Hi,

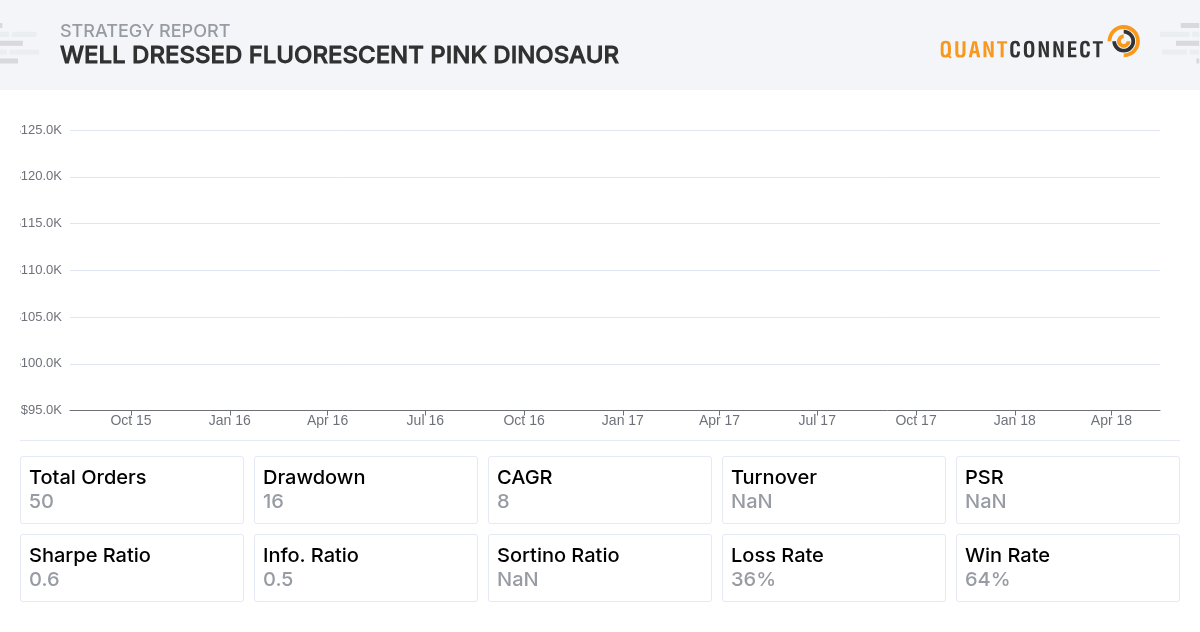

This is my first algorithm on QuantConnect. It is a simple resistance strategy that uses RSI. It is pretty risk-averse. Any ideas on making a resistance strategy like this have a higher alpha? I'm making around 24% while the benchmark(SPY) makes 42%.

Crypto Hai

have you had any success with this Gurumeher Sawhney ?

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Vladimir

I have success in this.

def rebalance(self): if (not self.Strength.IsReady): return rsi = self.Strength.Current.Value if rsi > THRESHOLD: self.wt[self.STK] = 1.0; self.wt[self.BND] = 0; elif rsi < THRESHOLD: self.wt[self.STK] = 0; self.wt[self.BND] = 1.0; for sec, weight in self.wt.items(): if weight == 0 and self.Portfolio[sec].IsLong: self.Liquidate(sec) for sec, weight in self.wt.items(): self.SetHoldings(sec, weight)The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Guillermo Diaz

Vladimir,

How do I add your piece to a clone algorithm?

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Foren Power

I second Guillermo,

Vladimir , it's probably secret, but if you don't mind sharing, then the algo would be appreciated.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!