I'm trying to get familiar with universe selection and am using the EMA Cross Universe Selection algorithm as a starting point. As part of it's selection it says to wait until a composite indicator that includes a 300 day EMA is ready.

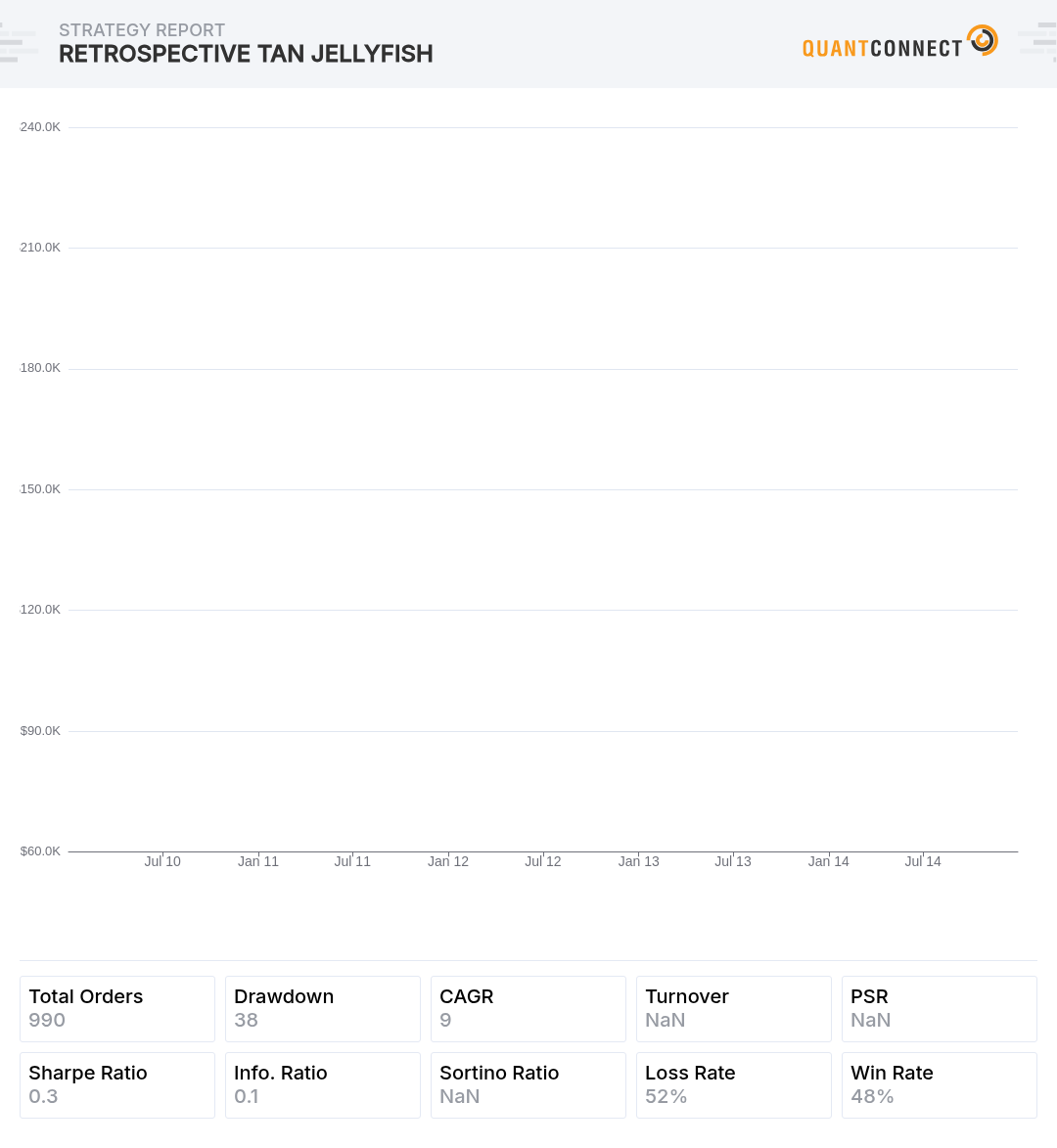

The starting date for the backtest I'm running is Jan 1, 2010. So I wouldn't expect any trades to occur until mid-March 2011, roughly 300 trading days from the start of the backtest. Instead the first trade occurs in mid-November 2010, 300 calendar days plus a few weeks from the start of the backtest.

My question is how are indicator periods treated when used in universe selection? It seems as if it is using calendar days as opposed to trading days as it would if I just did something like this:

AddEquity(spy.ID.Symbol, Resolution.Daily);

spyEma = EMA(spy, 60);

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!