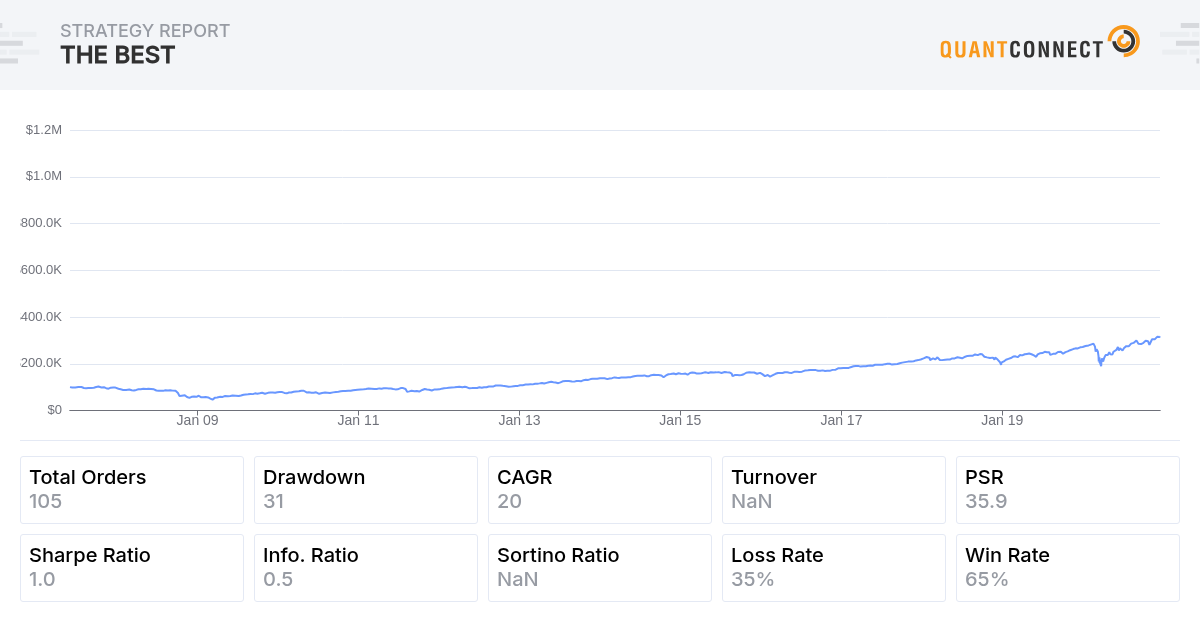

I used this Dual Momentum setup to select ETFs in the "DUAL MOMENTUM IN OUT" strategy.

This is how this setup looks like as a separate strategy.

- Sign in

-

Don't have an account? Join QuantConnect Today

- Sign up for Free

SIGN IN

QUANTCONNECT COMMUNITY

Radically Open-Source Algorithmic Trading Engine

LEAN is the open-source algorithmic trading engine powering QuantConnect. Founded in 2012 LEAN has been built by a global community of 180+ engineers and powers more than 300+ hedge funds today.

Join Our Discord Channel

Join QuantConnect's Discord server for real-time support, where a vibrant community of traders and developers awaits to help you with any of your QuantConnect needs.

Quarterly Open-Source Trading Competition

The Open-Quant League is a quarterly competition between universities and investment clubs for the best-performing strategy. The previous quarter's code is open-sourced, and competitors must adapt to survive.

Draft Discussions

Bookmarked Discussions

Strategy uses Dual Momentum setup to select ETFs in "DUAL MOMENTUM IN OUT" strategy.

Continue ReadingRefer to our Research Guidelines for high quality research posts.

SEARCH DISCUSSIONS

JOIN OUR Community MAILING LIST

Create an account on QuantConnect for the latest community delivered to your inbox.

Sign Up Today|

|

|

|||||||

|

||||||||

|

|

||||||||

|

|

||||||||

Dual Momentum Technology ETF

Vladimir | December 2020

IN THIS RESEARCH

QuantConnect™ 2025. All Rights Reserved

Steve Jost

Hi Vladimir,

Thanks for sharing. Clean and simple with good performance too!

I'm trying to learn how to code on this platform and your code is serving as a helpful example to understand and follow.

One question - where does the TimeSpan.FromDays() method come from? I couldn't find it in the docs anywhere but an online search suggests that this is a C# method. Can we use C# methods inside python code?

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Vladimir

Steve Jost,

It came from T Smith post.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Carsten

Using several ETF and using exponential regression for momentum

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Vladimir

Carsten,

I haven't reached the framework yet.

For comparison, I used the same symbols and dates as in my Dual Momentum Technology ETF.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Carsten

Vladimir,

I did the tutorial and liked the framework, thats why I started directly with that....I'm around 2 weeks in this and I'm a lousy programmer. Should be quite easy form you. The biggest issue is the warmup stuff, totaly nerve ripping. I'm choose the framework, beacuse I belive its later more easy to run several strateys and control them depending on the actual regime. I might be easyer to achive a higher return from several average strategie than go for one high return strategie.

This program was a translation from zipline. With Quandel data and a slightly different set of ETF I got around 15 CARG and 10 DD, and yes, the set of ETF's is importand. With this one abouve I get at least CAGR and DD on paar, both 16%. could be imroved, less DD would be nice.

My interpretation from the Dual Momentum was 1) relative: get the Top X relative ETF and 2) absolut: only invest if the slope > 0 for the ETF. Than i was looking for ETFs which have a more inverse corrolation. Unfortunatly there are some years when everything underperformed. One could experiment with more ETFs, worldwide. I tried as well to switch the stategy on of but got worse results. As the draw down is on par with its gains one could leverage up the strategie to 24% cagr and 24 DD with a leverage of 1.5.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

BukavuTrader

@Vladimir, Do you have one for FOREX?

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Vladimir

Carsten,

Crefuly analizing you code I find out that your code with some exeptions is very similar to

Andreas Clenow Momentum.

So I changed definition of self.Value, trading logic and published it in this thread.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Vladimir

BukavuTrader,

Do you have one for FOREX?

Not yet, but you can try yourself.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Papa Bear

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Derek Melchin

Hi Papa Bear,

This error occurs in the first algorithm in this thread because the history request doesn't return any data yet the algorithm tries to access the close column of the data frame that returns.

The other two algorithms in this thread don't have this issue.

Best,

Derek Melchin

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!