I've got a day trading algorithm that both shorts and longs futures. Only one trade is meant to happen at a time and when self.Portfolio.Invested is true or there are open orders, no new entries should submit. Entries are always stop market and exits are limit orders. It seems that if-testing for open orders is not working in Live Deployment with IBKR because QC is not recognizing any orders as open. In the order log, it appears that the all orders when expanded show every event happening at the same second (see picture). This implies that while orders and order updates are functioning properly, orders are not recognized as open. This was not an issue when back testing. I am using IBKR data if it matters.

There may be something else going on as well, because many orders are returning as “invalid” status, even those that have been filled or get filled after becoming “invalid.” This could be a result of the above, though.

These issues are resulting in a long entry filling, a short entry filling (which in fact acts as a long exit), and vice versa, then the respective exit orders being submitted. This ended up eventually resulting in orders being placed with double the intended quantity (see other picture) for a Sell Market order, leaving me short 1 contract. There aren't any market orders in the code at all… This “soft-locked” the algorithm since if-testing for self.Portfolio.Invested prevented a new “entry” order from submitting, and no “exit” orders could be triggered under OnOrderEvent, the position was held. This is dangerous with futures, and luckily the trade went in my favor and I was periodically checking the live deployment.

Is this a known bug / intended feature? What is the work around? Code below. Thank you in advance

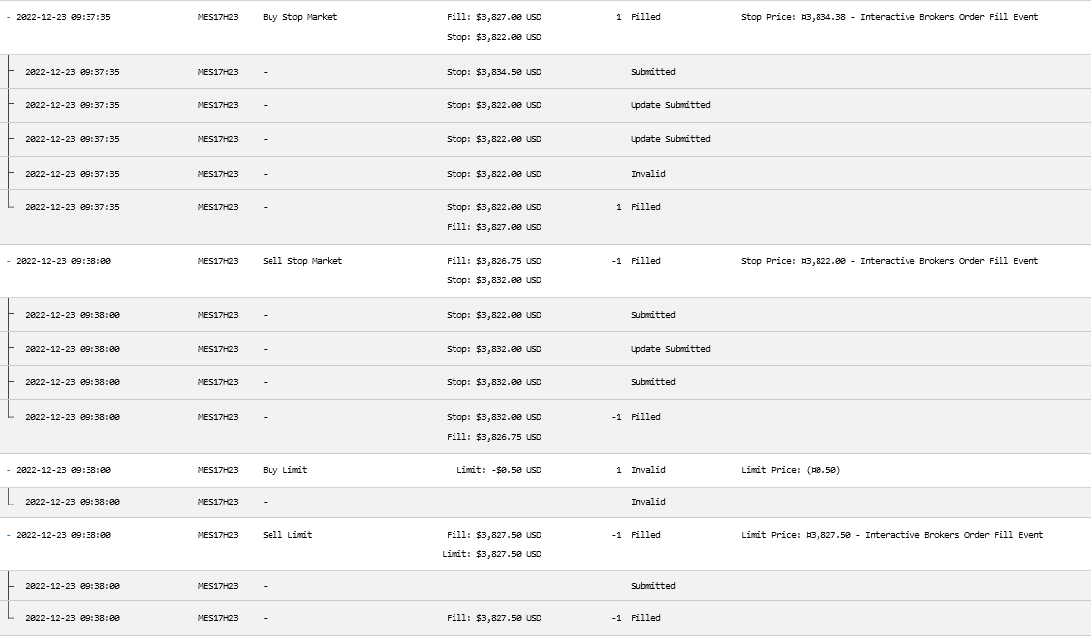

Showing all submissions, updates, and fills being recorded as happening at the time of fill

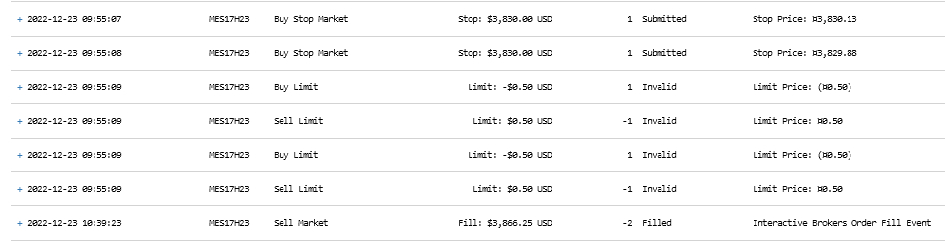

Showing all submissions, updates, and fills being recorded as happening at the time of fill Showing multiple orders as “invalid” and with strange limits. Also at bottom shows a Sell Market order for twice the intended quantity

Showing multiple orders as “invalid” and with strange limits. Also at bottom shows a Sell Market order for twice the intended quantity+ Expand

def Initialize(self):# Backtesting / Papertrading parameters if necessary#self.SetCash(15000)#self.SetStartDate(2022, 11, 15)#self.SetEndDate(2022, 11, 15)# Create futures contract symbol for ES using expiration date {UPDATE as necessary}# Request contract data with tick resolutionself.esContract = Symbol.CreateFuture(Futures.Indices.MicroSP500EMini, Market.CME, datetime(2023,3,17))self.es = self.AddFutureContract(self.esContract, Resolution.Tick)# Futures.Indices.MicroSP500EMini // Futures.Indices.SP500EMini# Set fees to zero for backtesting purposes#self.Securities[self.es.Symbol].SetFeeModel(ConstantFeeModel(0.25))# Variables to record W/L ratio & highest/lowest intraday P/Lself.tallyWin = 0self.tallyLoss = 0self.tallyEven = 0self.tallyS = 0self.tallyL = 0self.shortWin = 0self.longWin = 0# Variables for intraday high/low P/Lself.lowBal = self.Portfolio.Cashself.highBal = self.Portfolio.Cashself.begBal = self.Portfolio.Cashself.endBal = self.Portfolio.Cashself.lowTime = 0self.highTime = 0self.startTime = 0self.maxDrawD = 0self.dDTime = 0self.drawD = 0self.haltNum = 1self.dDHalt = False# Variables for both short and long entry and exit tickets, trade cooldowns, prices for trailing stops and cancellations, and contracts per tradeself.sEnTicket = Noneself.lEnTicket = Noneself.sExTick = Noneself.lExTick = Noneself.liquidateTicket = Noneself.exitFillTime = datetime.minself.cancelTime = datetime.minself.trgPrice = 0self.highestPrice = 0self.lowestPrice = 25000# Quantity {UPDATE manually}self.qty = 1# Variables for price levels {Must be > 3 pts away from any other}# ! Intended to be updated daily, ensure correct futures contract prices# Daily Support and Resistance price levelsself.resi6 = 0self.resi5 = 3901self.resi4 = 3892self.resi3 = 3880self.resi2 = 3869self.resi1 = 3856self.supp1 = 3838self.supp2 = 3826self.supp3 = 3807self.supp4 = 3784self.supp5 = 3773self.supp6 = 0# Dynamic price levels {e.g. previous day low, overnight high, etc.}self.dyna1 = 3788self.dyna2 = 3875self.dyna3 = 3830self.dyna4 = 0self.dyna5 = 0# Macroenvironment price levels {These weren't used in back tests}self.macr1 = 0self.macr2 = 0self.macr3 = 0# Multiples of one-hundredself.hund1 = 4000self.hund2 = 3700self.hund3 = 3800# Miscellaneous price levelsself.misc1 = 0self.misc2 = 0self.misc3 = 0# Variable for entry trail stopself.trailEntry = 3# Variable for order cancel based on PAself.entryCancel = 4# Variables for cooldowns {in seconds}self.exitCool = 30self.cancelCool = 15# no entries occur outside of RTHself.stopPreM = self.Time.replace(hour=9,minute=32, second=59)self.stopAftM = self.Time.replace(hour=15,minute=55, second=59)def OnData(self, slice):# Plot W/L and high/low intraday P/L at EOD & update ending balanceif self.Time == self.Time.replace(hour=15, minute=59, second=59):self.endBal = self.Portfolio.Cashif self.endBal == self.Portfolio.Cash:self.Plot("W/L", "Wins", self.tallyWin)self.Plot("W/L", "Losses", self.tallyLoss)#self.Plot("W/L", "Draws", self.tallyEven)self.Plot("P/L", "Highest", self.highBal - self.begBal)self.Plot("P/L", "Lowest", self.lowBal - self.begBal)self.Plot("P/L", "Ending", self.endBal - self.begBal)self.Plot("Intraday Times", "High Time", int(round(self.highTime / 60)))self.Plot("Intraday Times", "Low Time", int(round(self.lowTime / 60)))self.Plot("Intraday Times", "Max DD Time", int(round(self.dDTime / 60)))self.Plot("Misc. Stats", "Max Drawdown", self.maxDrawD)#self.Plot("Misc. Stats", "W/L", self.tallyWin * 100 / self.tallyTtl)self.Plot("Misc. Stats", "Long w/l", self.longWin * 100 / self.tallyL)self.Plot("Misc. Stats", "Short w/l", self.shortWin * 100 / self.tallyS)# Reset balances dailyif self.Time == self.Time.replace(hour=9, minute=30, second=0):self.highBal = self.Portfolio.Cashself.lowBal = self.Portfolio.Cashself.begBal = self.Portfolio.Cashself.startTime = int(round(self.Time.timestamp()))self.lowTime = 0self.highTime = 0self.maxDrawD = 0self.dDTime = 0self.drawD = 0self.haltNum = 1self.dDHalt = False# no entries occur outside of RTHself.stopPreM = self.Time.replace(hour=9,minute=32, second=59)self.stopAftM = self.Time.replace(hour=15,minute=55, second=59)# Variable for ES contract priceprice = self.Securities[self.es.Symbol].Price# Cooldownsif (self.Time - self.exitFillTime).seconds <= self.exitCool or (self.Time - self.cancelTime).seconds <= self.cancelCool:return# Submit entry order if there are no positions or open orders and time conditions are metif not self.Portfolio.Invested and not self.Transactions.GetOpenOrders(self.es.Symbol) and self.stopPreM < self.Time < self.stopAftM and self.dDHalt != True:# Short entriesif self.resi6 + 1.5 >= price > self.resi6 or self.resi5 + 1.5 >= price > self.resi5 or self.resi4 + 1.5 >= price > self.resi4 or self.resi3 + 1.5 >= price > self.resi3 or self.resi2 + 1.5 >= price > self.resi2 or self.resi1 + 1.5 >= price > self.resi1 or self.supp6 + 1.5 >= price > self.supp6 or self.supp5 + 1.5 >= price > self.supp5 or self.supp4 + 1.5 >= price > self.supp4 or self.supp3 + 1.5 >= price > self.supp3 or self.supp2 + 1.5 >= price > self.supp2 or self.supp1 + 1.5 >= price > self.supp1 or self.dyna1 + 1.5 >= price > self.dyna1 or self.dyna2 + 1.5 >= price > self.dyna2 or self.dyna3 + 1.5 >= price > self.dyna3 or self.dyna4 + 1.5 >= price > self.dyna4 or self.dyna5 + 1.5 >= price > self.dyna5 or self.macr1 + 1.5 >= price > self.macr1 or self.macr2 + 1.5 >= price > self.macr2 or self.macr3 + 1.5 >= price > self.macr3 or self.hund1 + 1.5 >= price > self.hund1 or self.hund2 + 1.5 >= price > self.hund2 or self.hund3 + 1.5 >= price > self.hund3 or self.misc1 + 1.5 >= price > self.misc1 or self.misc2 + 1.5 >= price > self.misc2 or self.misc3 + 1.5 >= price > self.misc3:if not self.Transactions.GetOpenOrders(self.es.Symbol):self.sEnTicket = self.StopMarketOrder(self.es.Symbol, -self.qty, price-5)self.trgPrice = price# Long entriesif self.resi6 - 1.5 <= price < self.resi6 or self.resi5 - 1.5 <= price < self.resi5 or self.resi4 - 1.5 <= price < self.resi4 or self.resi3 - 1.5 <= price < self.resi3 or self.resi2 - 1.5 <= price < self.resi2 or self.resi1 - 1.5 <= price < self.resi1 or self.supp6 - 1.5 <= price < self.supp6 or self.supp5 - 1.5 <= price < self.supp5 or self.supp4 - 1.5 <= price < self.supp4 or self.supp3 - 1.5 <= price < self.supp3 or self.supp2 - 1.5 <= price < self.supp2 or self.supp1 - 1.5 <= price < self.supp1 or self.dyna1 - 1.5 <= price < self.dyna1 or self.dyna2 - 1.5 <= price < self.dyna2 or self.dyna3 - 1.5 <= price < self.dyna3 or self.dyna4 - 1.5 <= price < self.dyna4 or self.dyna5 - 1.5 <= price < self.dyna5 or self.macr1 - 1.5 <= price < self.macr1 or self.macr2 - 1.5 <= price < self.macr2 or self.macr3 - 1.5 <= price < self.macr3 or self.hund1 - 1.5 <= price < self.hund1 or self.hund2 - 1.5 <= price < self.hund2 or self.hund3 - 1.5 <= price < self.hund3 or self.misc1 - 1.5 <= price < self.misc1 or self.misc2 - 1.5 <= price < self.misc2 or self.misc3 - 1.5 <= price < self.misc3:if not self.Transactions.GetOpenOrders(self.es.Symbol):self.lEnTicket = self.StopMarketOrder(self.es.Symbol, self.qty, price+5)self.trgPrice = price# Trailing stop and possible cancellation if a short entry order is openif self.sEnTicket is not None and self.sEnTicket.Status != OrderStatus.Filled:# Trailing stopif price < self.lowestPrice:self.lowestPrice = priceif self.lowestPrice + self.trailEntry <= price:updateFields = UpdateOrderFields()updateFields.StopPrice = price+5self.sEnTicket.Update(updateFields)# Cancel order and save time if price is not rejecting the levelif price <= self.trgPrice - self.entryCancel:self.sEnTicket.Cancel()self.cancelTime = self.Time# Cancel order if near end of RTHif self.Time > self.stopAftM:self.sEnTicket.Cancel()# Reset long entry ticket, lowest price, and trigger price variables if order is canceledif self.sEnTicket.Status == OrderStatus.Canceled:self.sEnTicket = Noneself.lowestPrice = 25000self.trgPrice = 0# Trailing stop and possible cancellation if a long entry order is openif self.lEnTicket is not None and self.lEnTicket.Status != OrderStatus.Filled:# Trailing stopif price > self.highestPrice:self.highestPrice = priceif self.highestPrice - self.trailEntry >= price:updateFields = UpdateOrderFields()updateFields.StopPrice = price-5self.lEnTicket.Update(updateFields)# Cancel order and save time if price is not rejecting the levelif price >= self.trgPrice + self.entryCancel:self.lEnTicket.Cancel()self.cancelTime = self.Time# Cancel order if near end of RTHif self.Time > self.stopAftM:self.lEnTicket.Cancel()# Reset long entry ticket, lowest price, and trigger price variables if order is canceledif self.lEnTicket.Status == OrderStatus.Canceled:self.lEnTicket = Noneself.highestPrice = 25000self.trgPrice = 0# Trailing stop and possible cancellation and liquidation if a short closing order is openif self.sExTick is not None and self.Portfolio.Invested:# Trailing stop which updates as the position moves favorablyif self.sEnTicket.AverageFillPrice + 2.5 <= price:updateFields = UpdateOrderFields()updateFields.LimitPrice = price + 2self.sExTick.Update(updateFields)# Trailing stop and possible cancellation and liquidation if a long closing order is openif self.lExTick is not None and self.Portfolio.Invested:# Trailing stop which updates as the position moves favorablyif self.lEnTicket.AverageFillPrice - 2.5 >= price:updateFields = UpdateOrderFields()updateFields.LimitPrice = price - 2self.lExTick.Update(updateFields)def OnOrderEvent(self, orderEvent):if orderEvent.Status != OrderStatus.Filled:return# Submit short exit order when long entry is filledif self.sEnTicket is not None and self.Portfolio.Invested:self.sExTick = self.LimitOrder(self.es.Symbol, self.qty, self.sEnTicket.AverageFillPrice - 0.5)# Reset price variablesself.trgPrice = 0self.highestPrice = 0self.lowestPrice = 25000# Submit long exit order when short entry is filledif self.lEnTicket is not None and self.Portfolio.Invested:self.lExTick = self.LimitOrder(self.es.Symbol, -self.qty, self.lEnTicket.AverageFillPrice + 0.5)# Reset price variablesself.trgPrice = 0self.highestPrice = 0self.lowestPrice = 25000# Save time and reset price and ticket variables when a short exit order fills & record W/L & high/low intraday P/Lif self.sExTick is not None and self.sExTick.OrderId == orderEvent.OrderId:self.tallyS += 1if self.sEnTicket.AverageFillPrice > self.sExTick.AverageFillPrice:self.tallyWin += 1self.shortWin += 1if self.sEnTicket.AverageFillPrice < self.sExTick.AverageFillPrice:self.tallyLoss += 1if self.sEnTicket.AverageFillPrice == self.sExTick.AverageFillPrice:self.tallyEven += 1if self.Portfolio.Cash > self.highBal:self.drawD = 0self.highBal = self.Portfolio.Cashself.highTime = int(round(self.Time.timestamp())) - self.startTimeif self.Portfolio.Cash < self.lowBal:self.lowBal = self.Portfolio.Cashself.lowTime = int(round(self.Time.timestamp())) - self.startTimeif self.Portfolio.Cash < self.highBal:if self.highBal - self.Portfolio.Cash > self.maxDrawD:self.maxDrawD = self.highBal - self.Portfolio.Cashself.dDTime = int(round(self.Time.timestamp())) - self.startTimeif self.highBal - self.Portfolio.Cash > self.drawD:self.drawD = self.highBal - self.Portfolio.Cashself.exitFillTime = self.Timeself.sEnTicket = Noneself.sExTick = Noneself.highestPrice = 0self.lowestPrice = 25000# UPDATE THESE VALUES FOR MICRO VS TRAD MINI [/*10]#if self.begBal+1450*self.qty <= self.highBal < self.begBal+1700*self.qty and self.haltNum != 3:#self.haltNum = 2if self.begBal+170*self.qty <= self.highBal:self.haltNum = 3if self.drawD >= 75*self.qty + 2.8*self.qty*3 and self.haltNum == 1:self.dDHalt = True#if self.drawD >= 500*self.qty + 2.8*self.qty*2 and self.haltNum == 2:#self.dDHalt = Trueif self.drawD >= 25*self.qty + 2.8*self.qty and self.haltNum == 3:self.dDHalt = True# Save time and reset price and ticket variables when a long exit order fills and record W/L & high/low intraday P/Lif self.lExTick is not None and self.lExTick.OrderId == orderEvent.OrderId:self.tallyL += 1if self.lEnTicket.AverageFillPrice < self.lExTick.AverageFillPrice:self.tallyWin += 1self.longWin += 1if self.lEnTicket.AverageFillPrice > self.lExTick.AverageFillPrice:self.tallyLoss += 1if self.lEnTicket.AverageFillPrice == self.lExTick.AverageFillPrice:self.tallyEven += 1if self.Portfolio.Cash > self.highBal:self.drawD = 0self.highBal = self.Portfolio.Cashself.highTime = int(round(self.Time.timestamp())) - self.startTimeif self.Portfolio.Cash < self.lowBal:self.lowBal = self.Portfolio.Cashself.lowTime = int(round(self.Time.timestamp())) - self.startTimeif self.Portfolio.Cash < self.highBal:if self.highBal - self.Portfolio.Cash > self.maxDrawD:self.maxDrawD = self.highBal - self.Portfolio.Cashself.dDTime = int(round(self.Time.timestamp())) - self.startTimeif self.highBal - self.Portfolio.Cash > self.drawD:self.drawD = self.highBal - self.Portfolio.Cashself.exitFillTime = self.Timeself.lEnTicket = Noneself.lExTick = Noneself.highestPrice = 0self.lowestPrice = 25000# UPDATE THESE VALUES FOR MICRO VS TRAD MINI [/*10]#if self.begBal+1450*self.qty <= self.highBal < self.begBal+1700*self.qty and self.haltNum != 3:#self.haltNum = 2if self.begBal+170*self.qty <= self.highBal:self.haltNum = 3if self.drawD >= 75*self.qty + 2.8*self.qty*3 and self.haltNum == 1:self.dDHalt = True#if self.drawD >= 500*self.qty + 2.8*self.qty*2 and self.haltNum == 2:#self.dDHalt = Trueif self.drawD >= 25*self.qty + 2.8*self.qty and self.haltNum == 3:self.dDHalt = True

Rich McPharlin

Looks like you're entering limit orders for -$0.5 and $0.5 which are either invalid or not marketable. Make sure your self.sEnTicket.AverageFillPrice is valid before using it.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

LoganW

What would be a good way to ensure this other than checking that the order is filled like I have? Following each limit order the ticket is reset to None to avoid duplicates or errors.

Do you know anything about testing for open orders?

Thanks

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Louis Szeto

Hi LoganW

Since your limit orders' logic was based on average filled price, is would be the best if you also check whether

according to your need to ensure the AverageFilledPrice is not 0.

Best

Louis

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!