Investopedia recently came out with an article on Warren Buffet’s barometer for gauging stock market valuations and how it currently shows an extreme overvaluation of the market. The “Buffet Indicator” is the ratio of market capitalization of all publicly-traded U.S. stocks to U.S. GDP. The article states that when the ratio is between 70%-80% it safe to put in stocks, 100% means danger and 140% means extreme danger. We are currently at a record high of 138%.

I thought it would be interesting to gauge the performance of this indicator using the historical data provided by QuantConnect and see how well it predicted previously overvalued markets. In the algorithm below I would stay invested in the SPY until the ratio reached the danger mark or 100%, and exit until the markets were not overvalued.

Sources:

https://www.investopedia.com/news/buffett-indicator-spells-bad-news-stock-investors/

Gurumeher Sawhney

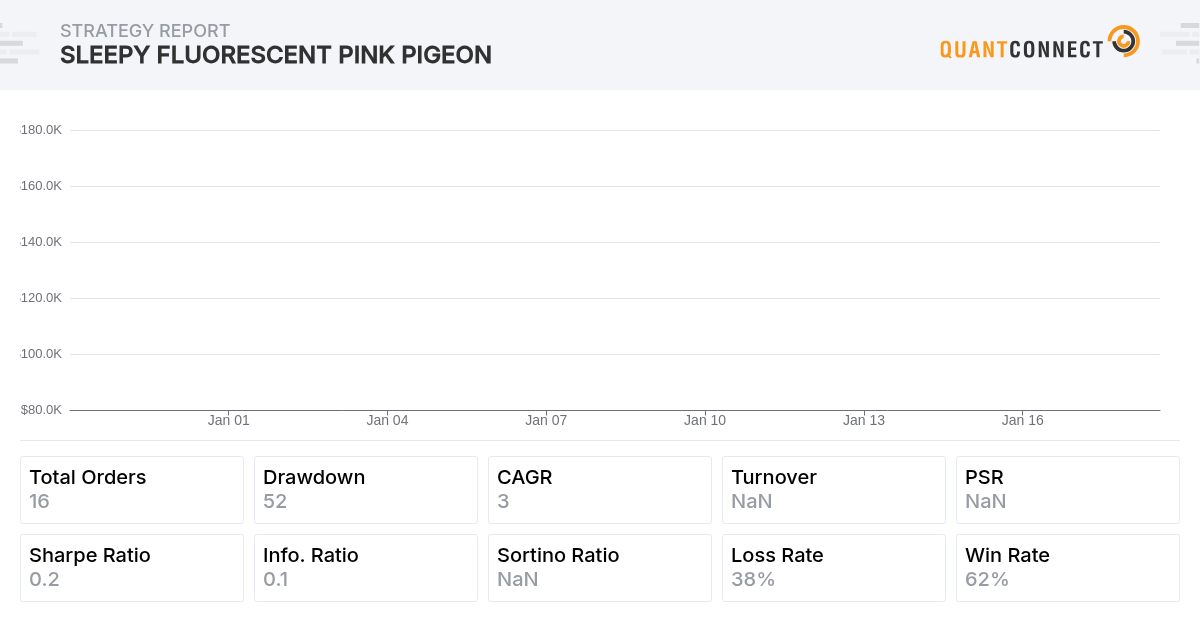

The basic strategy using the Buffet Indicator ended up not working as well as I hoped. There were some long flat periods and during the 2008 market crash the indicator went below 1 so we took a large loss. I created another strategy using what I learned with the mindset of still being a risk-averse investor but also riding the trends of the Buffet Indicator. If the market was overvalued or the market value was falling I stayed in AGG, otherwise, I invested in the QQQ. Due to the inception dates of the ETFs used, I was only able to back test to 2003. The results below pleasantly handled the 2008 market crash. It will be interesting to see how the “overvalued” stock market plays out in the coming months.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Saun Marsh

Let us look at the Buffett Indicator; first for the U.S. market, and then for several emerging markets. The chart below graphs both U.S. GDP and the U.S. stock market for the past sixty years. It is interesting to look at the graph in the context of Buffett’s investment career, which coincidentally extends for the sixty years of data. First, the period from 1960 to 1970 was one of consternation for value investors like Buffett who felt that valuations were extremely high. Buffett closed his initial partnership in 1969, partially because he felt valuations were too high to remain invested. Second, the period 1974 to 1997 which were Buffett’s most successful years. He thrived in the 1970s, an environment of very low valuations caused by high inflation. Third, 1998 to 2001 was a period of serious underperformance for Buffett, as he was out of the high-flying technology stocks. Fourth, from 2001 until today, Buffett has not performed as well as in the past, only outperforming the market during the large drawdowns of 2002 and 2008. The “Buffett Indicator” today points to very high valuations, and probably to a big opportunity for Buffett to capture alpha (relative market performance) in the next downturn.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!