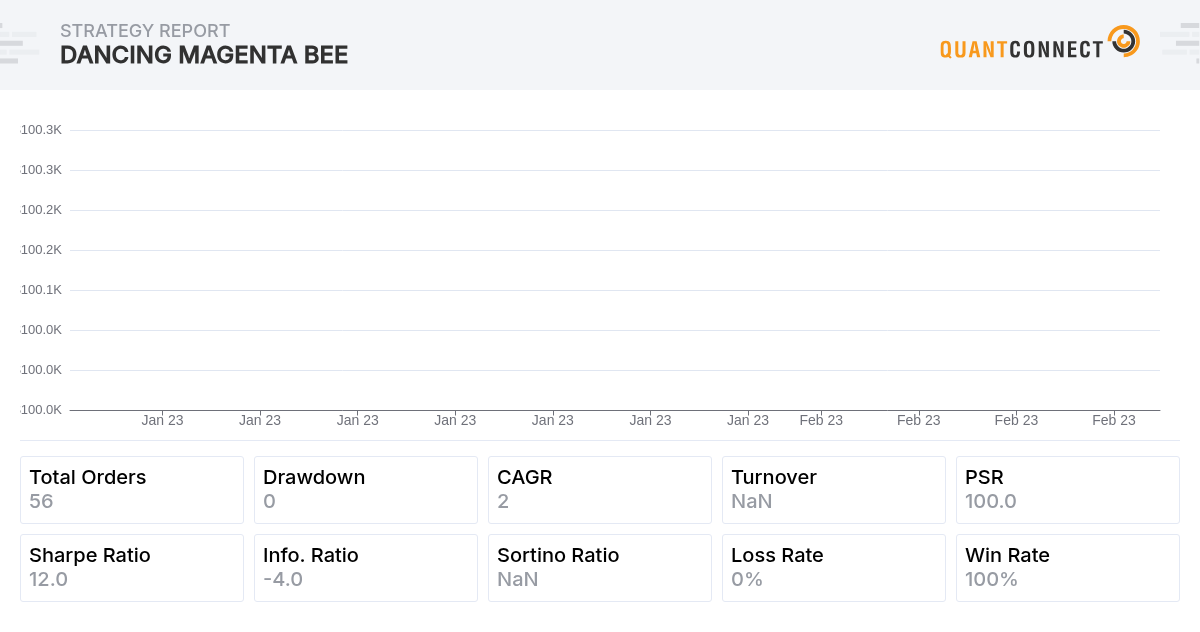

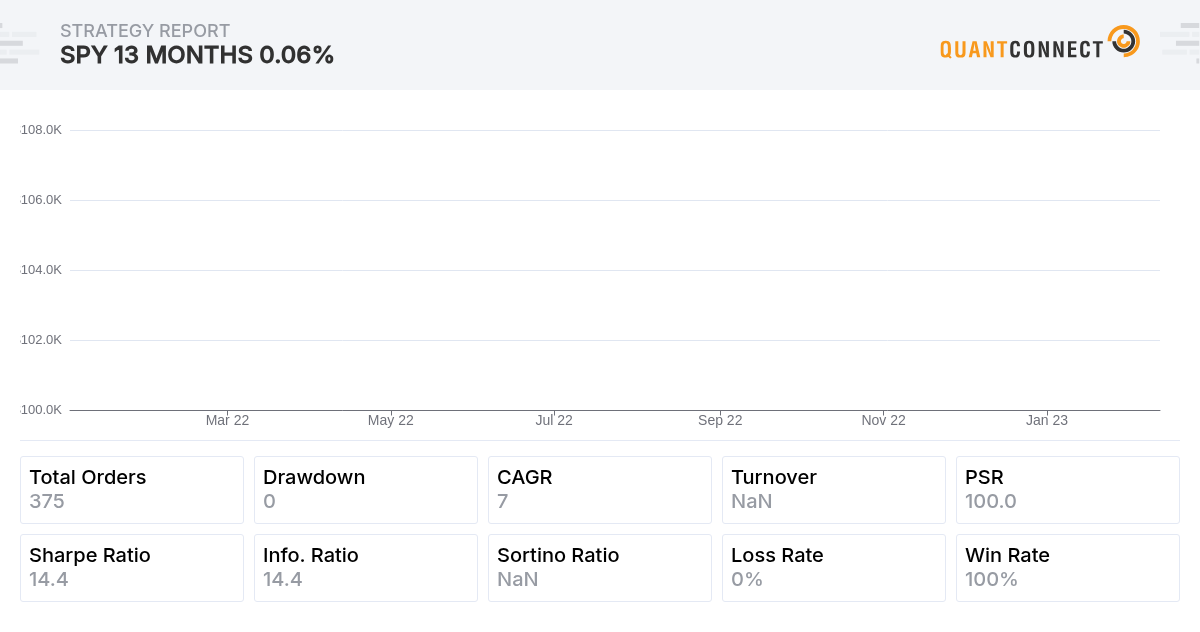

I created a strategy to sell SPXW DTE 0 call or put at delta 0.01 at price > 0.999 spx day high or price < 1.001 spx day low.

Sharpe ratio is super high but return is bad < 2.5% annual return.

Any suggestion on how to improve return to more than 15% but sharpe ratio still above 3? Maybe i should sell spread instead?

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!