I was recently sent an undergrad research paper titled "Trading strategies based on Vix Term Structure" that explored ways to capture the volatility risk premium (VRP), The paper presented three main strategies: Long Short VIX (LSV), Hedge Long Short VIX (HLSV) and Long Spy Long VIX (LSLV). LSV tries to collect the volatility risk premium by going long or short volatility ETF’s that proxy the futures curve and roll part of the exposure daily. The HLSV strategy expands on the LSV strategy but also adds long or short S&P 500 exposure as a hedge. LSLV explores how a VRP strategy can enhance a long only portfolio of S&P 500 stocks.

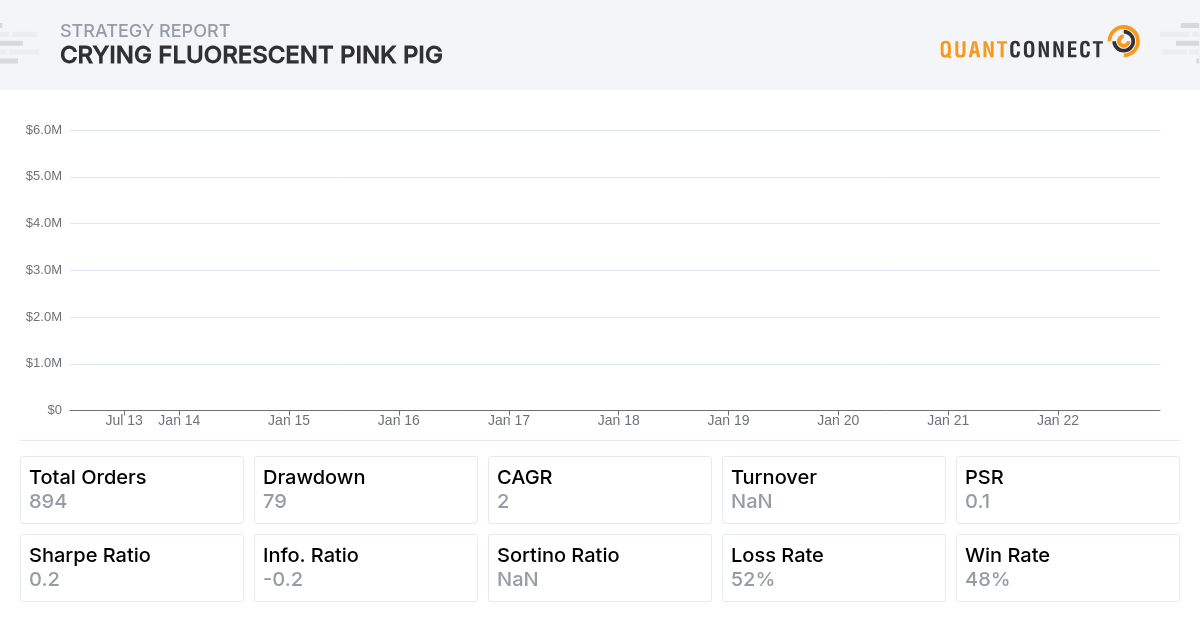

I have shared the backtests below.

Would love any comments on how to make VRP better or any code improvements.

LSV:

LSLV:

Derek Melchin

Hi Daniel,

Consider reviewing Quantpedia's VRP implementation to look for ways to improve the algorithms above. Their implementation achieved a Sharpe ratio of 0.63, which is larger than the Sharpe ratio of all the algorithms above if we backtest them over the same time period.

Best,

Derek Melchin

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!