Hey guys just thought I’d share Andres F. Clenows momentum strategy from his book stocks on the move. Here is the strategy:

Buy on Wednesday, if the spy is above the 200 SMA, the stock is above the 100 SMA and the security has not gapped in price more or equal to 15% over the past 90 days.

Rebalance every second Wednesday if the price of the stock is below the 100 day SMA sell, if the price gapped over the past 90 days sell, if the security has becoming a larger % of the portfolio than desired, we sell the difference in that amount so that we’re maintaining the same amount of risk as intended.

Ranking Methodology

Rank based off Annualized exponential regression slope -- buy the stocks with the greatest slope (I went with the top 10 %).

Position Sizing

Based off of the average true range of the security. Formula --Account value * 0.001/ATR (20 period)

Goal is to have the position only affect the portfolio by 10 basis points. The original strategy is performed on securities of the S&P 500, I did it on securities with some volume and trading above a price of 20 (to weed out smaller priced stocks)

Anyways that’s all cheers!

Jon Quant

Hi Leigham,

I cloned your algorithm and changed the following parameters:

self.SetStartDate(2006,01,01)

self.SetEndDate(2018,01,01)

self.SetCash(10000)

I get below error when I backtest the algorithm:

Runtime Error: Python.Runtime.PythonException: ValueError : zero-size array to reduction operation maximum which has no identityat Python.Runtime.PyObject.Invoke (Python.Runtime.PyTuple args, Python.Runtime.PyDict kw) [0x00033] in <59c711440fed482b8e57b026917e4706>:0

at Python.Runtime.PyObject.InvokeMethod (System.String name, Python.Runtime.PyTuple args, Python.Runtime.PyDict kw) [0x00007] in <59c711440fed482b8e57b026917e4706>:0

at Python.Runtime.PyObject.TryInvokeMember (System.Dynamic.InvokeMemberBinder binder, System.Object[] args, System.Object& result) [0x0003e] in <59c711440fed482b8e57b026917e4706>:0

at (wrapper dynamic-method) System.Object:CallSite.Target (System.Runtime.CompilerServices.Closure,System.Runtime.CompilerServices.CallSite,object,QuantConnect.Data.UniverseSelection.SecurityChanges)

at QuantConnect.AlgorithmFactory.Python.Wrappers.AlgorithmPythonWrapper.OnSecuritiesChanged (QuantConnect.Data.UniverseSelection.SecurityChanges changes) [0x0004f] in <7ab68f0d8e294fb99b0d6c17956078e8>:0

at QuantConnect.Lean.Engine.AlgorithmManager.Run (QuantConnect.Packets.AlgorithmNodePacket job, QuantConnect.Interfaces.IAlgorithm algorithm, QuantConnect.Lean.Engine.DataFeeds.IDataFeed feed, QuantConnect.Lean.Engine.TransactionHandlers.ITransactionHandler transactions, QuantConnect.Lean.Engine.Results.IResultHandler results, QuantConnect.Lean.Engine.RealTime.IRealTimeHandler realtime, QuantConnect.Lean.Engine.Server.ILeanManager leanManager, QuantConnect.Lean.Engine.Alpha.IAlphaHandler alphas, System.Threading.CancellationToken token) [0x00a96] in <34f68d5d9ef54d4e95213133d16a078b>:0

And this is the stacktrace:

[' File "../cache/main.py", line 106, in OnSecuritiesChanged', ' File "../cache/main.py", line 137, in gapper

', ' File "/usr/local/lib/python2.7/dist-packages/numpy/core/fromnumeric.py", line 2272, in amax

out=out, **kwargs)

', ' File "/usr/local/lib/python2.7/dist-packages/numpy/core/_methods.py", line 26, in _amax

return umr_maximum(a, axis, None, out, keepdims)

']

The runtime error occurs on May 4, 2006 so you don't have to wait very long when you start the backtest.

Any ideas?

Thanks,

Jon

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Leigham Springer Sutton

I haven't found a resolution to that bug as of yet, but I'm going to look into it, if you find the solution please make sure to let me know and I'll do the same :)

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Derek Tishler

That error sounds like a maximum operation is trying to reduce an axis with length zero inside the function gapper. On return, inside gapper, I noticed use of np.max. More importantly, I noticed History being used.

I knew right away it was a case of History not retuning the expected data for an asset; I often see this with dynamic universes. This was combined with use of np.diff, which returns Length-1 for an array, so enough(2) data points were required. I added some checks.

NOTE: I didn't review the trade logic. I'm not sure I returned the right thing in gapper when I force a return on a bad History. Code change in ###'s for review. Good luck!

def gapper(self,security,period): if not self.Securities.ContainsKey(security): return 0 security_data = self.History(security,period,Resolution.Daily) ############################################################### # we need to ensure we have data or np.max axis reduction will throw: # zero-size array to reduction operation maximum which has no identity if 'close' not in security_data.columns: self.Log(str("History had no Close for %s"%security)) return if len(security_data['close']) < 2: # we need enough for the np.diff which removes 1 from length self.Log(str("Close had too few or no values for %s"%security)) return ############################################################### close_data = [float(data) for data in security_data['close']] return np.max(np.abs(np.diff(close_data))/close_data[:-1])>=0.15

2006-05-11 00:00:00 :Close had too few or no values for AHGP TIIB7Z82AFS5Sample log of bad asset which returned under 2 close values:

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Leigham Springer Sutton

Thanks for the help Derek TishlerI'm going to look over this tommorow :).

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Jon Quant

It looks like Derek fixed the errors in May 2006 but like he said, not sure whether doing a "return" is the right thing to do. Stumbled across another runtime error on May 22, 2008 and it's as follows:

[ERROR] FATAL UNHANDLED EXCEPTION:/usr/local/lib/python2.7/dist-packages/scipy/stats/_stats_mstats_common.py:116: RuntimeWarning: invalid value encountered in sqrt, t = r * np.sqrt(df / ((1.0 - r + TINY)*(1.0 + r + TINY))),/usr/local/lib/python2.7/dist-packages/scipy/stats/_stats_mstats_common.py:118: RuntimeWarning: invalid value encountered in sqrt, sterrest = np.sqrt((1 - r**2) * ssym / ssxm / df),SecurityTransactionManager.GetSufficientCapitalForOrder(): Id: 3, Initial Margin: 39916.9500980220000, Free Margin: 36382.953820540000,/usr/local/lib/python2.7/dist-packages/scipy/stats/_stats_mstats_common.py:106: RuntimeWarning: invalid value encountered in double_scalars, slope = r_num / ssxm,/usr/local/lib/python2.7/dist-packages/scipy/stats/_stats_mstats_common.py:118: RuntimeWarning: invalid value encountered in double_scalars, sterrest = np.sqrt((1 - r**2) * ssym / ssxm / df),SecurityTransactionManager.GetSufficientCapitalForOrder(): Id: 49, Initial Margin: 61542.5957764665000,My parameters were:

self.SetStartDate(2006, 1, 1) self.SetEndDate(2009, 1, 1) self.SetCash(100000)The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Leigham Springer Sutton

Using your same parameters and slightly changing the code to return a True statement, and it seems to be fine :). Please let me know if you can still clone the code and find other errors. To be clear the logic behind why I'm returning True when there isn't enough data is to determine whether or not the security gapped in the past 90 days because the strategy wants to avoid stocks if It can't know for certain whether or not it gapped. By returning True this line below will come out false.

if self.Securities[stock].Price >self.moving_average(stock,100) and not self.gapper(stock,90) and cash >0 and not oo:

^^^ That ensures the return logic is doing 'the right thing' :p

As for the most recent error:

invalid value encountered in sqrt

^^

We simply won't encounter it now because the slope won't be calculated for securties that lack the data required calculate the slope.

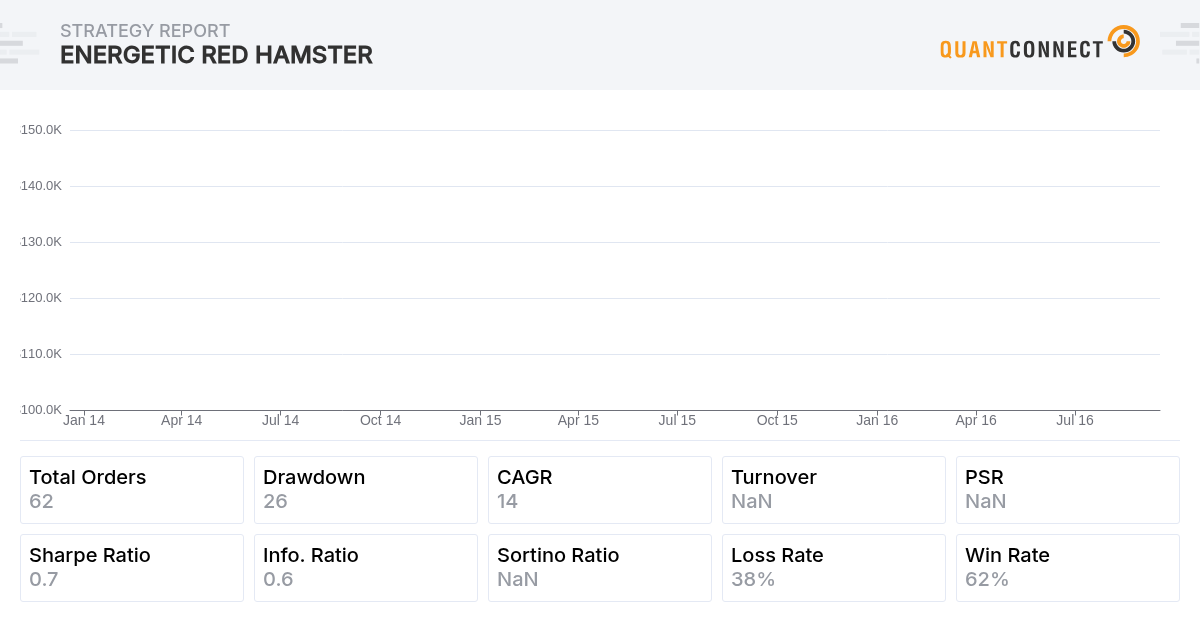

And we won't trade that security because we only want smoothly uptrending securities. Below is a backtest for the timeframe you stated you found the bug.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Derek Tishler

Fixing my code to 'return 0' instead of nothing prevented a crash or other errors for for me. I went through and applied some other changes to the code to:

-apply fix to any use of History more generally(also ended up doing a period check)

-update how stocks_to_trade is managed to ensure addition AND removal of assets from universe

-added a leverage plot in order to track margin issues

-set realism setting to IB margin account

- used pandas/numpy where possible vs list comprehension to "unpack"

- divide by zero check in weight() to avoid error

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Lexx7

Nice work Leigham Springer Sutton

Its a shame these strategies take so long to backtest on QC. Following the Trend is next !

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Leigham Springer Sutton

Thank you Lexx7 , I would love to code that strategy ableit I haven't bought that book as of yet if you'd like to tell me the precise buying/selling/ranking information I'll give it a go :)

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Jared Broad

Working on it Lexx =P.. thanks for your patience.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Quant Trader

Hi Leigham,

I have read the book and trying to simulate the same strategy. I also came across this post:

I believe you should select a new universe every time you rebalance your position and not in the init only. I could be wrong.

I would like to validate every function that is code. How did you debug them? Did you use a notebook for that?

Do you like to work together to see if we can get the same result as given in the book? Are you interested in reading the book about futures trading as well? Seems that this stock momentum strategy is derived from futures momentum trading. That is my second target to code. I can code in Python or C#.

J.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Lexx7

Thanks Jared - moreso my 'impatience' haha but I am happy with the support & growing community interest so far & will soon start my paid account once my strategies are fine tuned, keep up the good work !

Leigham, the rules are simple. For a portfolio of futures tickers (continuous), if the 10 day SMA crosses above the 100 day SMA then buy with ATR based position sizing similar to stocks on the move. I've attached a backtest that I started playing around with but I dont think anything works there but it may help as a skeleton.

The position sizing formula should be : (risk factor x portfolio value)/(ATR100 x Point Value)

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Quant Trader

Hi,

I managed to implement the algorithm. I spent too much time thinking of keeping performance low. I put the securities updates in the the securitiesonchanged and not in the ondata as it won't run. I did put a small period back test of 1 year. Calculating for 500 stocks every wednesday based on the S&P500 with slope takes considerable time. I hope to show some basis principles like getting a stock 500, register indicators and rebalancing it on wednesdays. The portfolio risk part is to be done. Input is welcomed. This one calculates the slope every wednesday, I am not sure the Python version does, or what Andreas Clenow says about that. I will check the book.

I would like to get some input on how to reduce the risk of a sudden market drawndown and how to implement the initial sizing for the first 20 or 30 stocks to buy. With ATR it takes for low ATR a lot of stock and for high a lot of stock, but it does not take into account the position size of the overall portfolio which must consist more or less of 20-30 stocks. Maybe just program it that way and a maximum based on the ATR, or is it normal to take leverage on a low ATR, but that will call in margin.

If there are European traders, I would like to trade EUR as do not like to put all my money in the USD. Or does somebody know how to hedge this properly?

Currently I am papertrading this one and I want to go live trading it. So any flaws, please let me know.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!