creator tool, but I'm unable to access it (even though it has popped up before). When I click “+ create new algorithm” all that happens is I'm brought to the python window to start coding.

Any help would be greatly appreciated.

Jared Broad

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!