Hi,

At the bottom of this post is part of the buy logic of an algo that I am working on. In short, when there is a buy signal, the order should place a stop limit order at 1 cent above the high. The order should be valid for the duration of the entire bar, which in this case is one minute, and if it has not been filled it should be canceled. For the most part, the algo is doing the right thing, but there are several instances I noticed where something is going wrong.

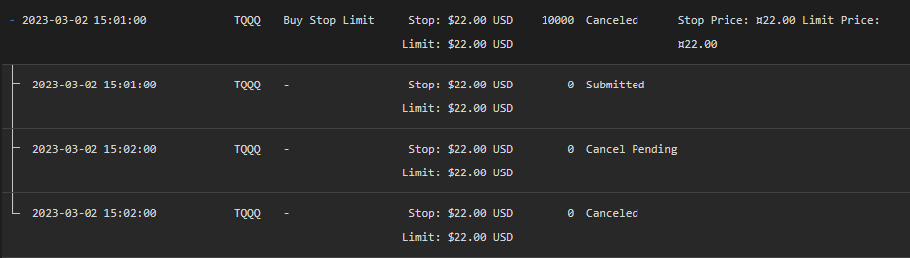

Instance 1:

In this order ticket, the order was placed at the right price and right time. If you look at a chart of TQQQ at this time and date, the price of TQQQ went above the price of 22 so the order should have been filled, but instead, it got cancelled. (The cancelation logic was right in this case since it only sent the cancelation order after the duration of one bar (one minute))

In this order ticket, the order was placed at the right price and right time. If you look at a chart of TQQQ at this time and date, the price of TQQQ went above the price of 22 so the order should have been filled, but instead, it got cancelled. (The cancelation logic was right in this case since it only sent the cancelation order after the duration of one bar (one minute))

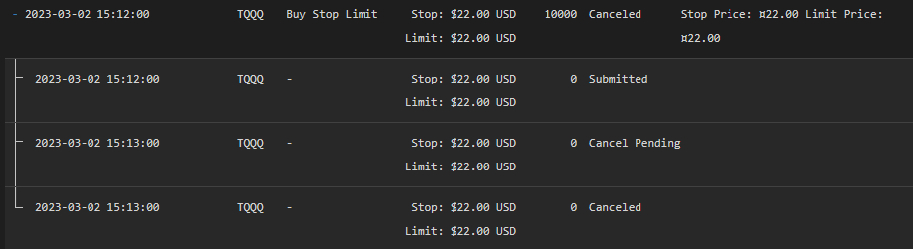

Instance 2:

In this order ticket, the order was placed at the right price and right time. If you look at a chart of TQQQ at this time and date, the price of TQQQ went above the price of 22 so the order should have been filled, but instead, it got canceled.

In this order ticket, the order was placed at the right price and right time. If you look at a chart of TQQQ at this time and date, the price of TQQQ went above the price of 22 so the order should have been filled, but instead, it got canceled.

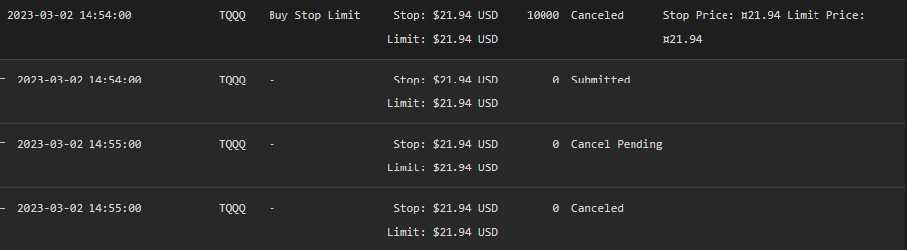

Instance 3:

In this order ticket, the order was placed at the right time and at the right price, but it got canceled even though the high of the bar was 21.94, so it should have been filled.

In this order ticket, the order was placed at the right time and at the right price, but it got canceled even though the high of the bar was 21.94, so it should have been filled. Could someone please help me understand what is going wrong in this program?

# region imports

from AlgorithmImports import *

# endregion

import pandas as pd

import numpy as np

from ta.trend import ema_indicator

from ta.volatility import bollinger_hband, bollinger_lband

import pandas_ta as ta

class LogicalBrownScorpion(QCAlgorithm):

def Initialize(self):

self.SetStartDate(2023, 3, 1)

self.SetEndDate(2023, 3, 24)

self.SetCash(1000000)

self.symbol = self.AddEquity("TQQQ", Resolution.Second, dataNormalizationMode=DataNormalizationMode.SplitAdjusted).Symbol

self.Consolidate(self.symbol, Resolution.Minute, self.CustomHandler)

self.barsSince = 0

self.ticket = None

self.OrderPlaced = False

self.entryPrice = None

self.SetWarmUp(300, Resolution.Minute)

def OnData(self, data: Slice):

try:

if self.IsWarmingUp: return

if self.Portfolio.Invested:

price = data.Bars[self.symbol].Close

if price >= self.entryPrice + .05:

self.Liquidate(self.symbol)

self.OrderPlaced = False

self.barsSince = 0

except:

pass

def CustomHandler(self, bar):

if self.IsWarmingUp: return

if self.OrderPlaced:

self.barsSince += 1

if self.barsSince == 1:

if self.ticket is not None:

self.ticket.Cancel()

self.OrderPlaced = False

self.barsSince = 0

if not self.Portfolio.Invested and self.OrderPlaced == False:

try:

history = self.History([self.symbol], 2, Resolution.Minute)

high_prices = history.high.unstack(level=0)[self.symbol]

current_high = round(float(high_prices[-1]), 2)

low_prices = history.low.unstack(level=0)[self.symbol]

current_low = round(float(low_prices[-1]), 2)

if buySignal1:

self.ticket = self.StopLimitOrder(self.symbol, 10000, current_high + .01, current_high + .01)

self.OrderPlaced = True

elif buySignal2:

self.ticket = self.StopLimitOrder(self.symbol, 10000, current_high + .01, current_high + .01)

self.OrderPlaced = True

except:

pass

Louis Szeto

Hi Rishab

You should place a LimitOrder, not a StopLimitOrder. StopLimitOrder is for a stop loss but not as a trigger.

Best

Louis

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Rishab Maheshwari

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!