Hello everyone,

I want to share my first algorithm based on this paper: An Intermarket Approach to Beta Rotation

I used the two ETFs (XLU and VTI) mentioned in the paper. For the calculation of the Relative Strength between these two markets I followed this example: Relative Strength Example

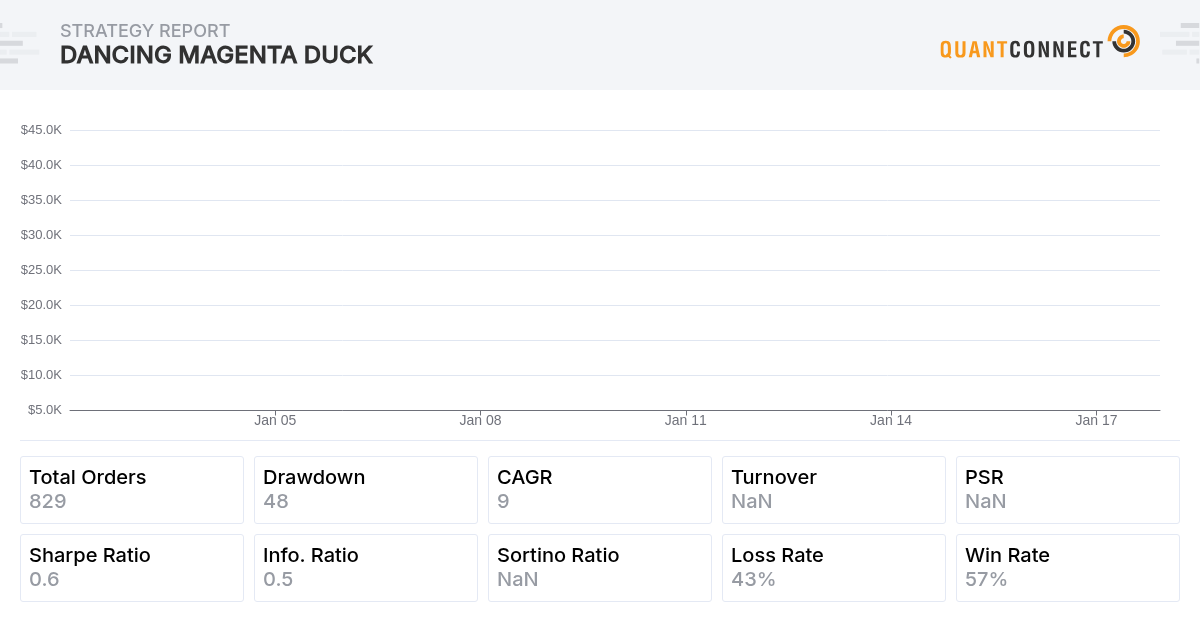

The result of the algorithms can be found below this post.

Biggest disadvantage of this strategy are the drawdowns during the backtesting period. The usage of Stop-Loss Orders didn't reduce the draw down during my backtests. I also tried a couple of different ETFs. One, for example, can get a higher overall return by using QQQ instead of VTI. Other low beta ETFs than XLU didn't improve the performance of the algorithm significantly. Using the ETF TLT as a negative beta ETF kept the equity curve flat from 2010 until the end of 2017.

The algorithm can be used for very long term oriented portfolios. The signal was backtested from 1926 to 2013 in the paper. A strategy using XLU and VTI was backtested from 2001 to 2013.

Best,

JD

Jared Broad

Nice work JDMar Original paper looks interesting as well

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Michael Handschuh

Awesome! I wonder if you could incorporate downside risk detection through something like CAPE? Here's a python example of an algorithm that uses CAPE to detect bubbles: BubbleAlgorithm.py -- this might help at least to maintain capital during events such as 2008.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!